Galaxy Digital, one of the leading companies in the cryptocurrency sector, is expanding its investment footprint by announcing a new $100 million fund. This joint venture aims to boost the power and potential of startups in the cryptocurrency sector.

The move reflects Galaxy’s continued commitment to promoting and growing the cryptocurrency ecosystem, an effort that previously relied largely on the company’s internal capital.

Galaxy Digital’s fund promotes cryptocurrency ecosystem growth

The new fund, called Galaxy Ventures Fund I, LP, is expected to support up to 30 startups over the next three years. Initial investments will start from $1 million, focusing on areas such as financial applications, software infrastructure development, and cryptocurrency protocols.

Galaxy Digital has a strong history of investing in cryptocurrency businesses, with over $200 million invested in over 100 projects over the past six years. However, this fund marks a shift in their investment strategy, partnering with outside investors for the first time. The company’s goal is to replicate the success of investing through this fund through accounting mechanisms.

“For years, we have used our capital to invest in innovative crypto businesses. Now, we are introducing Galaxy Ventures Fund I LP to partner with outside investors, helps us continue to advance the digital asset ecosystem by supporting promising early-stage companies,” the company said.

Galaxy Digital’s launch of the ambitious fund marks a notable surge of interest in the venture capital sector. Earlier this year, there was a partnership between Marc Andreessen, Accolade Partners and Galaxy Digital to launch a $75 million fund with the 1kx network. At the same time, Paradigm is said to be raising between $750 million and $850 million, and Hack VC aims to raise a minimum of $100 million.

Related: KuCoin Exchange Witnesses Significant Outflow of Funds

This resurgence mirrors the trend reflected in Galaxy Digital’s January 2024 research. The company’s report pointed to a link between venture fundraising strategies and growing cryptocurrency demand increase.

Institutional interest waned

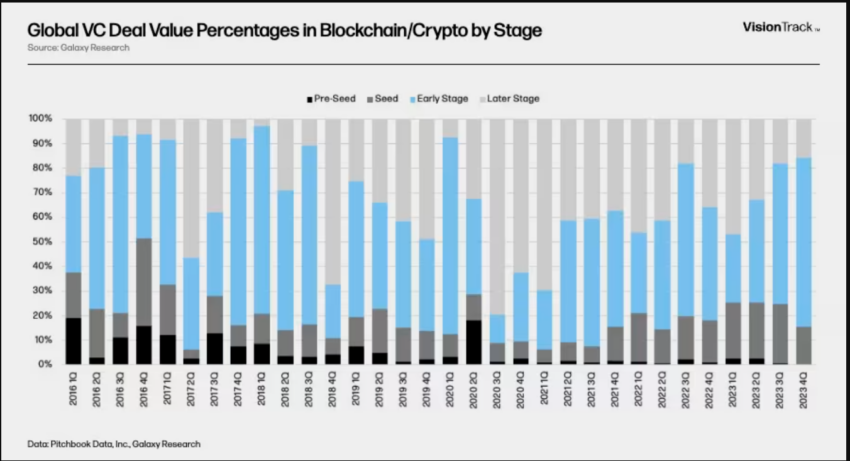

Global VC Deal Percentages in Blockchain or Crypto by Stage. Source: Galaxy Digital

However, institutional interest is gradually waning as valuations decline, posing a major challenge for crypto venture funding. This has become clearer throughout 2023 as passive investment products dominate the market.

Galaxy Digital’s report also clarifies the significance of their new fund. Globally, crypto/blockchain-focused venture fundraising will only reach $5.75 billion in 2023, down significantly from the 2022 record of $37.7 billion.

The firm’s research highlights that while crypto venture fundraising is not a major vehicle for 2021, the sector is still making progress compared to previous levels. The report predicts venture capital investment in crypto could regain momentum by 2024 if crypto investors choose to reinvest.

Je ne vois pas comment gagner de l’argent dans cette plateforme ?