Will Bitcoin Reach New All-Time Highs in 2023?

Bitcoin’s recent surge past $35,000, accompanied by a breakthrough of the critical $31,000 resistance level, has ignited discussions about the cryptocurrency’s future.

This rally has sparked optimism among experts and analysts, with some suggesting that Bitcoin may have found its bottom. Among those expressing a bullish sentiment is seasoned trader and market analyst, Peter Brandt.

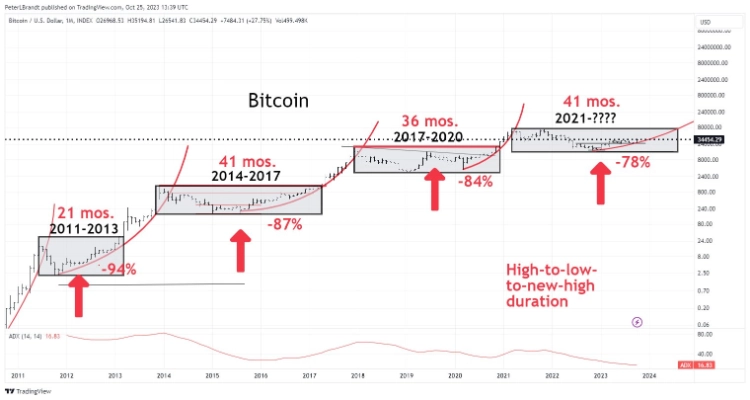

Brandt, acknowledging the unpredictable nature of financial markets, stated on Twitter that he believes Bitcoin’s bottom is in, and he envisions new all-time highs not occurring until Q3 2024.

However, he also suggested that Bitcoin might undergo an extended period of price consolidation or sideways movement before reaching those highs.

Brandt is not alone in his optimism. Crypto analyst Kevin Svenson emphasized that historical patterns support the idea that the best time to buy Bitcoin is typically before its halving events.

Nonetheless, not all voices in the crypto community share this optimism. Gold advocate Peter Schiff expressed skepticism about the demand for a new Bitcoin ETF and suggested that it is Bitcoin owners who have been waiting to sell rather than a surge of new buyers. Jim Cramer, host of CNBC’s “Mad Money,” also made pessimistic predictions about Bitcoin’s future price, anticipating a significant decline.

However, Bitcoin enthusiasts have largely met such forecasts with skepticism, taking pride in the recent price surge.

As the Bitcoin price surge continues, experts and analysts remain divided on its future trajectory. Crypto analyst ‘Rekt Capital’ noted that key bearish indicators have been invalidated, especially with Bitcoin’s break above the $31,000 yearly high, which could potentially drive prices higher.

Furthermore, crypto fund manager Dan Tapiero expressed bullish sentiments, suggesting that Bitcoin’s $25,000 support level could propel the cryptocurrency into the $35,000 to $45,000 range in the short term, with new all-time highs on the horizon by 2024.

Recovery Company Offers Solution to Unlock Ex-Ripple CTO’s $244M Bitcoin Hard Drive

A crypto recovery firm, Unciphered, has proposed to assist Stefan Thomas, the former Chief Technology Officer at Ripple, in unlocking an IronKey hard drive containing 7,002 BTC (approximately $244 million at the time of the report) that he has been unable to access for years.

Thomas had forgotten the password to access the drive, which is designed to erase its data after ten incorrect password attempts. He has already used eight of those attempts.

Unciphered claims to have developed a method to crack the hardware and safely access the Bitcoin keys stored on the drive. The company was reported to have successfully accessed the data on a similar IronKey after an astonishing “200 trillion tries,” effectively bypassing the ten-attempt restriction.

According to Unciphered, their ability to unlock the drive is not theoretical, and they are willing to demonstrate it. They state, “We can do it; we’ve done it many times before […] And we can do it again.” The CEO of Unciphered, Eric Michaud, explained that they achieved this by extracting information from the drive and using offline servers, giving them multiple attempts to guess the password.

This is an open letter to Stefan Thomas (@justmoon) – we would love to help you get back into your IronKey.https://t.co/zhfu41b9jn pic.twitter.com/1hYg3h79BF

— Unciphered LLC (@uncipheredLLC) October 25, 2023

Michaud did not disclose what Unciphered would request in return from Stefan Thomas but mentioned that they have built a “sustainable business” helping individuals recover lost crypto assets.

There have been several high-profile stories similar to Thomas’s, where individuals have been unable to access their cryptocurrency due to forgotten passwords or lost keys.

>>> Bitcoin ETF Roils the Market, Sentiment at All-Time High

In 2021, a Redditor claimed to have regained access to 127 BTC after more than a decade, while in 2013, a British national, James Howells, accidentally discarded a hard drive containing roughly 7,500 BTC and made multiple unsuccessful attempts to recover it from a landfill.

Reports from 2022 suggested that users may have lost access to around 20% of Bitcoin’s total supply, amounting to billions of dollars’ worth of the cryptocurrency.