Teucrium Investment Advisors is preparing to launch the first-ever leveraged ETF linked to XRP — the fourth-largest cryptocurrency by market capitalization — according to Bloomberg. The new fund, called Teucrium 2x Long Daily XRP ETF (ticker: XXRP), will be listed on the NYSE Arca exchange.

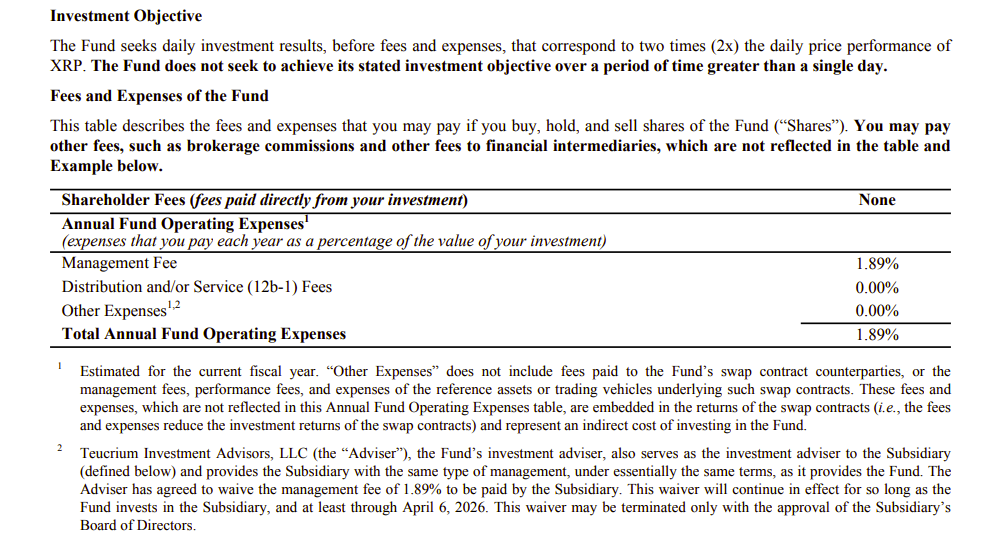

This ETF is designed to deliver returns that are twice the daily performance of XRP, using swap agreements. It targets investors seeking high-risk, high-reward exposure to XRP. The fund will charge a management fee of 1.89%.

As there are currently no U.S.-listed spot XRP ETFs, XXRP will rely on pricing data from various Europe-listed XRP ETPs, including those offered by 21Shares, Bitwise, WisdomTree, Virtune, and CoinShares.

Teucrium currently manages about $311 million in assets and specializes in alternative investment ETFs, such as those focused on agricultural commodities. The firm previously launched the Teucrium Bitcoin Futures Fund in April 2022, following approval by the SEC.

In addition to XXRP, Teucrium is planning a short version of the fund called the Teucrium 2x Short Daily XRP ETF, which would allow investors to profit from daily declines in XRP’s price.

According to Sal Gilbertie, founder and CEO of Teucrium, the decision to launch now is driven by XRP’s attractive current price and growing investor interest in the asset.

This move comes as the long-running legal battle between the SEC and Ripple Labs, the company behind XRP, nears its conclusion. Ripple CEO Brad Garlinghouse recently stated he expects multiple XRP ETFs to launch in the U.S. during the second half of 2025.

Following a favorable settlement outlook, the probability of XRP ETF approval has risen to 86%, boosting XRP’s price by 14%. Major asset managers such as Bitwise, 21Shares, Grayscale, and Franklin Templeton have already filed applications with the SEC to launch their own XRP ETFs. Industry giants like BlackRock and Fidelity may also join the race, depending on the outcome of the SEC-Ripple case.