Ethereum is making a strong comeback, with institutional investors pouring in substantial capital. In the past week, digital investment products recorded their sixth consecutive week of inflows, propelling Ethereum’s influx to its highest level in over a year. Additionally, Ethereum’s price has surged by 5.72% in just seven days, underscoring the prevailing bullish sentiment surrounding this smart contract platform.

This renewed interest in digital asset investment products began in late September and persisted throughout October, echoing the optimistic atmosphere in the broader cryptocurrency market.

After months of relatively lackluster interest and a continuous exodus of institutional funds, Ethereum is regaining favor with major investors. The latest weekly report from CoinShares reveals that digital asset investment products attracted a total of $261 million in inflows last week, culminating in a remarkable six consecutive weeks of inflow totaling $767 million.

While Bitcoin has often dominated headlines and enticed significant investments from institutional players, registering a surge in its price to a new annual high, Ethereum isn’t being left behind. Ethereum enjoyed a substantial influx, garnering $17.5 million in investments last week.

Notably, this marks the largest inflow of institutional capital into Ethereum’s digital products since August 2022. Consequently, Ethereum’s month-to-date net flow has turned positive at $13.6 million, although its year-to-date net flow still stands at a negative $107 million.

Similar sentiments are evident among other altcoins, such as Solana, XRP, and Cardano, which also witnessed inflows last week. Solana received a substantial $11 million in inflows, while Chainlink, XRP, and Cardano received $2 million, $0.2 million, and $0.5 million, respectively.

This influx of capital suggests that institutional investors are potentially considering re-entering the altcoin market, signaling the potential for a robust bullish trend across the entire cryptocurrency landscape.

Related: Bitcoin and Ethereum Outperform Gold This Year, Major Whales Leaving Binance

Geographically, the majority of these investments came from the United States, with investors closely monitoring the SEC’s potential approval of spot Bitcoin ETFs as a trigger for the next sustained bull run. U.S. investors channeled $157 million into digital asset investment products during the week.

This surge in investments coincides with the U.S. Federal Reserve’s decision to maintain its interest rates at a 22-year high. Germany, Switzerland, and Canada also followed suit, contributing respective inflows of $63 million, $36 million, and $9 million.

According to CoinShares, the recent streak of inflows has now surpassed the total inflows recorded throughout 2022, matching the six consecutive inflows witnessed in July 2023 and marking the largest inflow since the conclusion of the bull market in December 2021. This data underscores the growing confidence of institutional investors in the cryptocurrency market, particularly in Ethereum and other promising altcoins.

Ethereum Has Strong Incentives to Reach $2,000 Price

Ethereum has been on a robust upward trajectory, nearing a 25% gain in just three weeks and setting its sights on the $2,000 mark. This rally was spurred by positive news from Hong Kong about the potential introduction of exchange-traded funds (ETFs) directly investing in cryptocurrencies, including ETH, which bolstered investor confidence.

While the market appeared firmly bullish on the one-day chart, there are some obstacles to Ethereum’s surge. The RSI stood at 74, reflecting strong bullish momentum, and the On-Balance Volume demonstrated consistent buying pressure since mid-October, indicating more buying than selling over the past three weeks.

Nonetheless, the psychological level of $2,000 could pose a challenge to the bullish momentum. On the one-week ETH price chart, the $1,940-$2,140 range has been a formidable resistance zone since May 2022. Therefore, an immediate breakout beyond this critical resistance zone was less likely, providing an opportunity for ETH holders to secure their profits and await the next market move.

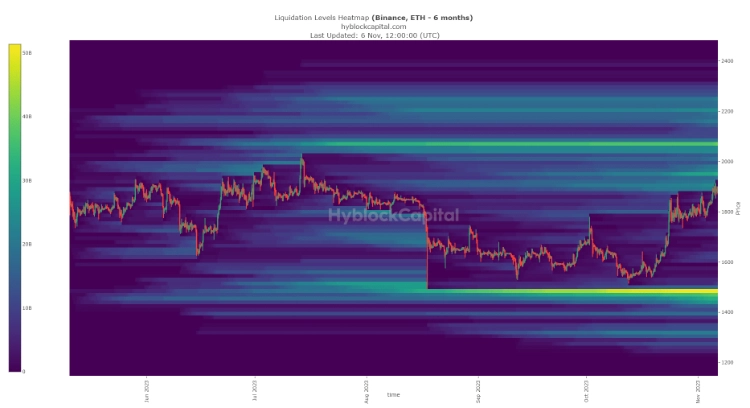

Additionally, the liquidation levels heatmap suggested two key areas that could be crucial for long-term investors. The first was around $2,070, coinciding with the resistance zone identified in the earlier technical analysis. A move above $2,070 might trigger liquidations and potentially a market reversal. The second significant accumulation of liquidations was noted at around $1,485, offering a potential attractive buying opportunity should the price revisit the $1,500 area.

While the 180-day mean coin age continued to increase alongside rising ETH prices, indicating that holders had not rushed to sell their ETH, the MVRV ratio had reached levels not seen since July. This could signify that profit-taking activities might emerge soon and result in a market reversal. Consequently, ETH bulls may consider securing their profits and monitoring the market’s direction for their next move.