Paris-based tech firm Blockchain Group is ramping up its Bitcoin reserves after raising €63.3 million ($72 million) through a bond issuance. The company plans to use the funds to purchase an additional 590 BTC, bringing its total holdings to 1,437 BTC.

At current prices of around $109,000 per Bitcoin, the raised amount could buy up to 658 BTC. However, Blockchain Group stated that 95% of the proceeds will go toward acquiring Bitcoin, while the remaining 5% will be allocated for operational and management costs.

The majority of the investment came from venture capital firm Fulgur Ventures, which contributed €55.3 million, while Moonlight Capital added €5 million. The bonds are convertible into Blockchain Group shares at a price of €3.809 per share.

Blockchain Group (trading under ticker ALTBG) is listed on Euronext Paris, Europe’s second-largest stock exchange. According to its website, the company aims to “increase the number of Bitcoin per share over time” by leveraging excess cash and appropriate financing instruments.

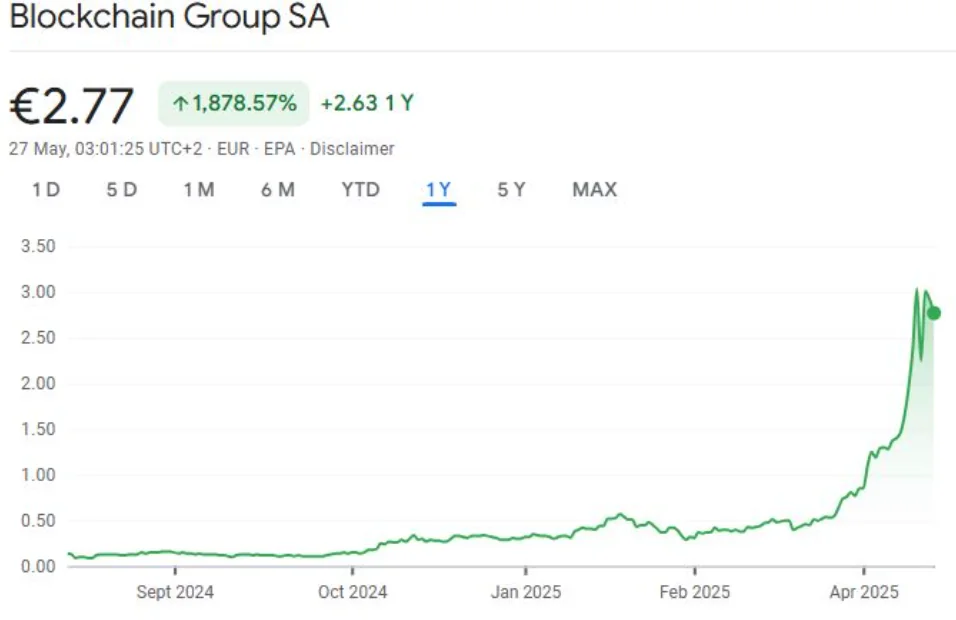

ALTBG shares have surged nearly 766% so far in 2025. Notably, after the company began purchasing Bitcoin on November 5 last year, its stock price jumped 225%. Although shares closed 5.5% lower on May 26 at €2.77, the overall performance remains strong.

In its 2024 financial report, Blockchain Group recorded a yield of over 709% from its Bitcoin holdings. However, total consolidated revenue dropped to €13.86 million, a 32.1% decrease from the previous year’s €20.41 million.

Looking ahead, the company has set an ambitious goal: to acquire 1% of the total global Bitcoin supply—more than 170,000 BTC—by 2032.

Blockchain Group is not alone in this trend. A growing number of publicly listed companies are turning to Bitcoin as a long-term asset. On May 22, Swedish health tech firm H100 Group AB announced a strategic shift toward Bitcoin. Earlier, on May 7, Strive Asset Management also declared its transition to a Bitcoin treasury strategy.

Despite its notorious volatility, Bitcoin continues to attract corporate interest as a hedge against inflation, a store of value with long-term growth potential, and a low-correlation asset compared to traditional equities.