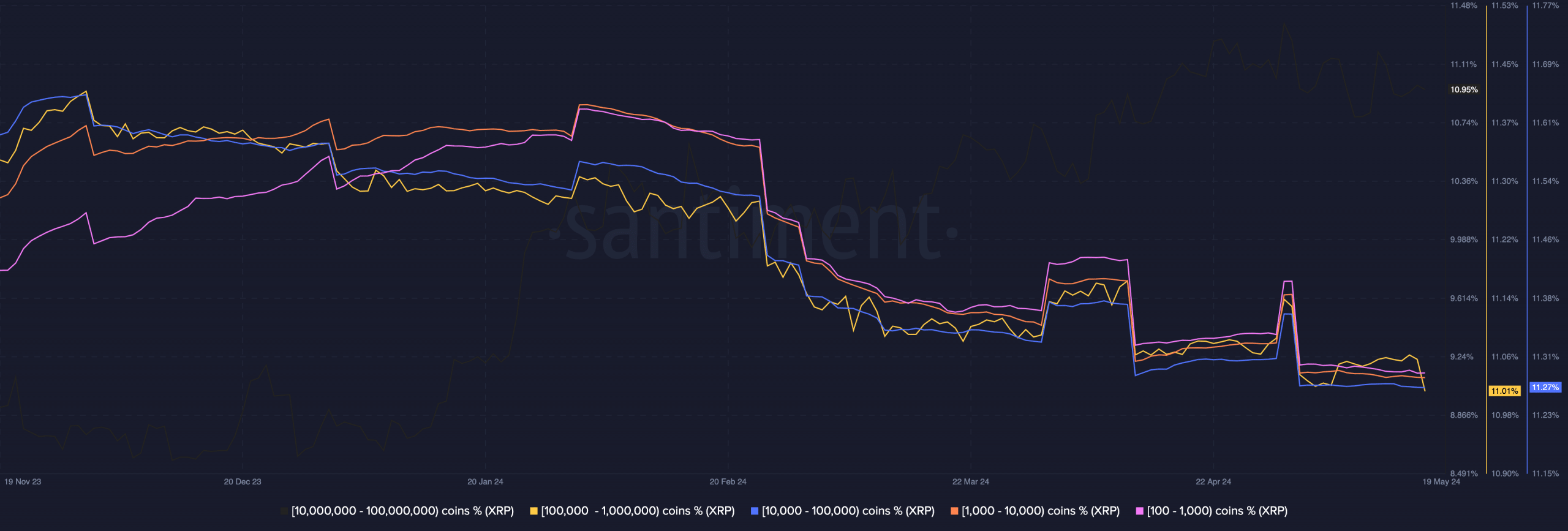

Wallets holding between 100,000 and 1 million XRP have distributed their tokens into smaller amounts, based on data analysis from Santiment.

As of this writing, on-chain data reveals that wallets within the 100,000 to 1 million range now constitute 11.01% of the total circulating supply of XRP. Additionally, a decrease in wallet balances indicates that those holding between 10,000 and 100,000 XRP now make up 11.27%.

XRP’s Decline Begins

Last week, XRP’s price managed to climb from $0.48 to $0.52 within a few days. However, some of those gains have since been erased. With the reduction in wallet balances, the token’s price could potentially dip below $0.50. At the time of writing, XRP is valued at $0.51, suggesting the impact has already started.

Source: Santiment

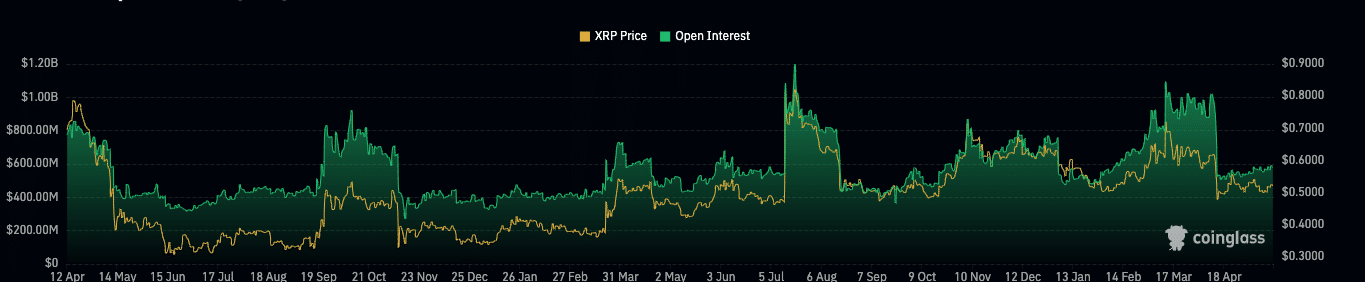

However, this metric alone cannot determine whether XRP will continue to fall. Therefore, the assessment of Open Interest (OI) was considered. OI reflects the value of all open positions in contracts. An increase in OI implies that more liquidity is entering the market, indicating aggressive buying.

Conversely, a decrease in OI suggests that the number of closed net positions is rising, signifying aggressive selling. At the time of writing, XRP’s Open Interest stands at $577.63 million, marking a net decline over the past 24 hours. If this trend continues, the token’s price might avoid another surge.

Source: Coinglass

The Market Stabilizes

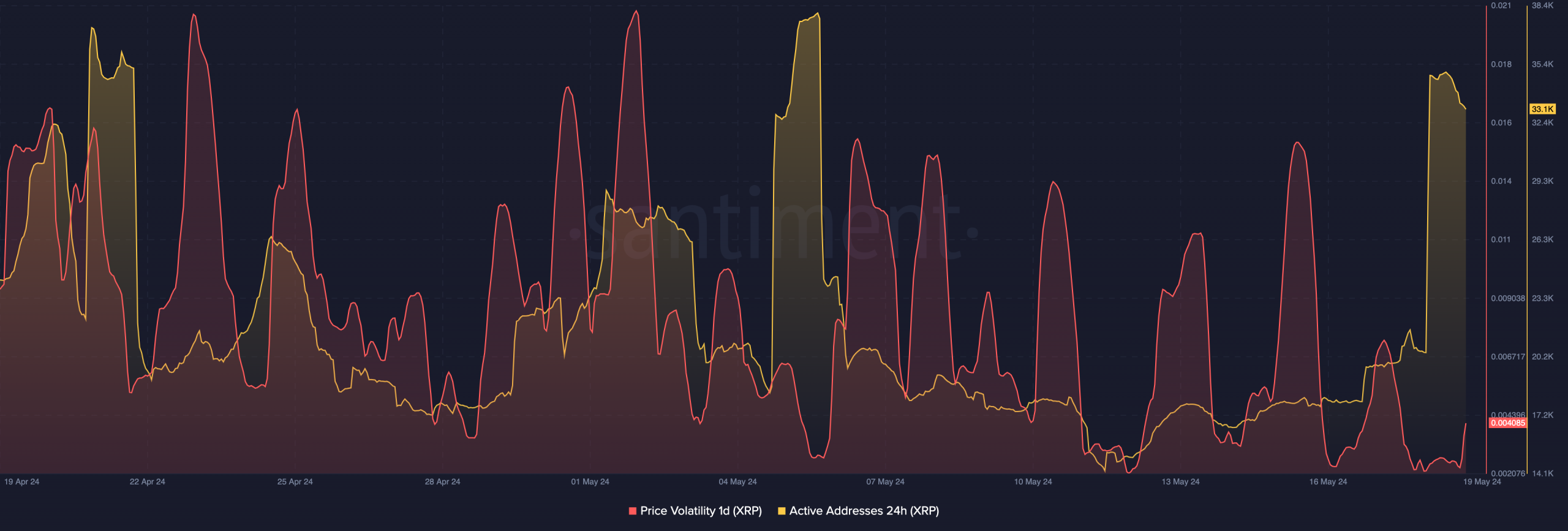

Moreover, bullish speculators aiming for price increases might need to temper their optimism. On the surface, XRP’s value could drop to the support level of $0.50. However, if selling pressure intensifies, the native token of the XRP Ledger could potentially fall back to $0.48. Additionally, the level of daily volatility was also considered. Volatility indicates how frequently and significantly price changes occur. Increased volatility, supported by rising buying pressure, can lead to price surges.

Related: 280 Million XRP Transferred Amid New Developments in Ripple vs. SEC Case

At the time of writing, XRP’s daily volatility has surged following the recent decline. However, this spike does not seem to facilitate an upward movement. Instead, the indicator might reinforce a downward trend.

Source: Santiment

Furthermore, on-chain data shows that the number of active addresses in a 24-hour period increased to 35,000 on May 18. But as of this writing, the figure has decreased to 33,100.

Active addresses represent the number of unique addresses that participated in transfers of a given asset on any specific day. Historically, an increase in active addresses has driven up the price of XRP. Thus, the recent price decline suggests that XRP may struggle to initiate a price rally. In the short term, XRP appears poised for a significant downturn.

This is so interesting because of the interface of the sweet app

Great job