Following a brief correction, HBAR has rebounded above the $0.23 mark. If demand from large investors continues to grow, this rally may gain even more momentum in the coming days.

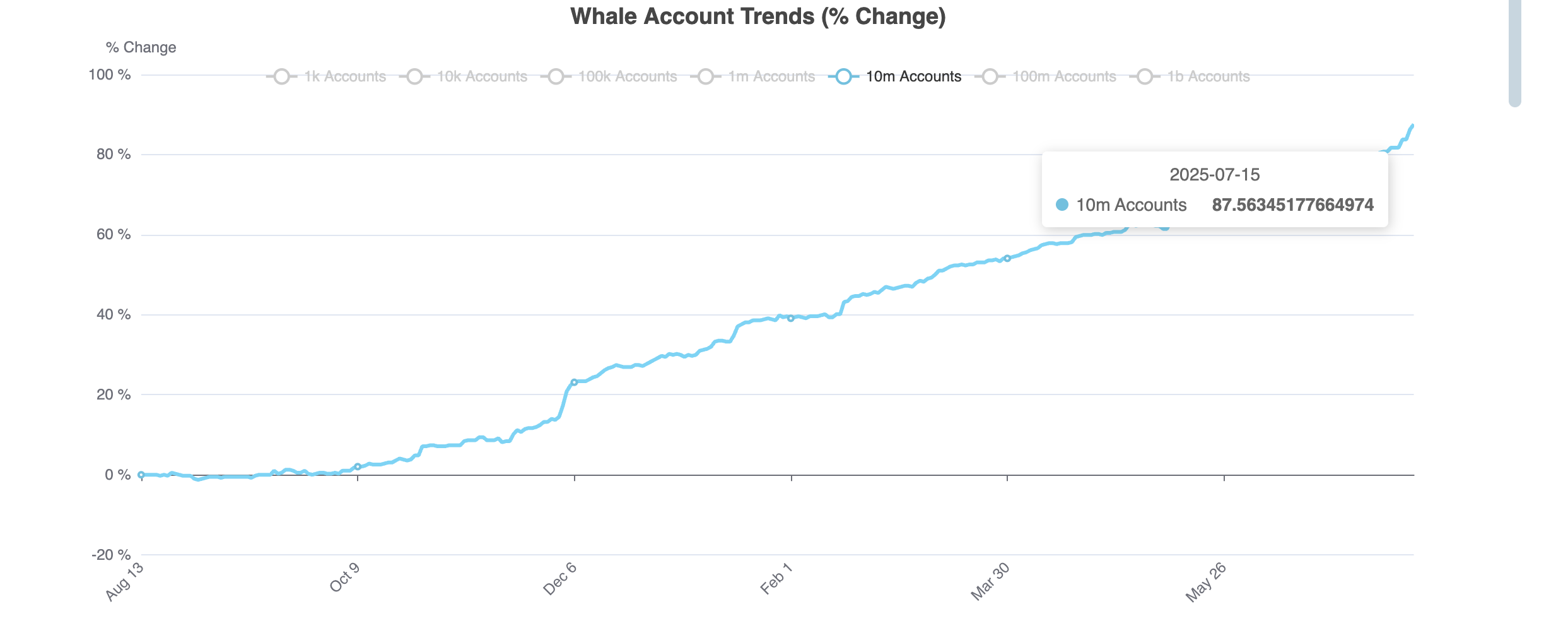

Mega Whales Accelerate Accumulation in July

According to data from the Hedera whale tracker, the percentage of HBAR supply held by whale wallets (those holding over $10 million worth of HBAR) surged from 81.72% to 87.56% between July 9 and July 15. This marks the highest level of whale holdings in recent weeks.

Such a sharp increase suggests high-conviction buying by deep-pocketed investors, often signaling long-term confidence or early access to market-moving information. Their aggressive accumulation is typically a bullish indicator for price action.

Chaikin Money Flow Cools – More Room for Upside

During HBAR’s recent rally, the Chaikin Money Flow (CMF) indicator — which measures the volume and direction of capital inflows — reached slightly overbought levels. However, as of July 15, CMF has cooled down, indicating that the market has reset and may be ready for another leg up.

Although HBAR saw a 9% intraday drop as CMF retreated, the price quickly recovered and is now trading above $0.23. A neutral CMF during ongoing whale accumulation often sets the stage for the next breakout.

Technical Outlook: 27% Rally Still in Play

HBAR is currently hovering around $0.23, a key support zone that bulls will look to defend. The next major upside target lies at $0.29 — representing a potential 27% increase from current levels.

This price target is based on the trend-based Fibonacci extension tool, which helps traders identify future resistance levels by projecting past price moves from a key retracement point.

In HBAR’s case, the Fibonacci extension is drawn from the early April 2025 swing low to the mid-May peak, and extended from the June 22 retracement.

If HBAR falls below $0.23, the uptrend weakens. However, the real breakdown level sits at $0.19 — aligned with the 0.618 Fibonacci level, which is often seen as the strongest support/resistance zone.