Amid concerns of a price drop in BNB Chain after CZ’s exit, the coin has demonstrated resilience, marking a notable 6% increase in the past week. Encouragingly, a promising bullish pattern is emerging on BNB’s price chart, with the potential for further gains.

As per Ali, a prominent crypto analyst, BNB Chain may be forming a head-and-shoulders pattern. In a tweet on December 12th, he stated, “A sustained close above the neckline at $261 could ignite a bullish breakout, propelling BNB toward $310!”

Examining BNB’s daily chart reveals the possibility of reaching $261, with the MACD indicating a clear bullish advantage in the market. Additionally, the Chaikin Money Flow (CMF) has shown a promising uptick in recent times. While these indicators point towards a positive trend, it’s worth noting that some other signals appear bearish.

For instance, the coin recently touched the upper limit of the Bollinger Bands, and the Relative Strength Index (RSI) took a downturn towards the neutral zone, raising the likelihood of a potential price correction.

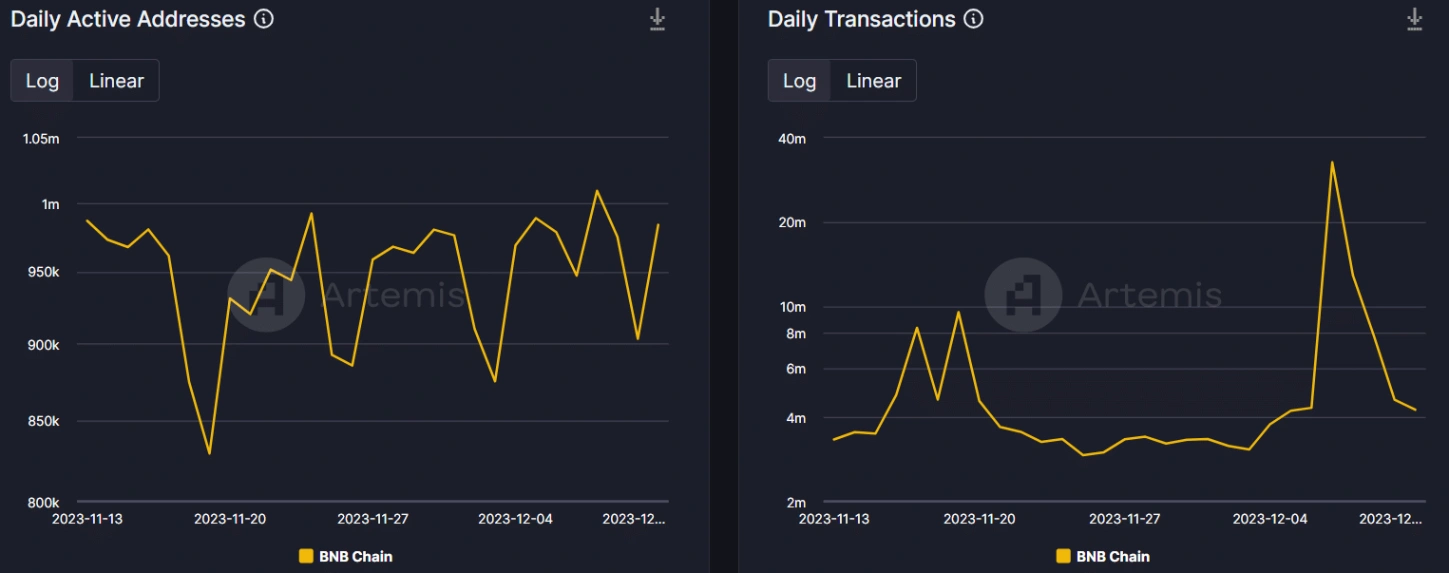

In terms of network activity, BNB has maintained a robust performance. Despite the blockchain’s price chart reflecting positive momentum, there has been a notable uptick in network activity in recent times.

Related: BNB Significantly Impacted Following CEO Changpeng Zhao’s Departure

Analysis of Artemis’ data highlights the stability of BNB’s daily active addresses throughout the past month. Notably, on December 7th, 2023, the blockchain witnessed a significant surge in daily transactions, indicating a sudden spike in BNB’s network usage.

Furthermore, BNB’s standing in the DeFi space appears promising, with an increase in Total Value Locked (TVL).”