The U.S. Federal Reserve, through its New York branch, has continued to inject liquidity into the American economy via overnight repo operations. This move is widely seen as a positive signal for risk assets, including cryptocurrencies, even as overall market optimism for a year-end rally continues to fade.

New York Fed Injects $26 Billion as Crypto Market Reacts

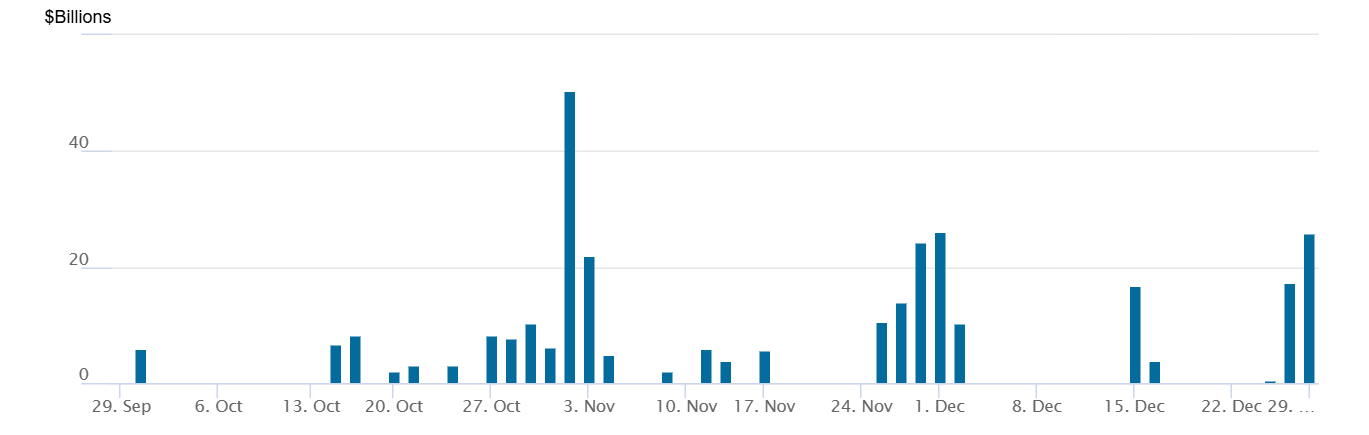

According to data from the New York Federal Reserve, the U.S. central bank conducted overnight repo operations that injected a total of $26 billion into the financial system. This liquidity infusion included $16 billion in U.S. Treasury bill purchases and $9.95 billion in mortgage-backed securities (MBS).

This follows a similar move last week, when the Fed injected $2.5 billion through Treasury bills and MBS. In theory, rising liquidity conditions tend to support risk-on assets, fueling hopes for a potential year-end rally in the crypto market.

Notably, Bitcoin briefly surged above $90,000, coinciding with the Fed’s liquidity injection. However, the rally was short-lived, as BTC quickly reversed course and dropped to around $86,700 later in the day.

Broader Crypto Market Turns Red

Bitcoin’s pullback triggered a broader market decline. Data from CoinMarketCap shows that total crypto market capitalization has fallen to $2.96 trillion, down nearly 1% over the past 24 hours.

Without a year-end rally, several major cryptocurrencies risk ending the year in negative territory. Bitcoin is currently down more than 6% year-to-date (YTD), while Ethereum, XRP, and Solana have posted YTD losses of approximately 11%, 10%, and 36%, respectively.

Year-End Rally Optimism Continues to Fade

Data from Polymarket indicates that trader confidence in a year-end rally is steadily declining. The probability of Bitcoin reaching $95,000 by year-end has dropped to just 3%, while the odds of a decline to $80,000 stand at 4%. This suggests that most traders expect BTC to remain range-bound through the end of the year.

Bitcoin continues to face heavy selling pressure near the $90,000 resistance level. Notably, BlackRock recently transferred 2,201 BTC (worth approximately $192 million) to Coinbase, a move widely interpreted as preparation for potential selling. Meanwhile, Bitcoin ETFs have continued to record daily net outflows, with total net outflows in December reaching $1.08 billion.

Market analyst Ted Pillows noted that Bitcoin’s spot CVD is trending lower, signaling that downside risks currently outweigh the likelihood of a year-end rally. He also warned that the Coinbase Bitcoin premium turning negative is another concerning sign for overall market sentiment.