Long-term holders have sent their Bitcoins to exchanges for further selling, ever since the price of Bitcoin surpassed the $51,000 mark. Bitcoin may undergo short-term adjustments, as on-chain data indicates a shift from long-term holders to short-term ones.

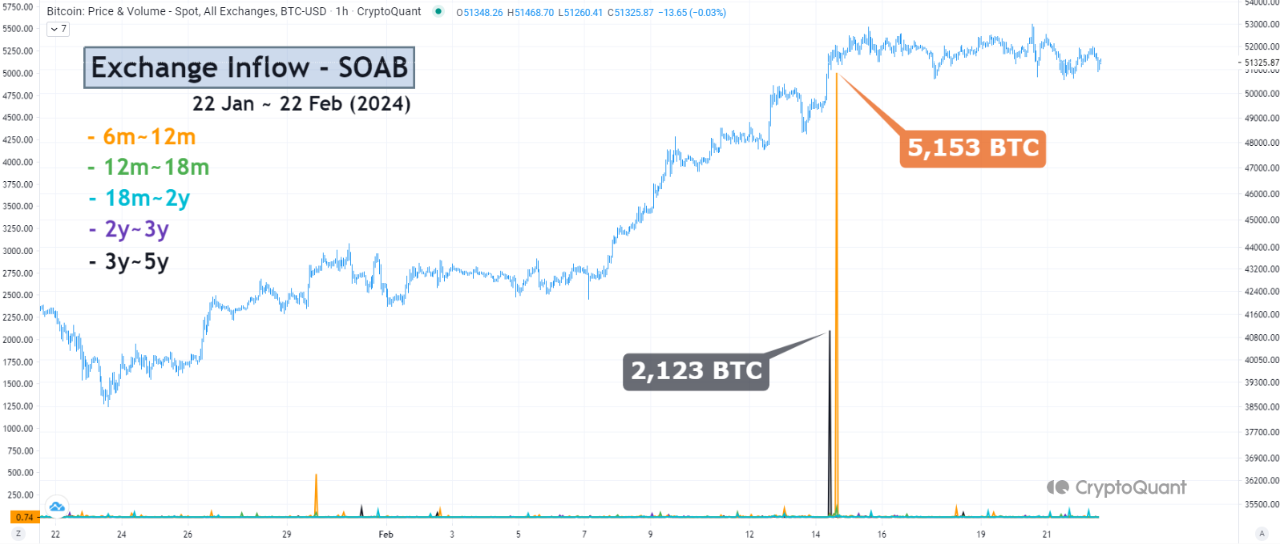

CryptoQuant analysts have assessed Bitcoin exchange activity, noting an increase in the transfer of BTC from long-term holders to exchanges after it crossed the $51,000 price threshold on February 14. Immediately following the breach of the $51,000 mark on February 14, over 5,153 BTC aged between 6 to 12 months were poured into exchanges.

Investors in this group had acquired Bitcoin during the 2023 bull market, starting in October, propelling the currency to its highest year-end trading value in months, reaching $42,000. Furthermore, on the same day, the influx of funds into exchanges from Bitcoin holders of 3 to 5 years rapidly rose to 2,123 BTC.

According to analysts, the majority of these investors acquired their assets during the bull market from 2019 to 2021. Consequently, the recent surge in funds entering exchanges suggests a profit-taking behavior among them.

Examining the Bitcoin price at $48,000 on February 14, 2021, it appears that a portion of investors in the 3 to 5-year bracket may have exited the market at their break-even point. As funds from these investor groups flow into exchanges, it indicates a shift of Bitcoin from long-term to short-term investors.

Related: Bitcoin Battles $51K Resistance Amidst Altcoin Declines

This transition often coincides with a price correction, driven by the tendency of short-term holders, often considered as the “weak hands,” to sell their assets at any sign of negative sentiment. However, compared to previous cycles, the scale of this movement is relatively small.

Out of all BTC holding addresses, 92.23% are classified as “in profit,” meaning they currently hold Bitcoin with a profit. On the flip side, 5%, comprising 2 million addresses, are currently in a loss. These holders bought Bitcoin when the price ranged from $52,000 to $67,000.