🔹 1. Token Buybacks Accelerate Rapidly in 2025

-

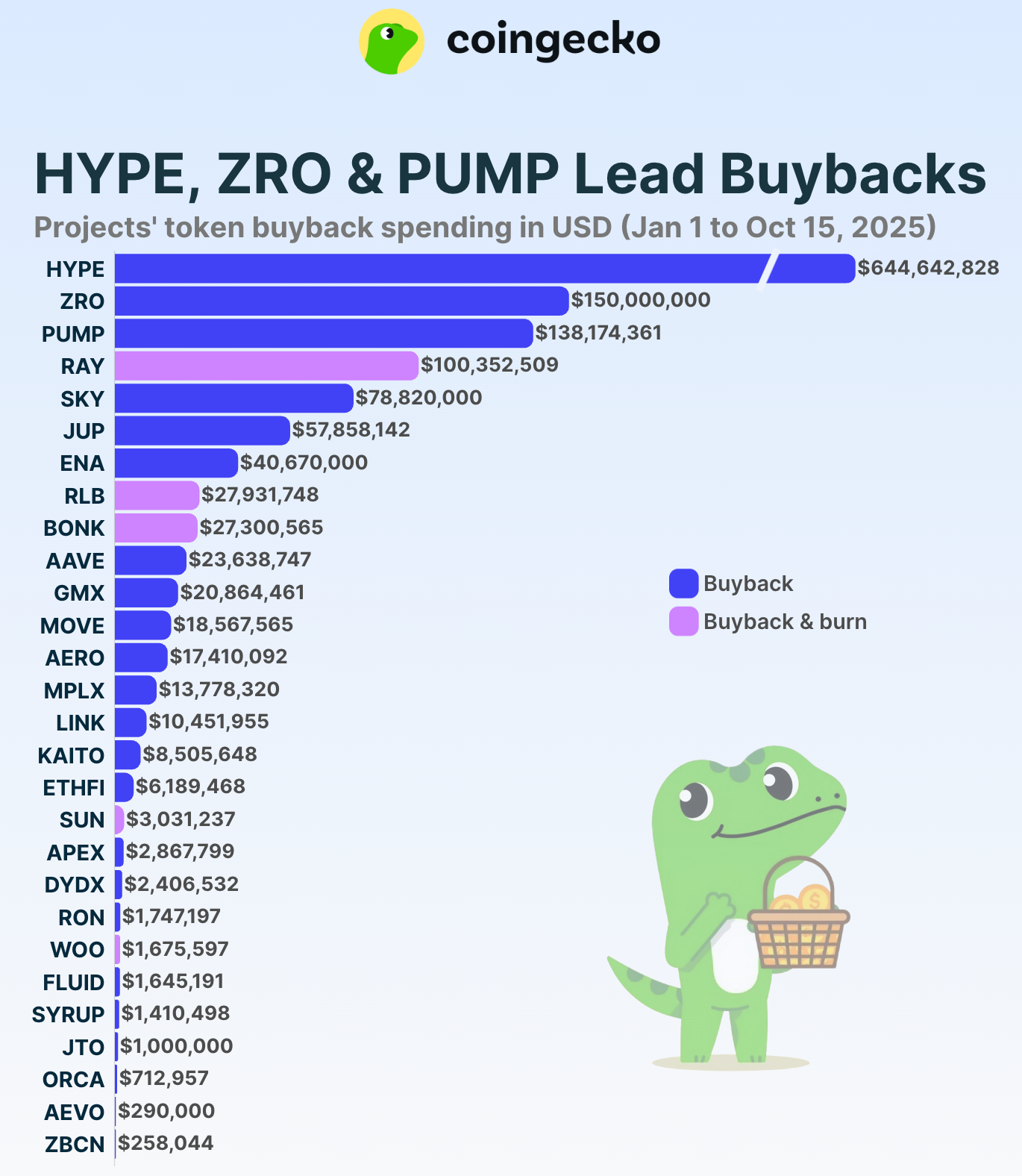

A total of 28 crypto projects have launched token buyback programs this year.

-

Spending surged 85% in July alone, marking a strong acceleration in the second half of the year.

-

According to CoinGecko, while September saw a spike due to LayerZero’s one-off buyback, excluding that, actual buyback spending was $168.45 million.

-

By mid-October, total buyback spending had reached $88.81 million, marking the fourth consecutive month above the first-half monthly average of $99.32 million.

-

On average, projects have spent $145.93 million per month, underscoring rising confidence in the buyback mechanism across the market.

🔹 2. Hyperliquid – The Undisputed Champion of Token Buybacks

-

Hyperliquid, a decentralized perpetual exchange (perp DEX), has emerged as the clear leader, allocating $644.64 million through its Assistance Fund.

-

This accounts for 46% of all buyback activity, equivalent to the combined total of the next nine projects.

-

So far, Hyperliquid has repurchased over 21.36 million HYPE tokens, representing 2.1% of its total supply.

-

According to OAK Research, Hyperliquid’s model could allow the protocol to buy back up to 13% of its total supply annually, if sustained at current efficiency.

🔹 3. Other Projects Following in Hyperliquid’s Footsteps

-

LayerZero executed a $150 million one-off buyback of ZRO tokens, retiring 5% of its total supply.

-

Pump.fun has spent $138 million since July to repurchase 3% of PUMP’s supply.

-

Raydium invested $100 million into its ongoing buy-and-burn program for RAY tokens.

-

Top 10 projects by buyback spending also include:

-

Sky Protocol (SKY)

-

Jupiter (JUP)

-

Ethena (ENA)

-

Rollbit (RLB)

-

Bonk (BONK)

-

Aave (AAVE)

-

-

Notably, GMX achieved remarkable efficiency — spending only $20.86 million yet retiring 12.9% of its total supply, proving that smaller-scale buybacks can deliver outsized impact.

🔹 4. What’s Driving the 2025 Buyback Boom?

According to DWF Labs, three key factors are fueling this unprecedented wave:

-

Rising profitability: As more projects reach sustainable revenue, buybacks have become a way to reward loyal users, reduce token supply, and enhance long-term value.

-

Maturing governance structures: DAOs and projects are adopting disciplined treasury management, exemplified by Aave’s “Aavenomics” model, making buybacks a strategic, recurring mechanism.

-

Scarcity-driven market psychology: After a volatile 2024, investors are increasingly drawn to deflationary token models, viewing buybacks as a signal of financial strength and commitment.

-

Transparent on-chain automation: Projects like Hyperliquid and Raydium have integrated automated, verifiable buyback systems, turning the process into a continuous, transparent mechanism that builds community trust.

🔹 5. Buybacks – The New Symbol of “Disciplined Tokenomics”

-

Token buybacks are no longer just a financial tool — they have become a new standard of credibility and maturity within the 2025 crypto landscape.

-

The combination of real revenue, solid governance, and transparent technology has made buybacks a defining feature of sustainable tokenomics.

-

At the center of this transformation, Hyperliquid stands out as the benchmark setter, shaping what could become the next evolution of decentralized finance.