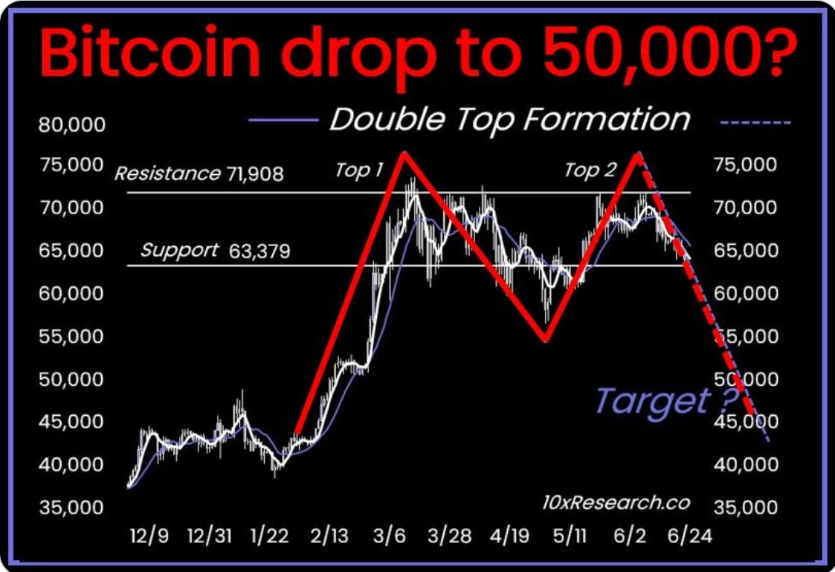

According to cryptocurrency analyst Markus Thielen, Bitcoin’s failure to break above the $72,000 mark has led to the formation of a “double-top” price pattern, potentially pushing the price down further to the $50,000 level.

In an analysis note on June 24, Thielen, founder of 10x Research, explained:

Currently, Bitcoin seems to be following a double-top pattern and is testing its critical support level.

A double-top pattern forms when the price reaches two similar peaks with a slight dip in between. This pattern typically completes when the price breaks below the “neckline,” potentially leading to a further decline equal to the distance between the peaks and the neckline.

Thielen noted:

Bitcoin could shift from its current trading range (60,000-70,000) into a double-top formation, potentially resulting in a steeper decline.

This should be our base case unless this pattern is invalidated. This formation could easily push the price down to $50,000—if not $45,000.

As we have observed over the past three months, range trading is a complex phase, often accompanied by several false breakouts.

Thielen also pointed out that double-top patterns often lead to significant losses for retail investors, with many altcoins experiencing substantial drops during this period.

While events like the upcoming U.S. elections and the Consumer Price Index (CPI) could have positive impacts later this year, Thielen cautioned that Bitcoin could still face a “sharp correction” in the short term.

After Bitcoin’s halving event on April 20, where the miner’s reward was cut from 6.25 BTC to 3.125 BTC, many prominent cryptocurrency traders are speculating about Bitcoin’s price.

Trader Jelle noted that Bitcoin’s price action is still playing out “similarly” to the post-halving cycle in 2016 and is “trading around previous cycle highs.”

More and more fear, uncertainty, and doubt (FUD) are being released at the current prices,” Jelle stated in a June 24 X post, adding that this is part of the “shakeout effect.”

Either it’s really over, or we are close to a bottom.

Cryptocurrency trader Rekt Capital believes there is still significant potential for short-term growth. In a June 24 post, he said that the market is approximately 40% through the “bull market” phase.

This suggests that the recent drop in BTC price below $60,000 provides an opportunity for buyers to accumulate more before Bitcoin enters a “parabolic uptrend.”

Related: Willy Woo Explains Why Bitcoin Cannot Recover

Bitcoin Price Fluctuations

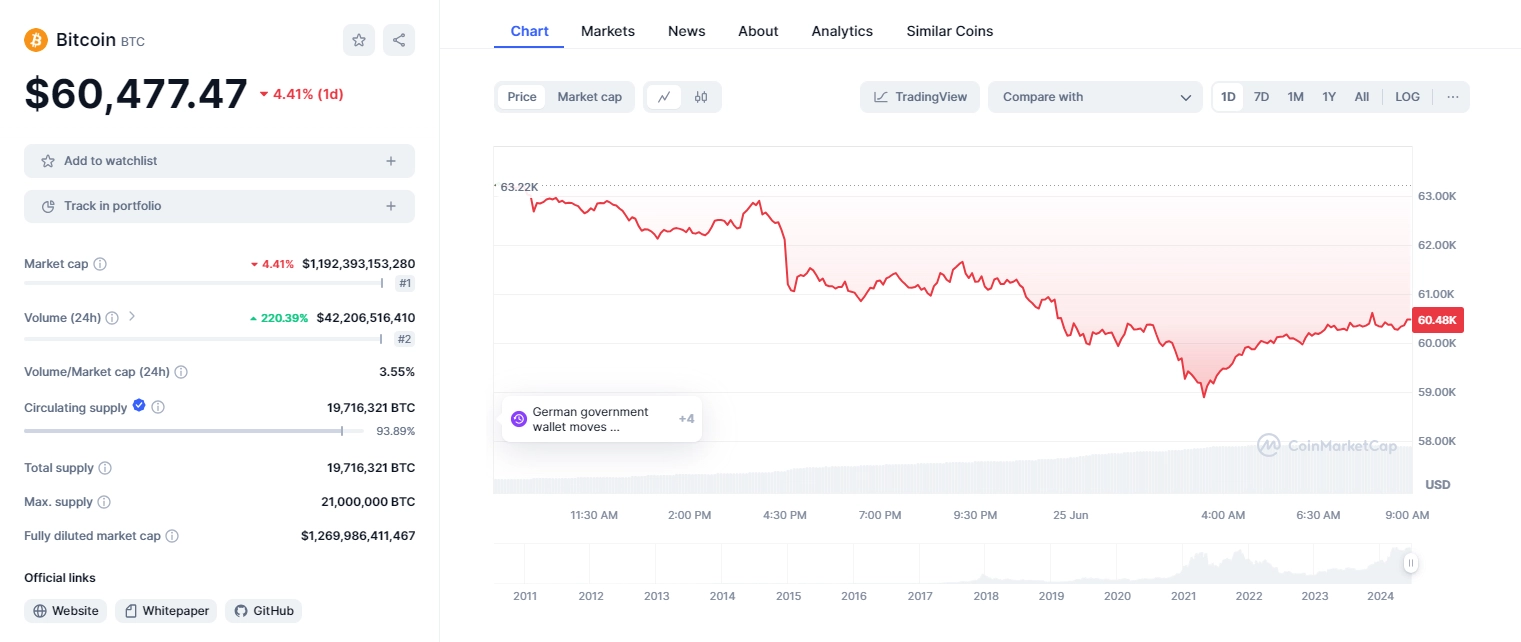

At the time of writing, Bitcoin is hovering around $60,300 with a market capitalization of approximately $1.2 trillion and a 24-hour trading volume of $42 billion.