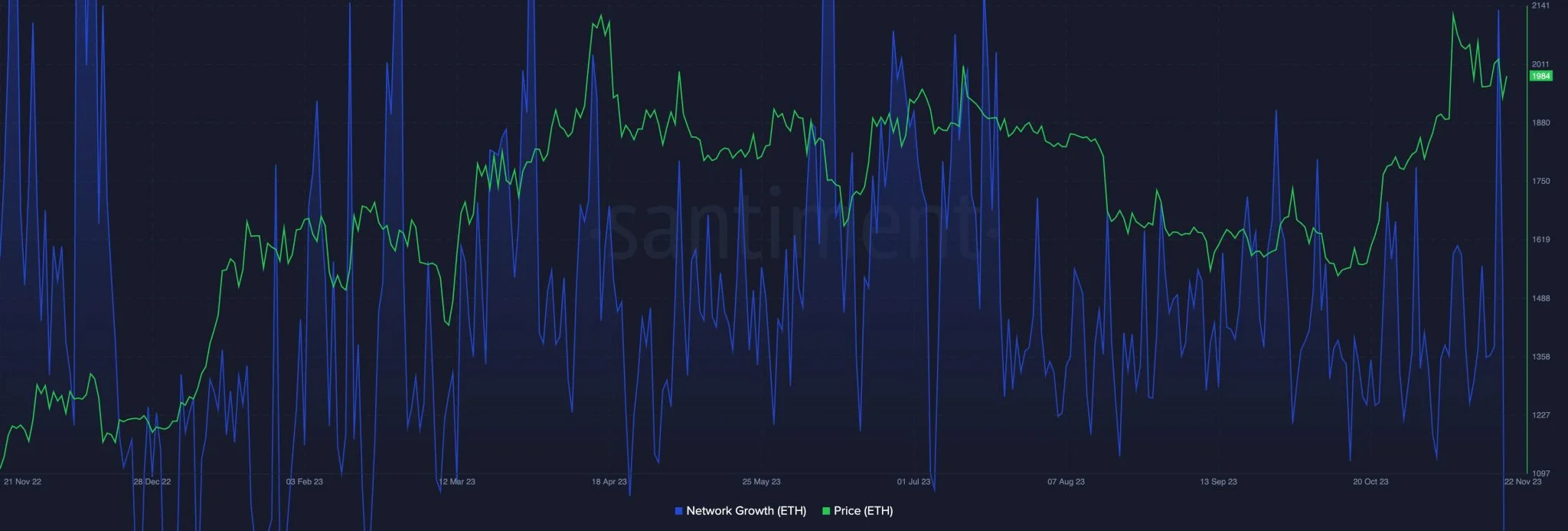

Demand for Ethereum has experienced a notable surge, reaching a four-month high on November 20th, as indicated by data from Santiment. The figures revealed that on that particular day, a total of 94,703 new ETH addresses were created, marking a substantial 33% increase compared to the previous day’s count of 70,968.

This surge in demand for Ethereum coincided with its rebound above the $2000 mark on November 19th, following a two-day period of trading below this significant price threshold. The increased interest in the leading altcoin suggested a renewed enthusiasm within the market.

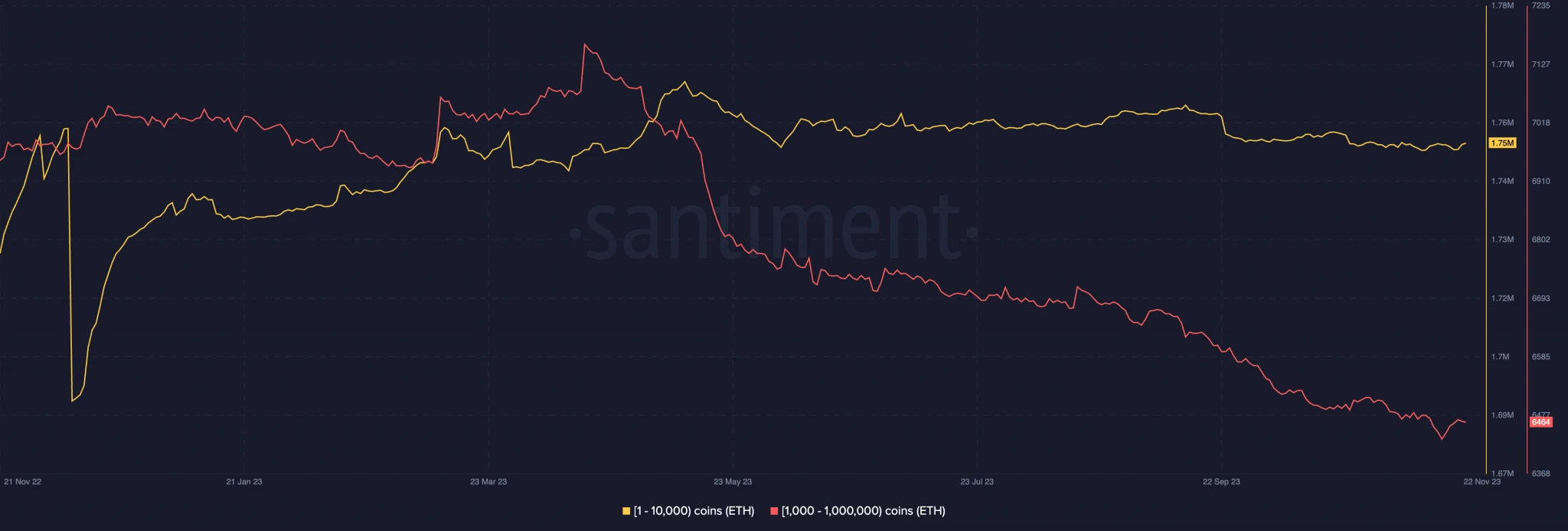

An analysis of Ethereum’s whale activity since April depicted a shift in the behavior of large addresses holding between 1,000 and 10,000 ETH coins. Data sourced from Santiment disclosed that, since April 16th, the cumulative count of such addresses had diminished to 6464, reflecting a 10% decrease over the past seven months.

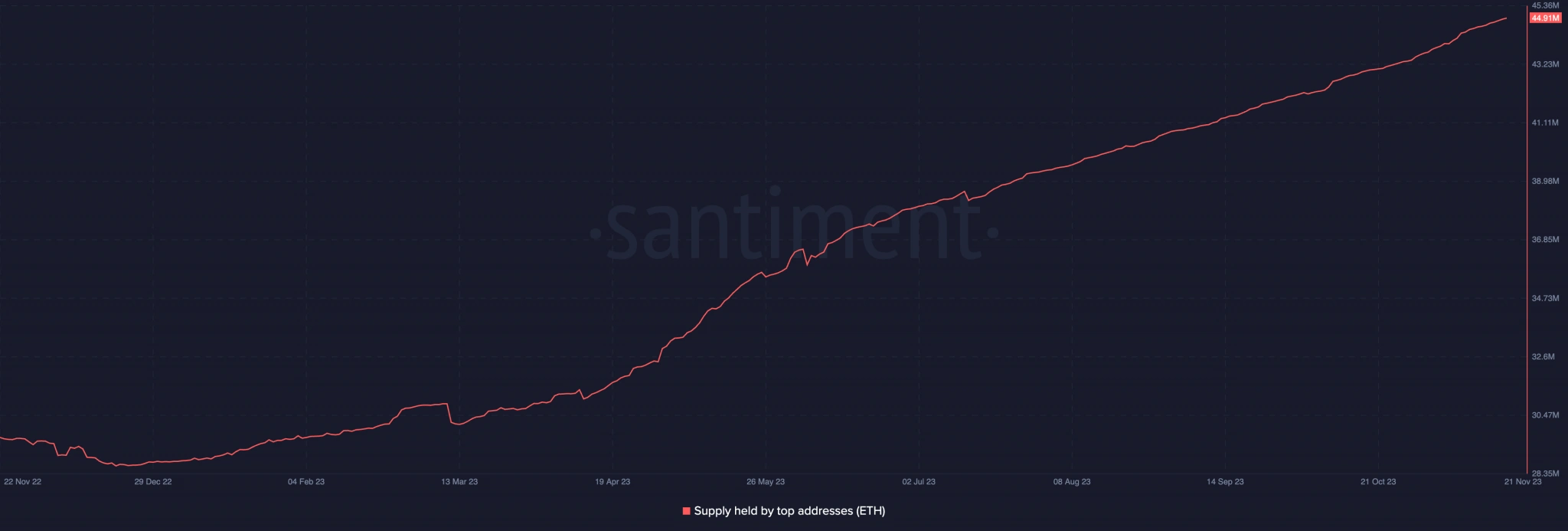

Furthermore, the number of smaller whales, possessing between 1 and 10,000 ETH coins, also saw a decline of 1.12% since May 10th. Despite this trend, a noteworthy observation was made regarding the top 200 ETH wallets, which consistently increased their holdings of the altcoin.

Since the beginning of the year, these top 200 wallets have accumulated 97% more ETH, currently holding a total of 62.76 million ETH valued at approximately $124.1 billion. Notably, their accumulation continued even during the first half of the year when the overall value of ETH experienced a persistent decline.

As of the latest update, ETH was trading at $1,984, facing resistance at the $2000 level. The price movement of Ethereum has displayed a relatively stable pattern in the past week, with the Choppiness Index on a daily chart confirming this sideways trend.

Related: Ethereum Price Analysis: ETH Eyes Fresh Increase To $2,150

The index, currently at 62.70 and in an uptrend, indicates that ETH’s price is not exhibiting a clear direction, fluctuating within a narrow range. The market sentiment remains cautious as Ethereum navigates the challenges posed by the $2000 resistance level.