After more than two years of anticipation, cryptocurrency exchange FTX is preparing to return over $1.2 billion to users who lost access to their assets following the platform’s shocking collapse.

According to Sunil, a representative of the FTX Customer Ad-Hoc Committee—the largest creditor group with over 1,500 members—users with balances under $50,000 will be prioritized in the first repayment phase. The deadline for filing claims has been extended to January 20, with the repayment process expected to commence shortly thereafter.

Interestingly, January 20 also marks the inauguration day of President-elect Donald Trump, sparking optimism about potential positive changes in cryptocurrency policies. Notably, attention is on the possible passage of the Bitcoin Act, a groundbreaking proposal aimed at establishing Bitcoin reserves for the world’s largest economy.

Good news for creditors is that under the restructuring plan approved in October 2024, 98% of FTX users may recover up to 119% of their declared assets. However, some creditors remain dissatisfied, as the valuations are based on prices at the time of bankruptcy, while Bitcoin has surged over 370% since November 2022.

Blockchain expert Anndy Lian predicts mixed reactions from investors:

Heavily impacted users might sell immediately to stabilize their finances, whereas optimists will likely hold on, betting on the future of the crypto market.

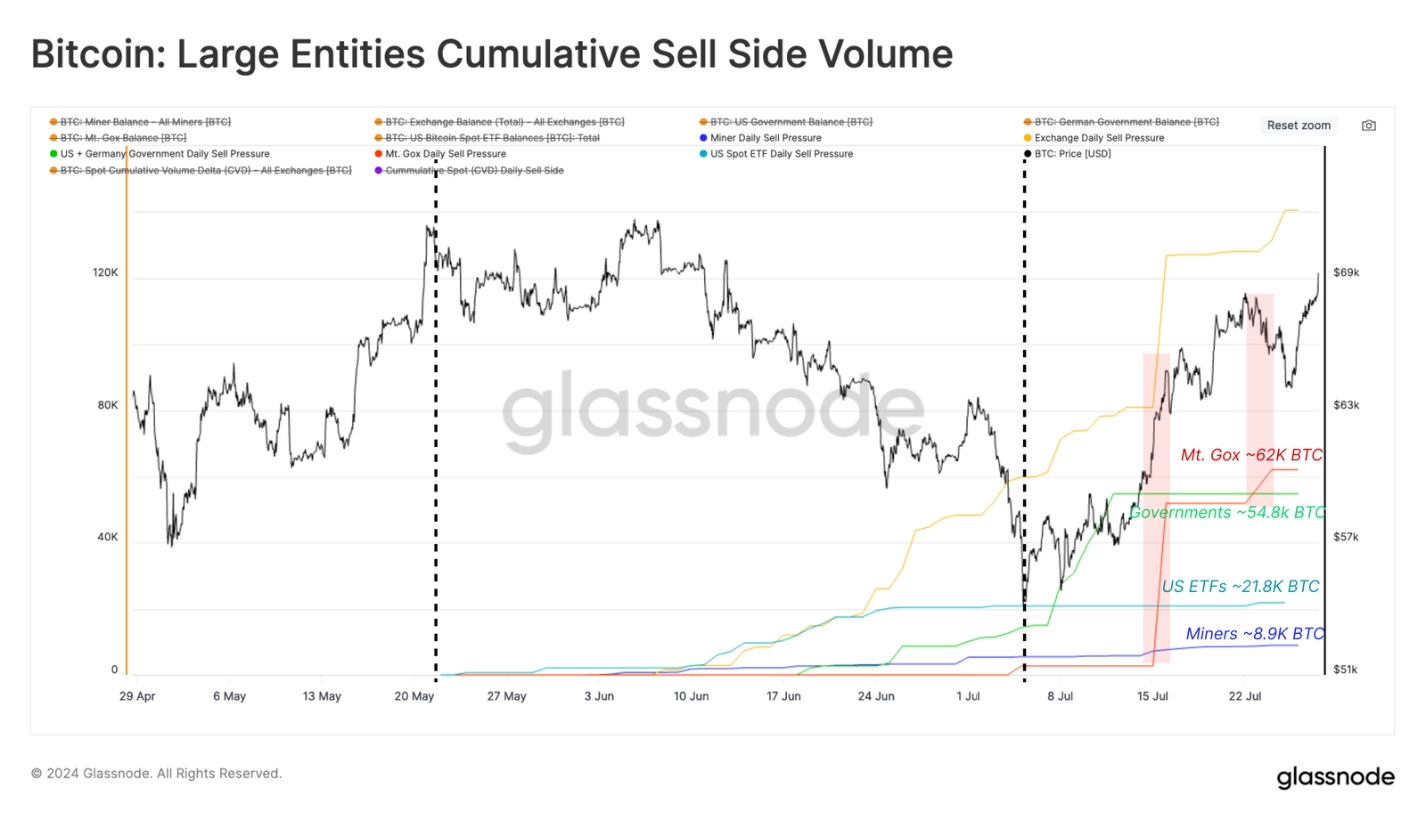

The lessons from the Mt. Gox case may serve as a reference point. Ten years after its collapse, most Mt. Gox creditors opted to retain their Bitcoin despite an 8,500% price increase. In the most recent repayment round on July 30, creditors received 59,000 BTC, worth nearly $4 billion. According to Glassnode, the majority of these coins have yet to be sold on the market.

Related: FTX Sues Binance and CZ, Demanding Compensation of Up to $1.76 Billion

Philipp Zentner, CEO of LI.FI Protocol, described the upcoming $1.2 billion repayment as a potential “key liquidity event” for the crypto industry. With support from BitGo and Kraken in debt distribution, FTX is projected to repay a total of approximately $16 billion if all claims are approved.