Operating under Switzerland’s DLT regulations, Backed has issued tokens that function similarly to ERC-20 tokens, reflecting the value of various assets, including silver ETFs, corporate bond ETFs, and stocks. These tokens are backed by underlying assets and can be freely transferred across wallets.

This is an advertisement per Article 22 Prospectus Regulation.

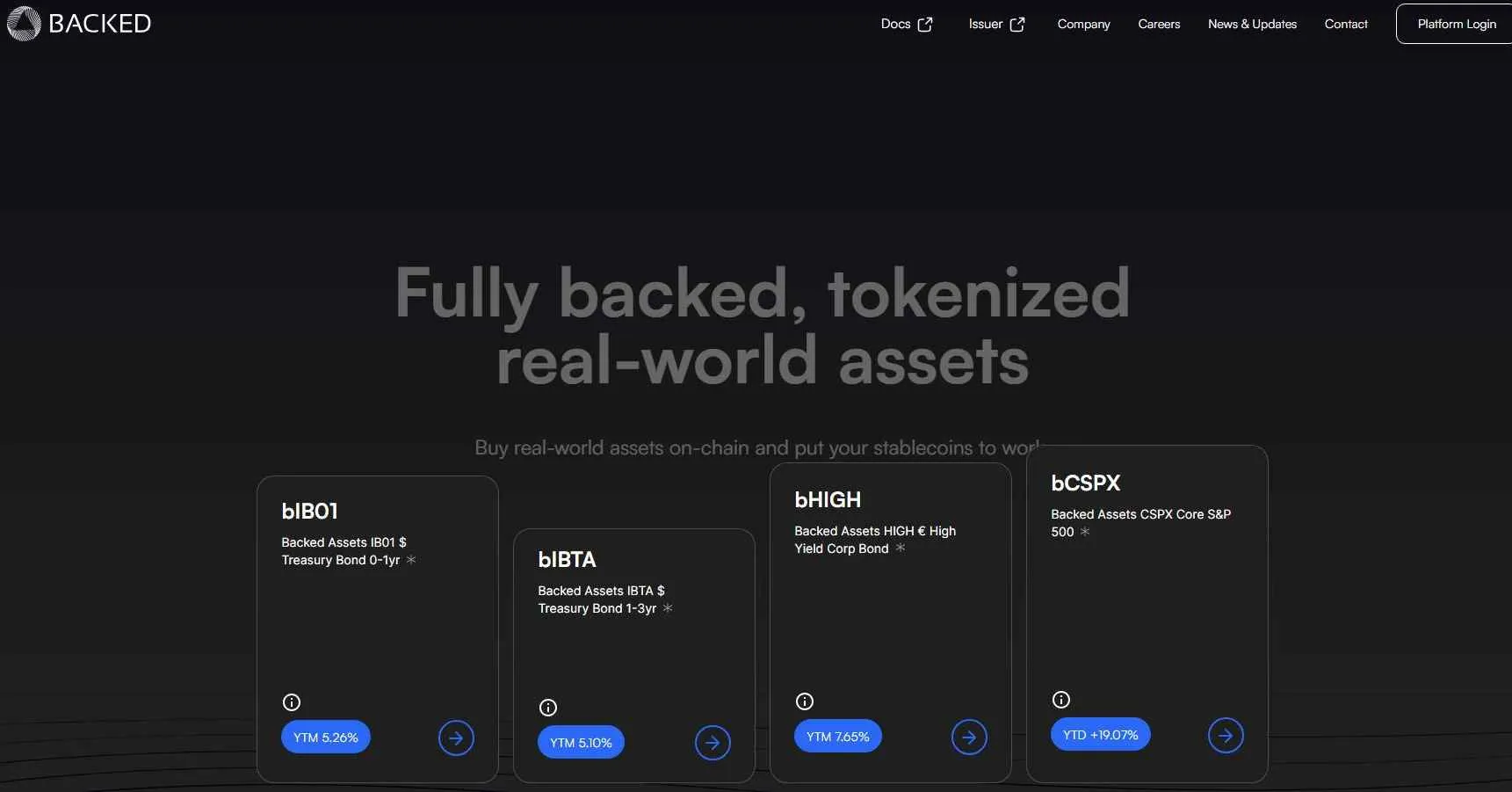

🔵 🚀 Backed has issued the FIRST tokenized security on Base – bIB01, a tokenized short-term US treasury bond ETF.

We’ve been eagerly getting ready for Base’s mainnet launch, ensuring our tokenized RWAs are ready… pic.twitter.com/CKusCLUX1c

— Backed (@BackedFi) October 6, 2023

Backed’s product is not registered with the SEC and is not available to US residents.

Prior to expanding to Base, Backed had previously deployed b1B01 on Ethereum and Gnosis, with a total market capitalization exceeding $37 million USD, according to on-chain data aggregated by Steakhouse on Dune.

Explaining the rationale behind its move to Coinbase’s layer-2 solution, Backed cited Base’s cost-effectiveness and developer-friendly environment, suitable for testing encrypted securities products.

Backed is one of the major companies providing tokenized securities on the blockchain, alongside Ondo Finance, Maple Finance, Matrixdock, OpenEden, and TrueFi.

Given the potential of the Real World Asset (RWA) narrative, many prominent players are entering this arena, including:

- MakerDAO: deploying 500 million DAI into US bonds.

- Pendle: introducing RWA products, supporting sDAI and fUSDC.

- Mantle: integrating Ondo Finance’s USD Yield (USDY).

- Avalanche Foundation: allocating $50 million USD for investment in the subsector.

>>>> Related: What is an RWA crypto?

Last month, the Federal Reserve publicly released research documents on RWAs, acknowledging the potential growth and risks in this emerging field.