Ether is resilient amidst bearish pressures in the cryptocurrency market, demonstrating robustness at the $2,500 support threshold. Despite the escalation in futures liquidations, with Coinglass data indicating $15.03 million of ETH shorts liquidated compared to $5.3 million in long liquidations on January 16, the ETH price has steadfastly maintained its grip on the $2,500 mark.

Simultaneously, the ETH/USD pair surged to reach $2,614 on the same day, breaking through the previously challenging resistance at $2,500. In-depth analysis from Glassnode illustrated the prevalence of short liquidations compared to long ones on January 16. A comprehensive report from 10xResearch underscored Ether’s expanding share of open interest since the beginning of the year.

The report highlighted the static nature of Bitcoin’s open interest share in perpetual futures, remaining at 41.1% compared to 41.6% on January 1. In contrast, ETH’s share surged from 21.8% to 26.5%. Investors are optimistic about the continued appreciation of the ETH/BTC pair.

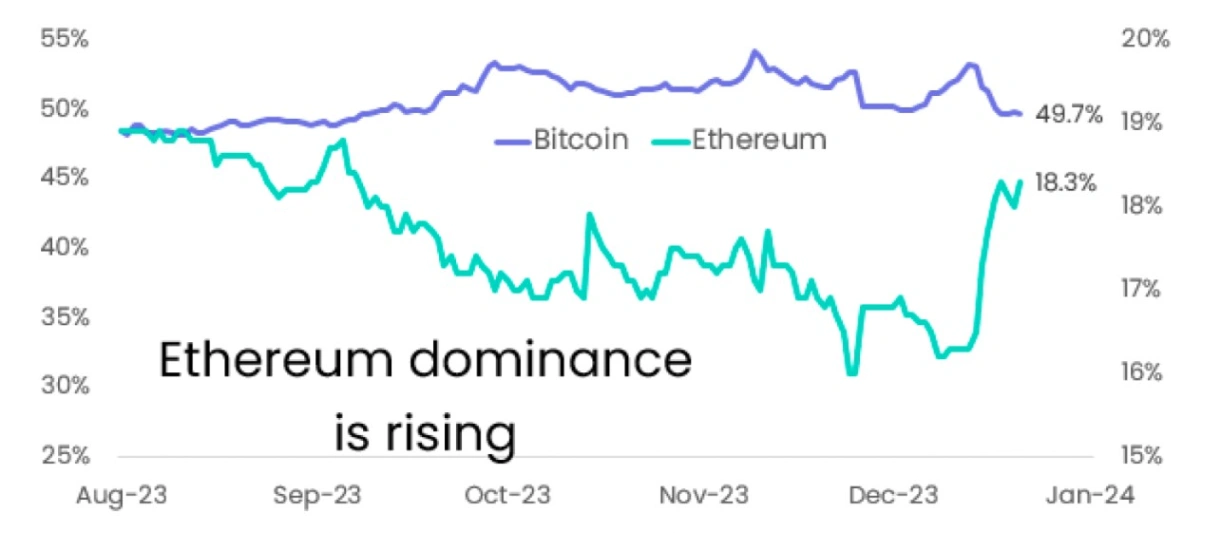

Moreover, 10xResearch drew attention to the Bitcoin dominance indicator falling below 50% for the fourth consecutive day, signaling the potential for altcoins to outperform Bitcoin. ETH’s dominance reached a three-month high, surpassing 18%, as illustrated in the accompanying chart. Santiment’s on-chain data further emphasized Ethereum’s ascending price dominance over Bitcoin, recording a notable 22.4% increase in the past week.

During this period, approximately 89,400 new Ethereum addresses were created daily, underscoring the platform’s growing popularity. Notably, on January 16 alone, an impressive 96,300 wallets were created, highlighting the increasing momentum of Ethereum.

The data further reveals that ETH’s supply on exchanges is approaching its historical low of 8.05%. This suggests a shift towards self-custody and staking, indicating a reduced risk of an imminent sell-off. This development presents a more promising scenario compared to concerns arising from an increasing supply on exchanges.

These on-chain metrics provide valuable insights into Ether’s current market strength and its potential to outperform Bitcoin in the short term. Meanwhile, the latest upgrade to the Ethereum network, known as “Cancun-Deneb” or “Dencun,” has been activated on the Goerli testnet, as shared in a January 17 social media post by Ethereum developer Parithosh Jayanthi.

📈 #Ethereum‘s price dominance continues to surge against #Bitcoin’s, now +22.4% in a week. During this stretch, there have been 89.4K new $ETH addresses created per day, and 96.3K wallets just yesterday. Additionally, the 2nd largest market cap asset’s supply on

(Cont) 👇 pic.twitter.com/9nHCl6PJPy

— Santiment (@santimentfeed) January 16, 2024

At the core of the Dencun deployment on the Goerli testnet is the implementation of EIP-4844. This upgrade is anticipated to substantially reduce transaction costs on Ethereum layer 2 solutions like Optimism, Base, Polygon zkEVM, among others. It will also impose limitations on self-destruct operations and enable new bridge and staking pool features.

Related: Is Ethereum’s Comeback Possible as it Struggles Against BTC?

As per Ethereum’s 2024 roadmap, the next significant milestone in Dencun’s testing schedule is slated for January 30, when it is scheduled to be introduced on the Sepolia testnet. Subsequently, the Holesky testnet will follow on February 7. The team, however, has not yet disclosed a specific date for implementing the upgrade on the mainnet.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.