A bold and controversial theory is once again stirring discussion within the XRP community: the possibility that the token could one day reach a value of $20,000 — a staggering increase of over 913,000% from its current price of around $2.

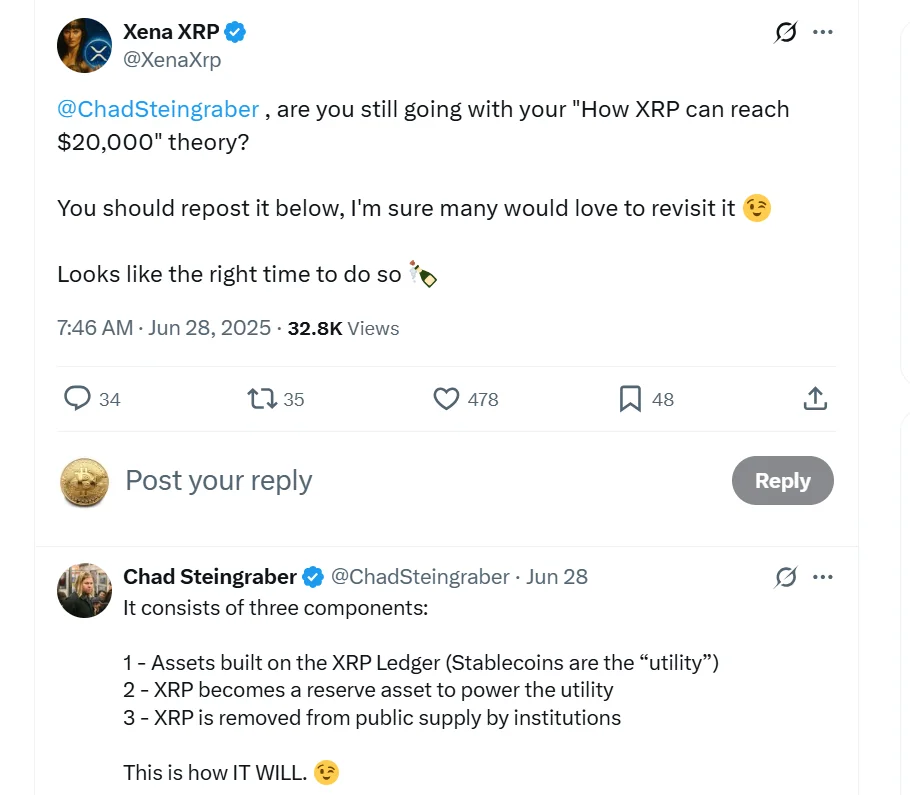

The idea was first introduced in 2022 by Chad Steingraber, a game developer and longtime XRP supporter. Recently, it has regained attention as the crypto market rebounds and institutional interest in blockchain utility continues to grow.

The Three Pillars Behind the “$20,000 XRP” Prediction

Steingraber’s ambitious forecast is based on three core assumptions that envision XRP transforming from a speculative asset into a fundamental component of the global financial infrastructure:

- Tokenized Asset Issuance on the XRP Ledger

Steingraber believes that governments and major financial institutions will eventually adopt the XRP Ledger to issue stablecoins and central bank digital currencies (CBDCs). Since XRP is the native token of the ledger, it would play a key role in settling transactions, thereby increasing its utility and demand.

- XRP as a Reserve Asset

In this scenario, XRP would no longer be traded primarily on exchanges. Instead, it would be held by institutions as a reserve asset, similar to how gold is used today. These holdings would support internal liquidity, facilitate seamless value transfers, and provide backing for organization-specific digital assets.

- Institutional Absorption of Circulating Supply

Steingraber suggests that over time, financial institutions will acquire large amounts of XRP and lock them into private ledgers. This would reduce the circulating supply available on public markets, potentially triggering significant price appreciation due to scarcity.

From Retail Trading to Institutional Utility

According to Steingraber, the current retail-dominated XRP market is only a transitional phase. He argues that institutions are unlikely to rely on public trading platforms due to concerns over transparency and regulatory exposure. Instead, they would shift toward private networks and rely on professional liquidity providers for secure, large-scale settlements.

This transition, he claims, marks a shift from speculation toward real-world utility as XRP becomes embedded in enterprise-level infrastructure.

Another key point in Steingraber’s argument is the looming possibility of a supply shock. He estimates that only around 20 billion XRP tokens remain in active circulation after accounting for lost, burned, or locked tokens. In a worst-case scenario, this could fall below 100 million tokens if institutions begin buying aggressively — setting the stage for a sharp price rally driven by limited supply and high demand.

Steingraber further argues that the demand for XRP won’t be limited to the U.S. He anticipates interest from international banks, sovereign wealth funds, and private enterprises looking to integrate XRP into their digital infrastructure. This would further elevate the token’s role in the global financial system.

While Steingraber’s vision offers an exciting outlook for XRP’s future, it remains speculative. Critics note that it overlooks the competitive landscape, where other digital assets are also vying for institutional adoption. Moreover, the $20,000 valuation relies heavily on global adoption that has yet to occur at scale.

Nevertheless, the theory continues to capture the imagination of XRP supporters who see long-term potential in the token’s unique ledger technology and evolving use cases.