Huge Ethereum Whale Transfers $55 Million to Binance

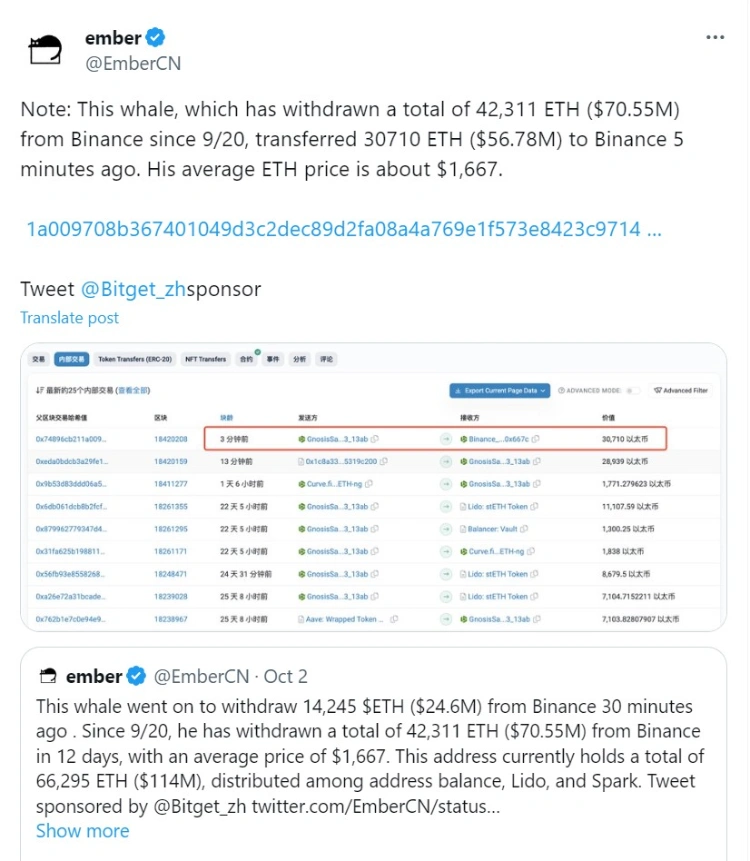

A significant Ethereum ($ETH) whale has recently transferred 30,710 ETH, valued at approximately $54.9 million at the current market rate, to the prominent cryptocurrency exchange, Binance. It appears that the whale’s intention is to sell these tokens on the exchange, following a prior withdrawal of 42,311 ETH from the same platform.

Starting on September 20, this whale has conducted total withdrawals amounting to more than $75.67 million. These withdrawals were made at an average price per ETH of around $1,667. It’s apparent that the whale’s motive is to take advantage of potential profits, given that the current trading price of ETH hovers close to $1,800.

Such substantial transactions often exert influence on the market, impacting the price of Ethereum and provoking discussions among traders and experts. Whales, due to their significant holdings, are frequently regarded as indicators of market trends.

It remains to be seen whether this latest action by the whale foreshadows a broader market trend or is simply an isolated high-value asset management decision.

As recently reported, addresses categorized as “billionaire tier” Ethereum whale wallets, holding at least 1 million $ETH, currently control 32.3% of the circulating supply of the second-largest cryptocurrency by market capitalization. This marks the highest percentage of supply control by this group since 2016 when ETH experienced a notable price surge from approximately $1 to $18 before ending the year at around $7.5 per token.

Coincidentally, this development occurs in the same month when the Ethereum Foundation, through the decentralized exchange Uniswap, executed its largest single transaction of the year, selling 1,700 Ether for $2.73 million worth of USDC.

Moreover, Ethereum futures exchange-traded funds (ETFs) were recently introduced in the United States. However, as per David Duong, the Head of Coinbase Research, these ETH ETFs failed to generate the same level of enthusiasm and trading volume as the initial BTC futures ETF, ProShares’ BITO, which made its debut in October 2021.

The top ETH futures ETFs collectively saw less than $1.5 million in trading volume on their first day, in stark contrast to BITO, which experienced over $1 billion in trading volume on its opening day, as per Bloomberg data. Additionally, the net inflow into these ETH futures ETFs was less than 2% of what BITO managed to attract.

Ethereum Predicted to Rise to $10,000 USD

The crypto market has seen renewed activity this week, bringing hope to the Ethereum community and suggesting a potential rise in Ethereum’s price. As Ethereum (ETH) moves away from the lower boundary of a long-term price pattern, it is eyeing the upper boundary of the same pattern, which points to a price of $10,000 or more. However, the timeline for reaching this ambitious target remains uncertain.

Ethereum’s price has been following a pattern that resembles a rising wedge for most of its history. Traditionally, rising wedge patterns are considered bearish, with a tendency to break downward about 60% of the time.

However, there’s a 40% chance that they might break upward instead. The unique characteristic of these patterns is their propensity for false breakouts or breakdowns, where the price initially breaches one trend line but then reverses its direction to target the other.

In the current scenario, Ethereum is holding close to the lower trend line, which suggests that the logical next target is the upper trend line. There’s at least some probability that the price could break upward towards this upper trend line, which is currently around $10,000 per ETH and gradually rising over time.

The timing of Ethereum touching the upper trend line is still uncertain. Historically, Ethereum’s previous rallies have lasted between six months to a year. This implies that the wait for Ethereum to reach the upper trend line may be shorter than expected.

The notion of a rising wedge pattern breaking upward can be puzzling, given that it’s traditionally seen as a bearish pattern. However, in Elliott Wave Principle, rising wedges belong to the diagonal family of patterns. Diagonals can be either leading or ending, and they can expand or contract.

A leading diagonal marks the beginning of a sustained move, often defying expectations by breaking upward. In contrast, an ending diagonal signifies the conclusion of a sustained move and typically results in the expected bearish breakdown in a rising wedge pattern.

It’s possible that Ethereum is in the midst of a massive diagonal pattern rather than a straightforward rising wedge. What remains unclear is whether this marks the beginning of a substantial, sustained move as a leading diagonal, or if it signifies the end of Ethereum’s dominance, concluding with an ending diagonal.

Related: $90 Billion USD Flows into Cryptocurrency

Both leading and ending diagonals follow a five-wave pattern. However, diagonals have unique rules, such as wave 1 being the longest, wave 4 entering wave 1’s territory, and wave 5 being the shortest. Since wave 5 is usually the shortest and final wave, Ethereum’s touch of the upper trend line may be on the horizon.