Brett Harrison, the former president of FTX US, has successfully raised $35 million for his new venture, Architect Financial Technologies, marking a notable comeback for a figure once closely associated with the historic collapse of FTX. The deal highlights renewed institutional investor confidence in crypto-linked derivatives infrastructure.

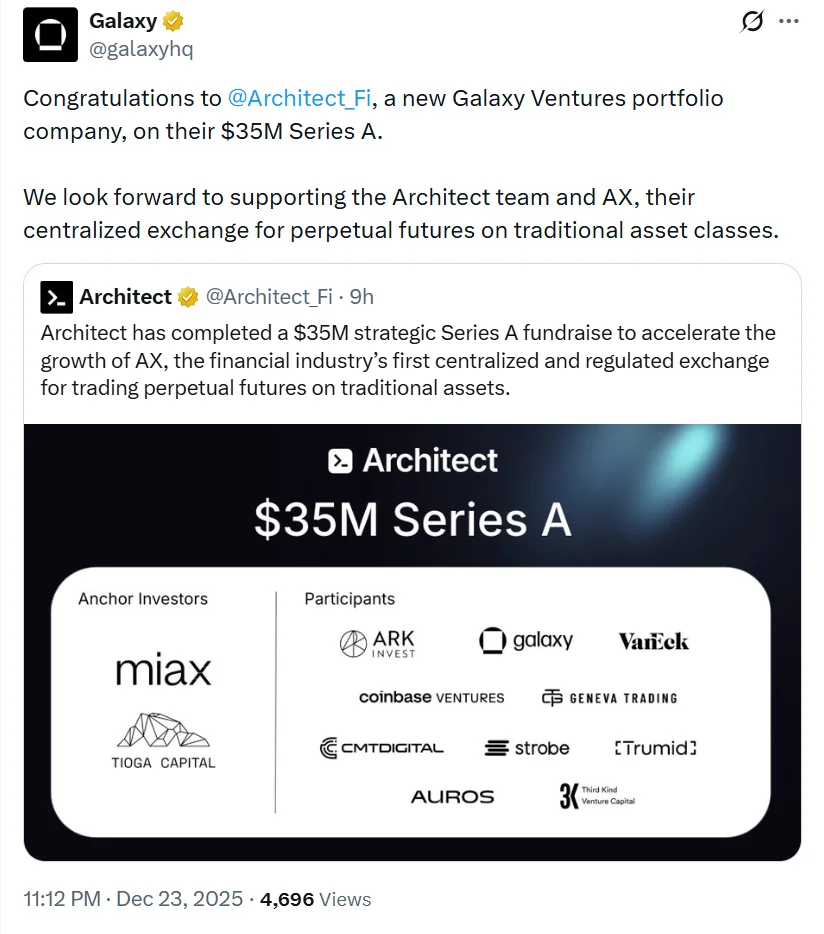

According to The Information, the newly raised capital will be used to build an institutional-grade trading platform covering a wide range of assets, including cryptocurrencies, equities, futures, and derivatives. The funding round attracted prominent participants such as Miax, Tioga Capital, ARK Investment, Galaxy, and VanEck.

Previously, in 2024, Architect raised $12 million in an earlier round backed by Coinbase Ventures, Circle Ventures, SALT Fund, and other investors, signaling sustained interest from major players in the financial and crypto sectors.

The latest funding follows Architect’s receipt of regulatory approval in Bermuda, allowing the company to offer perpetual futures contracts tied to traditional assets such as stocks, commodities, and foreign currencies. Perpetual futures were first popularized by BitMEX and later became a core product at FTX before its collapse in late 2022.

Architect is explicitly targeting professional and institutional traders, offering features such as algorithmic trading, advanced risk management tools, and multi-asset derivatives support. The company also plans to expand beyond Bermuda into additional markets, including Europe and the Asia-Pacific region.

Derivatives Markets Dominate Global Finance

Derivatives are widely regarded as the largest segment of global financial markets. By some estimates, the notional value of outstanding derivatives contracts reaches hundreds of trillions of dollars, far exceeding global economic output.

In a February report, S&P Global noted that while the derivatives market continues to evolve, liquidity remains a core challenge across many asset classes. As a result, investors are increasingly focused on products offering deep liquidity and tight bid-ask spreads, even as market structures and index-based solutions continue to innovate.

Derivatives have also been widely embraced by the cryptocurrency sector. Some estimates suggest that derivatives account for 75% to 80% of total trading volume on major crypto exchanges, underscoring their central role in market activity.

However, this dominance has also amplified volatility. The risks were clearly demonstrated during the October 10 liquidation event, the largest in crypto history, when $19 billion was wiped out in a single day.