Speculators of FLOKI failed to reclaim the $0.000176 zone, lacking the strength to retest the resistance level and falling short of the $0.00016 target. The CMF (Chaikin Money Flow) dropped sharply below -0.05, indicating a significant outflow of capital from the market in recent days. On the 4-hour chart, the RSI (Relative Strength Index) also remains in bearish territory, suggesting the memecoin may face further losses.

This leads to the question: Do on-chain metrics align with these findings?

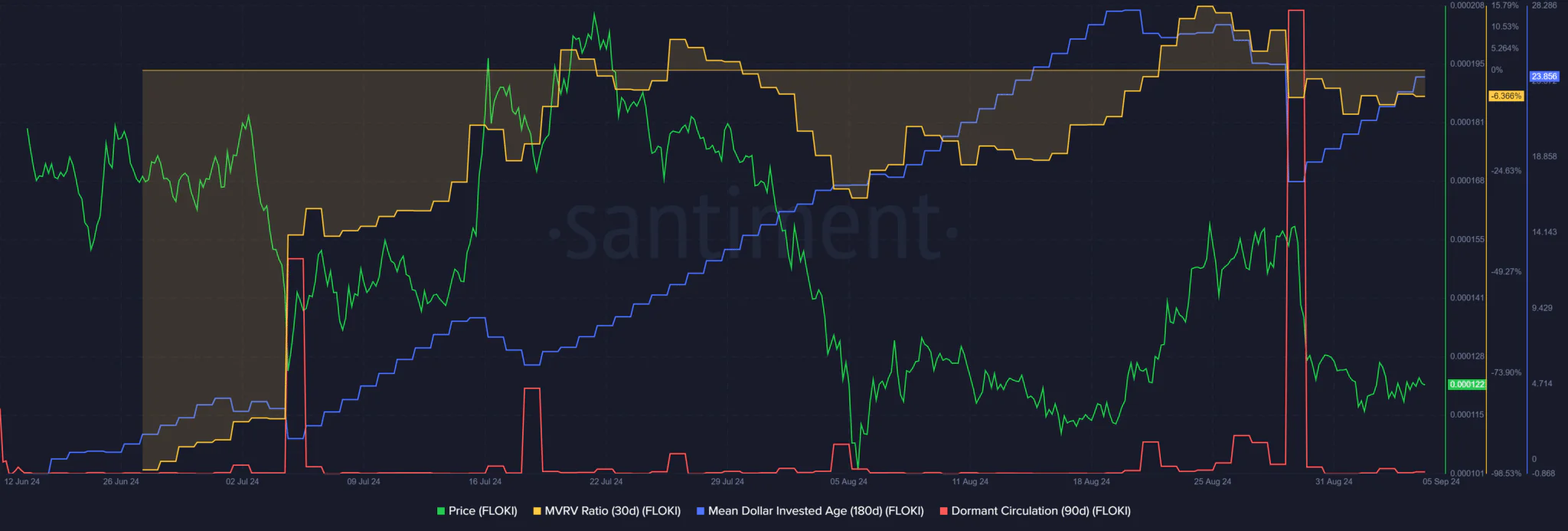

While bearish signals dominate, there remains a glimmer of hope for holders. On August 29, dormant circulation spiked, hinting at a series of token movements likely aimed at selling. Concurrently, the price fell from $0.000157 to $0.000135. The short-term MVRV, which had been in the positive zone, was forced into a decline, indicating that holders have experienced minor losses amidst the recent price surge, likely driven by a significant wave of selling.

The average dollar investment age also saw a pullback, signaling the re-entry of older tokens into circulation. After nearly three months of upward trend, this is a positive sign. There’s potential for FLOKI to rise following this recent reset. However, under the current circumstances, buying pressure remains insufficient to favor the bulls.

FLOKI sentiment deteriorated after the pullback

In the final week of August, FLOKI experienced a strong short-term surge, which was accompanied by a steady rise in daily active addresses. This indicated higher usage and potential demand. Additionally, token velocity increased, reflecting greater utilization in transactions.

However, this upward momentum quickly faded within a few days as pessimism took over the market, causing participants to retreat. Network growth remained relatively unaffected despite the downturn.

Open interest (OI) surged even after FLOKI hit a local high and started declining, a clear sign of heavy short selling in the market. Since then, OI has decreased, suggesting that negative sentiment now prevails.

Overall, in the short term, metrics and indicators favor the sellers. The drop in the average dollar investment age seems to be the only mildly positive factor.