Dogecoin (DOGE) surprised investors with a sudden 10% surge a few days ago, sparked by Elon Musk’s launch of the official Payments account for X on Twitter. However, this upward trend was short-lived, and the meme coin experienced a swift correction, erasing its weekly gains. Despite the bearish price action, a notable metric for Dogecoin has consistently remained robust for several months.

Dogecoin Erases Weekly Profit, Faces Price Setback

In the aftermath of the XPayments excitement, Dogecoin struggled to sustain its price uptrend, resulting in a significant drop. According to CoinMarketCap, DOGE recorded nearly a 4% decline in the last 24 hours alone, currently trading at $0.08031 with a market capitalization exceeding $11.4 billion.

Notably, amidst the bearish price movement, Dogecoin’s transaction volume has maintained a high level for an extended period. IntoTheBlock highlighted this resilience in a recent tweet, emphasizing that Dogecoin’s transaction activity continues to outpace several other top cryptocurrencies, including Shiba Inu (SHIB).

One could argue that the memecoin wars aren’t about utility. Nonetheless, Dogecoin’s dominance in the number of transactions is unmistakable. #Doge pic.twitter.com/kE4wW5IrmY

— IntoTheBlock (@intotheblock) January 22, 2024

Can Increased Network Activity Propel DOGE’s Recovery?

The question remains: Can network activity alone facilitate Dogecoin’s recovery? Despite the meme coin boasting a consistently high transaction count, it seems insufficient to offset its recent losses.

Related: XPayments Propels Dogecoin to Seven-Day Peak

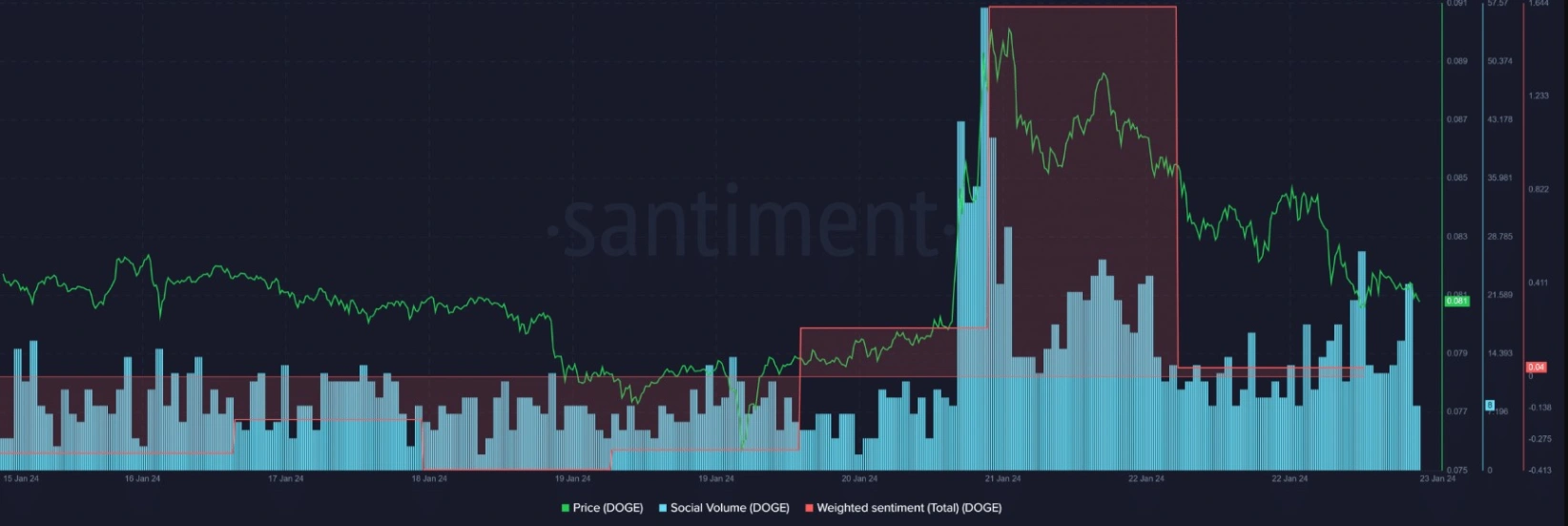

While Dogecoin maintained elevated Social Volume last week, driven by heightened price volatility, the emergence of bearish sentiment became apparent through a decline in its Weighted Sentiment since January 22nd.

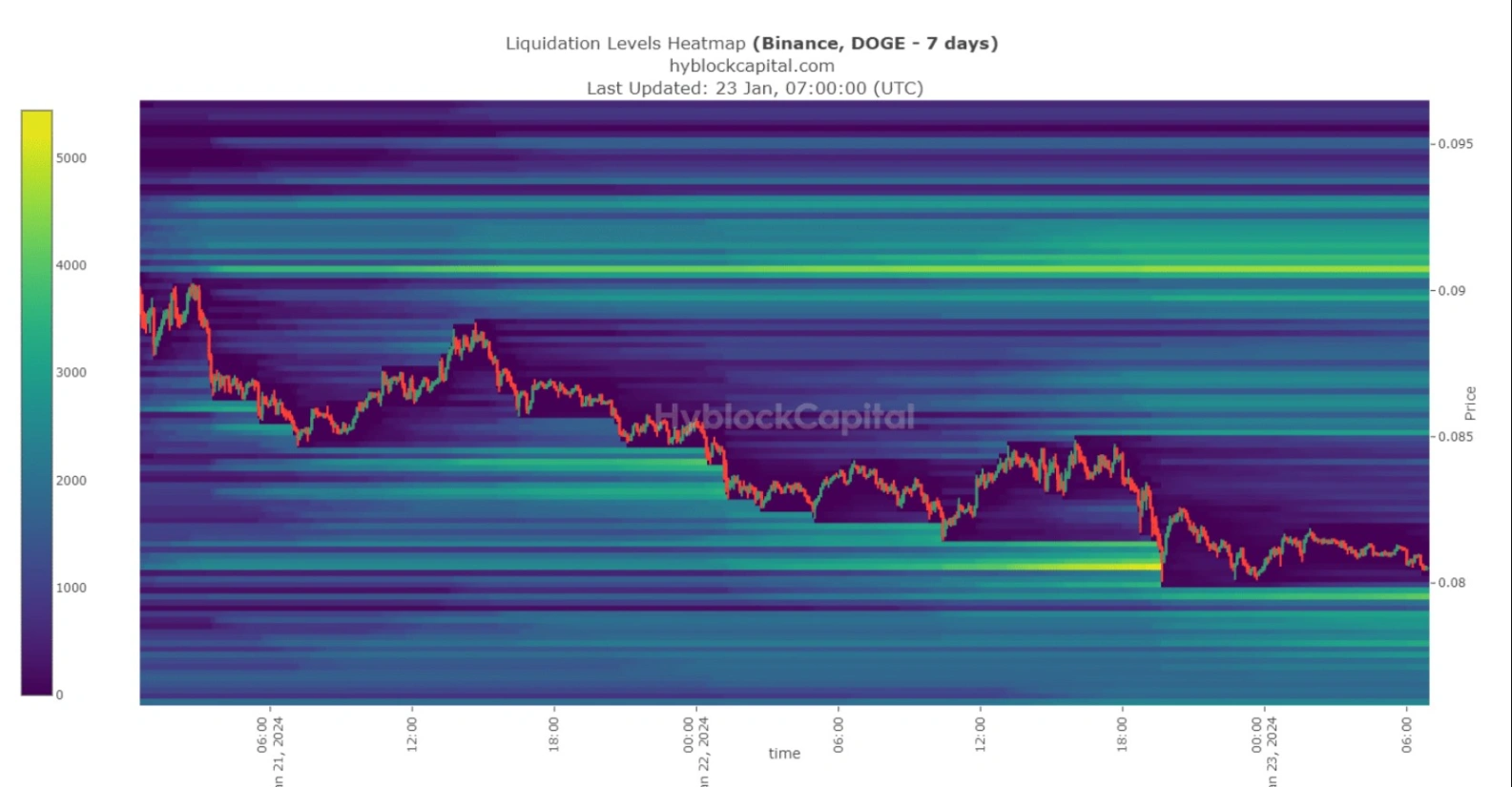

Examining Dogecoin’s liquidation heat map reveals a crucial support level around $0.079, suggesting a potential price dip to that threshold before any upward movement. Failure to test this support zone may lead to further price decline.

In an optimistic scenario of upward movement, Dogecoin could encounter formidable resistance around the $0.09 mark. However, our analysis indicates a likelihood of the meme coin’s price further decreasing. Both the Money Flow Index (MFI) and Relative Strength Index (RSI) have experienced downticks.

Despite these indicators, the Bollinger Bands suggest that Dogecoin’s price is currently in a less volatile zone, hinting at the possibility of reaching its support level and initiating a new rally from that zone.