After earning $200 million from accurately predicting the market crash triggered by the U.S.–China trade tensions in October, the crypto whale HyperUnit has returned with a bold new move — opening $55 million in long positions on Bitcoin (BTC) and Ethereum (ETH), signaling renewed confidence in a potential market rebound.

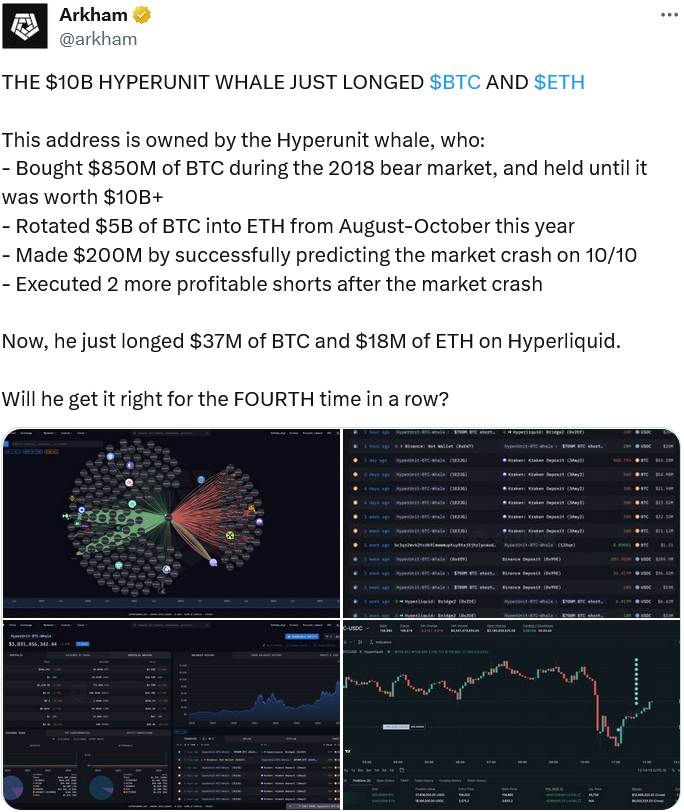

According to on-chain analytics platform Arkham, HyperUnit’s latest move includes $37 million in Bitcoin longs and $18 million in Ethereum longs on the decentralized derivatives exchange Hyperliquid. The trader, now dubbed the “prophetic whale,” became famous for correctly calling the October 10 market collapse, securing massive profits within hours.

HyperUnit is no newcomer to the game. With over seven years of experience, the whale previously purchased $850 million worth of Bitcoin during the 2018 bear market, holding it until its value surged to over $10 billion. Since last month’s successful prediction, HyperUnit has made two more profitable trades — prompting analysts to wonder if they’ll “get it right for the fourth time in a row.”

🔹 Key Highlights:

-

Bitcoin is trading around $106,598, down 15.5% from its all-time high.

-

Ethereum sits at $3,602, down 27.3% from its peak.

-

The Fear & Greed Index remains in the “Fear” zone at 42/100.

-

CryptoQuant data shows long-term holders have sold 405,000 BTC in the past month.

-

Santiment reports nearly 209,000 BTC have been withdrawn from exchanges over the last six months — a sign that selling pressure may be easing.

Meanwhile, Bitwise CEO Hunter Horsley noted that early “OG whales” have been gradually trimming their positions after achieving massive 100x–1000x gains, citing the emotional strain of watching large portfolios fluctuate. Still, he emphasized that most continue to hold the majority of their assets.

Outlook: HyperUnit’s bold “buy-the-dip” move amid widespread fear could be a telling signal that the market correction is nearing its end — and that a new wave of recovery may be on the horizon.