Key points:

-

The Federal Reserve is deeply divided as it approves a 0.25% rate cut, reflecting concerns over inflation and slowing growth.

-

Bitcoin briefly surged before the FOMC meeting, but remains stuck under $100,000.

-

Glassnode data shows BTC is trading within a “fragile range,” pressured by weakening on-chain conditions and declining futures demand.

-

Unrealized losses are rising, increasing the risk of forced selling if BTC continues to move sideways.

-

Derivative market activity is falling, making spot-driven rallies difficult to sustain.

Fed cuts rates but remains divided, while Bitcoin struggles to break above $100,000

On Wednesday, the U.S. Federal Reserve approved a 25-basis-point interest rate cut—the third of the year—aligning with market expectations. Ahead of the meeting, Bitcoin briefly spiked above $94,000, repeating the familiar pre-FOMC pattern of price rallies.

However, media coverage described the decision as “hawkish,” highlighting internal disagreements within the Fed about the economic outlook and the future path of monetary policy.

According to CNBC, the 9–3 vote shows that Fed members remain concerned about persistent inflation, weakening growth, and the possibility that rate cuts could slow significantly in 2026.

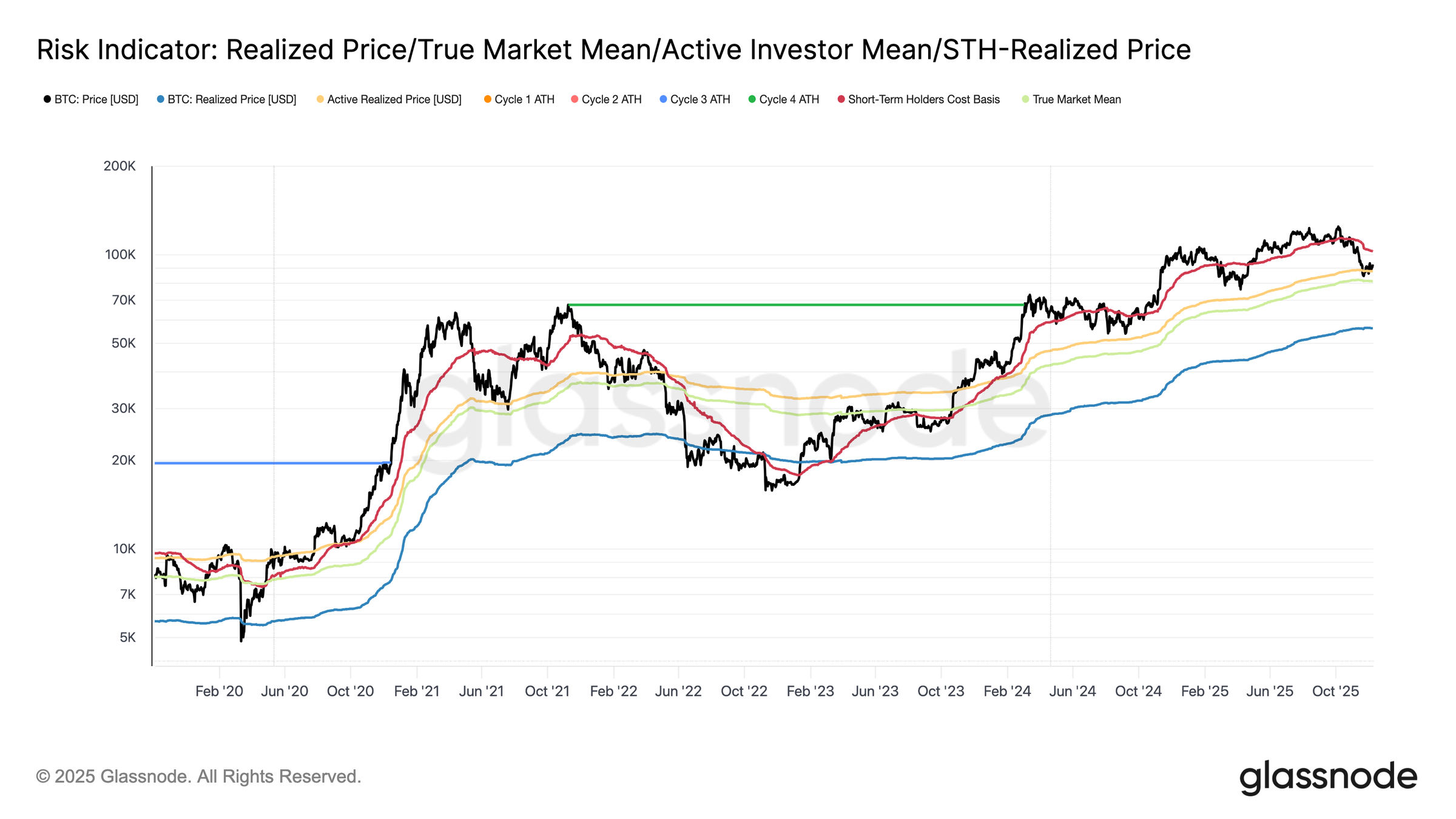

Bitcoin stuck in a structurally fragile range

Glassnode’s analysis indicates that Bitcoin continues to struggle below the $100,000 threshold. Its price remains trapped between two critical levels:

-

Short-term cost basis: $102,700

-

True Market Mean: $81,300

This structure keeps BTC locked in a weak, unstable trading zone, while on-chain data reflects deteriorating conditions:

-

Futures demand is thinning,

-

Selling pressure persists,

-

Momentum is weakening.

Time is running out for Bitcoin to reclaim $100,000

Glassnode warns that the longer BTC stays in this fragile zone, the more unrealized losses pile up—raising the risk of forced selling.

Key stress indicators include:

-

The 30-day SMA relative unrealized loss has climbed to 4.4%, surpassing 2% for the first time in two years.

-

Even as BTC rebounded to around $92,700 after the Nov. 22 low, entity-adjusted realized losses kept rising, reaching $555 million per day, a level previously seen during the FTX collapse.

-

Long-term holders (over 1-year holding period) have been realizing profits of over $1 billion per day, peaking at a record $1.3 billion.

This combination of capitulation from top buyers and heavy profit-taking from long-term holders has kept Bitcoin below the critical resistance band of $95,000–$102,000.

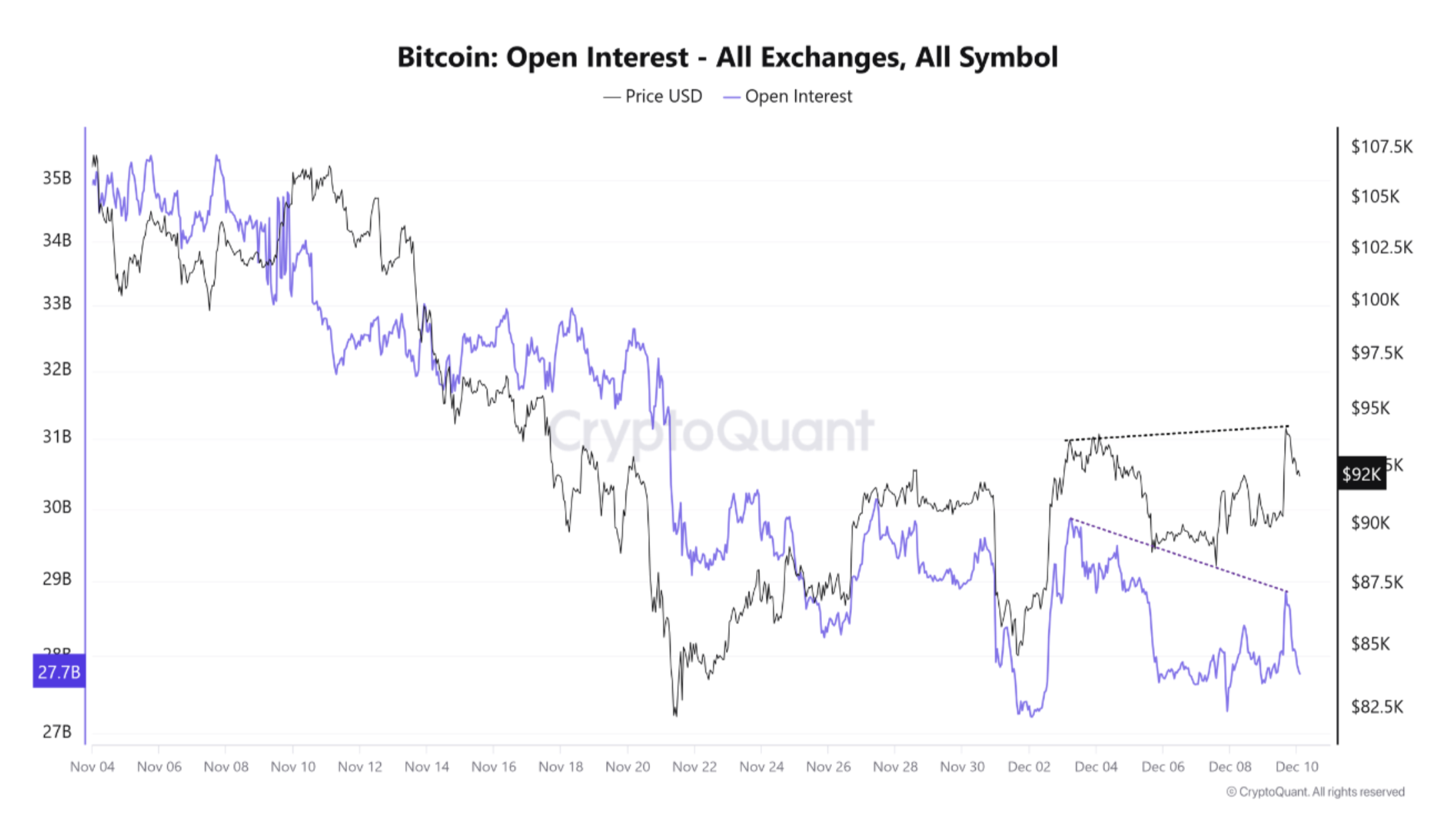

Spot-driven rally struggles as futures interest declines

CryptoQuant data shows that while crypto markets often rally before FOMC meetings, this time a notable divergence has emerged: Bitcoin’s price is rising while open interest (OI) is falling.

-

Since October, OI has declined during the corrective phase.

-

Even after BTC bottomed on Nov. 21 and moved to higher highs, OI continued dropping.

-

This indicates the rally is driven mainly by spot buying, not leveraged speculation.

Although spot-led uptrends are generally healthy, CryptoQuant warns that:

-

The derivatives market still dominates overall volumes,

-

Spot volume accounts for only about 10% of derivatives activity,

-

Therefore, the rally may not be sustainable if expectations for aggressive rate cuts weaken.