Why is the Bitcoin halving event in 2024 affected by previous surgical procedures?

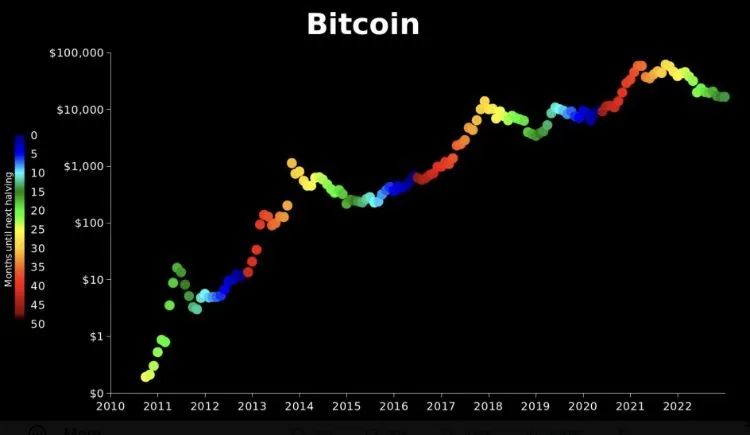

As Bitcoin gears up for the 2024 halving event, the cryptocurrency space is buzzing with excitement. Throughout its history, Bitcoin has witnessed significant value surges following halvings, particularly in 2012, 2016, and the record-breaking spike in 2020, reaching an astonishing all-time high in November 2021.

While the fundamental premise of halving is to create scarcity by reducing the supply of new Bitcoins by half, making it an attractive proposition for potential investors, caution is warranted. Despite the optimism, various factors can influence the coin’s trajectory.

Notably, reducing Bitcoin’s supply rate emphasizes its deflationary nature. This, while driving demand, may pose long-term challenges to its supply-demand dynamics, especially when rising interest rates seemingly benefit Bitcoin holders. As we approach April 2024, only time will tell how this grand event will shape the future of Bitcoin.

In the context of the ever-evolving cryptocurrency landscape, Bitcoin remains a frontrunner, and its halving events serve as pivotal milestones. With each halving, Bitcoin reaffirms its resilience and potential, solidifying its position as a foundation for the future of the cryptocurrency industry.

In just over a decade, Bitcoin has risen to prominence as the most popular and widely traded cryptocurrency. From a mere concept in the 2008 whitepaper to a valuation of approximately $69,000 per coin in 2021, Bitcoin’s journey has been nothing short of an economic adventure. In 2024, a seismic event is on the horizon – the Bitcoin halving. It’s easy to see the anticipation, as previous halvings have consistently foreshadowed significant changes in the cryptocurrency economy.

Bitcoin Halving: The Basics

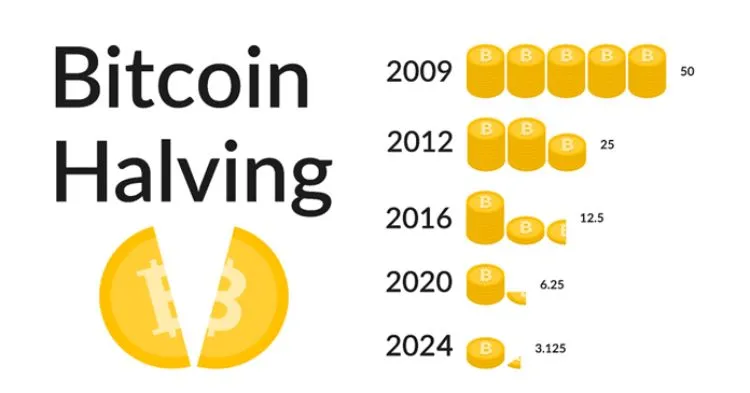

The Bitcoin network undergoes a halving event after every 210,000 blocks mined, roughly every four years. The mining rewards, the livelihood of Bitcoin miners worldwide, are halved, and the rate of new Bitcoin supply is also reduced.

Much like a metronome, Bitcoin has experienced three halving events in 2012, 2016, and 2020. Each halving has created a genuinely economic backdrop. After the 2012 halving, Bitcoin’s price skyrocketed from around $12 to over $1,100 within a year. The 2016 halving caused Bitcoin’s price to surge from $650 to nearly $20,000 in 2017. Most recently, the 2020 halving preceded Bitcoin’s strong rise to nearly $69,000 in 2021.

Please note that prices are approximate and can vary based on different sources due to Bitcoin’s volatility and differing exchange rates on various platforms. The price in 2024 is still undetermined (TBD).

Hunger Games 2024: The Bitcoin Edition

2024 awaits a rendezvous at this economic crossroads. – Bitcoin miners will see their rewards drop from 6.25 to 3.125 Bitcoin.

Predicting the exact impact of the upcoming halving event is like speculating about the future without a basis. However, historical lessons demonstrate that reducing the supply, in the context of increasing or stabilizing demand, can create conditions for a price surge. As always, other external factors, including regulatory changes and technological advancements, can introduce unpredictable turning points.

Many are wondering how Bitcoin halving will affect the broader market’s dynamics. Let’s delve deeper into it!

The Butterfly Effect: How Bitcoin Halving Affects the Cryptocurrency Market

Bitcoin’s influence extends beyond its own network. Bitcoin plays a pivotal role in the world of cryptocurrencies, charting a course for a vast digital asset ocean. As seen in previous halving events, the waves created by Bitcoin often lead to significant ripples in the crypto market.

In history, altcoins – a term for cryptocurrencies other than Bitcoin – have shown a tendency to outshine Bitcoin’s price trajectory after a halving event. For example, following the 2016 halving, Ethereum’s price increased from about $8 in early 2017 to a peak of around $1,448 in January 2018, marking an impressive 18,100% surge. Similarly, Litecoin, often referred to as silver to Bitcoin’s gold, surged from around $4 in January 2017 to over $360 in December 2017, marking an astounding 9,000% increase.

As Bitcoin’s scarcity increases after the halving, Bitcoin’s dominance ratio – a metric representing Bitcoin’s market capitalization compared to the total value of all cryptocurrencies – may also rise. As of May 2023, Bitcoin’s dominance stands at around 47%. The impact of the 2024 halving could push this number higher, indicating Bitcoin’s more significant role in the cryptocurrency economy. This potential change could open a period of turmoil and opportunity for altcoins in the post-halving landscape.

>>> New Legal Milestones and Regulations: Signs of a Growing Cryptocurrency Market

Cryptocurrency experts are discussing the possibility that the 2024 halving event could act as a catalyst for the next price surge. This belief is rooted in the cyclical nature of the cryptocurrency market and the historical trends of growth following previous halvings. For instance, the total cryptocurrency market capitalization, which was around $10 billion during the 2016 halving period, soared to over $800 billion by the end of 2017, marking an exceptional increase. Similarly, after the 2020 halving event, the total market capitalization surged from approximately $250 billion in May 2020 to nearly $2.5 trillion in May 2021, a tenfold increase. If these historical patterns repeat, the post-2024 landscape could be an exciting journey for the entire cryptocurrency market.

Trading Strategies for Crypto Enthusiasts

You might be wondering how to navigate the tumultuous Bitcoin market leading up to the upcoming halving. Halving can be an opportunity rather than a risk if you apply a cautious strategy and make informed decisions.

Monitoring the market closely is crucial as Bitcoin halving approaches because prices can surge. Keep in mind that Bitcoin’s value is not isolated and can be influenced by various factors, such as economic conditions and regulatory news. Tailor your strategy to your goals; long-term holders may buy before the halving, while short-term traders can capitalize on volatility. Always manage your risks, only invest what you can afford to lose, and stay updated with the latest Bitcoin news.”