In 2025, gold has recorded an impressive rally, rising nearly 40% year-to-date. This surge has been driven by growing demand for safe-haven assets amid inflation concerns, central bank buying, geopolitical instability, and expectations that the U.S. Federal Reserve (Fed) will continue cutting interest rates.

Recently, the Fed reduced rates by another 25 basis points, making gold even more attractive to investors. With lower interest rates, the opportunity cost of holding gold decreases, further boosting demand. Major financial institutions such as Deutsche Bank, Citi, and UBS have revised their forecasts upward, projecting that gold could reach $4,000 per ounce by 2026 if monetary policy remains loose and yields from other assets stay weak.

Uptober – a seasonal driver for Bitcoin

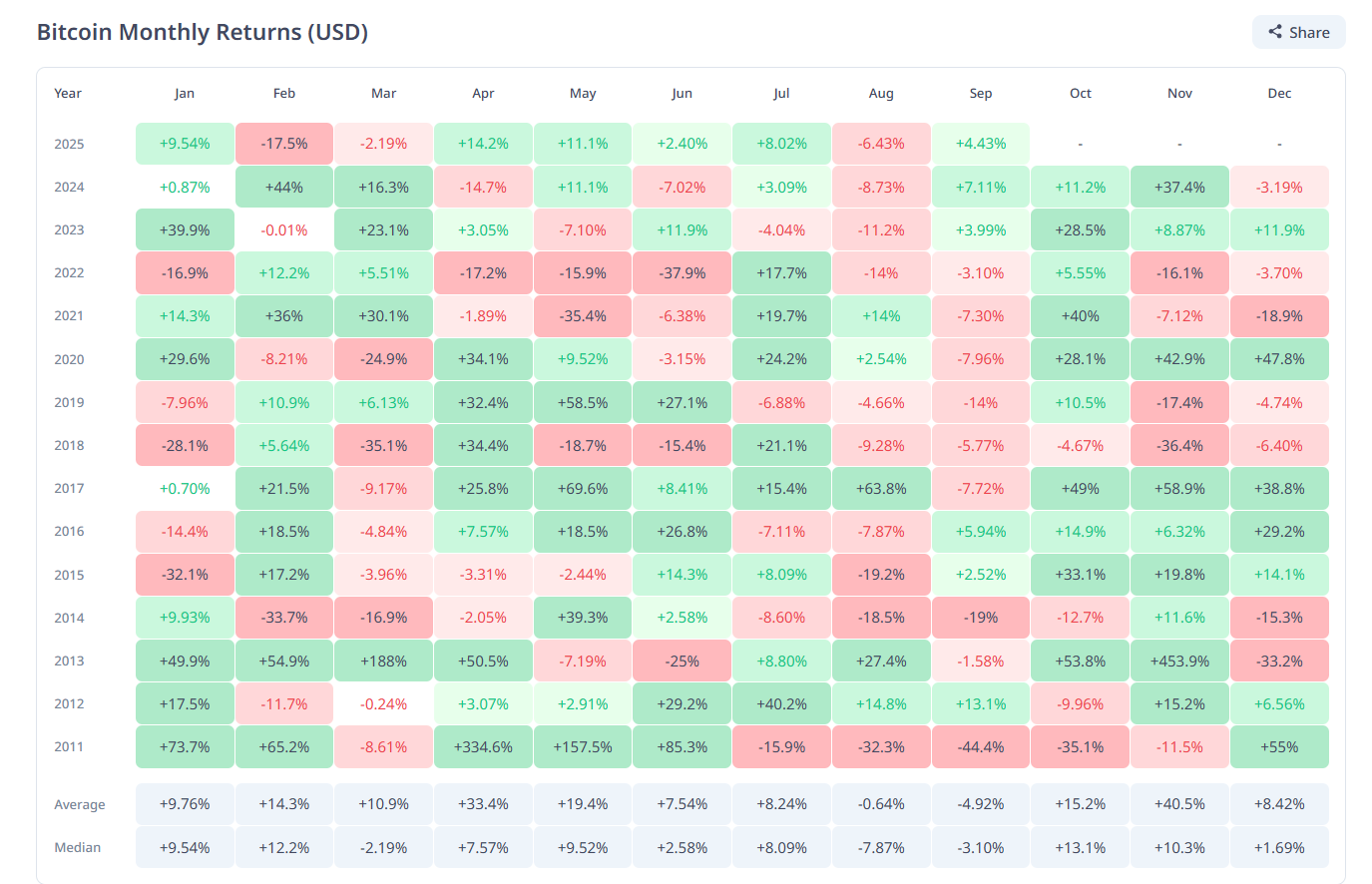

While gold strengthens, the crypto market is turning its attention to October – often dubbed “Uptober.” Historically, this has been a favorable month for Bitcoin, with gains recorded in 10 of the past 12 years. For example, after rising 7.3% in September 2024, Bitcoin advanced another 10.8% in October. Similarly, a modest uptick in September 2023 was followed by a 28.5% surge the next month.

Currently, several factors could support a strong October for Bitcoin in 2025, including the prospect of further Fed rate cuts, improved market liquidity, and technical signals suggesting a potential breakout as Bitcoin consolidates in a narrow trading range.

Gold and Bitcoin – driven by similar macroeconomic forces

Both gold and Bitcoin tend to benefit from macroeconomic conditions such as inflation, interest rate expectations, liquidity, and geopolitical risks. When rate cuts are anticipated, both assets typically see upward momentum. With gold already surging, some capital could flow into Bitcoin as investors seek higher returns in a low-rate, high-liquidity environment.

There is also a psychological factor: rising gold prices often reflect heightened caution. However, if other parts of the market remain stable, that caution can shift into confidence, potentially fueling a stronger October rally for Bitcoin.

Risks tied to monetary policy

Despite the optimistic outlook, liquidity remains a critical uncertainty. If the Fed unexpectedly pauses or slows its pace of rate cuts, gold’s momentum could ease, and Bitcoin’s “Uptober” rally may lose steam.

In the weeks ahead, investors will closely monitor the Fed’s policy signals, forward premiums, and funding conditions. If these remain supportive, both gold and Bitcoin could continue to rise in tandem. Otherwise, “Uptober” may turn into a less exciting month than many anticipate.