Ethereum’s Exchange Supply Hits a 2015 Low

The amount of Ethereum available on exchanges has been steadily dwindling ever since the FTX crash rocked the crypto world in 2022.

This downward trend can be attributed to the growing skepticism surrounding centralized exchanges and a growing preference among investors for safeguarding their tokens through self-custody. This sustained decline has now brought the amount of Ethereum held on exchanges to its lowest point since its inception.

Ethereum Exchange Balances Revert to Early Days

When the Ethereum network made its debut in 2015, the quantity of ETH available on exchanges was quite modest, owing to its status as a newcomer in the field. Over the following years, as the digital asset gained widespread recognition and started trading on numerous platforms, exchange balances gradually increased.

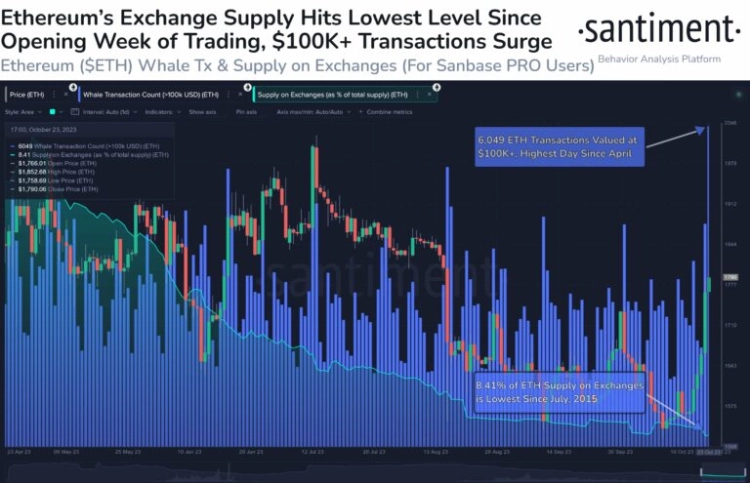

However, the tide has shifted, with cryptocurrency investors increasingly opting to store their ETH in private wallets rather than keeping them on exchanges. Consequently, only 8.41% of the total circulating ETH supply remains available on exchanges.

On-chain data tracker Santiment has highlighted that this marks the lowest level of Ethereum exchange balances since its Genesis in 2015. In an X post, Santiment stated, “Prices crossed $1,850 for the first time since August 15th, and the now 8.41% of $ETH supply on exchanges is the lowest since #genesis in 2015.

Whale transactions also hit a 6-month high.” This shift away from exchanges has coincided with a rapid price surge, implying that accumulation by holders has been a significant factor in the digital asset’s recovery. If exchange balances continue to decline, indicating a reduced willingness to sell ETH and lower selling pressure, the value could continue to soar.

Three Price Targets for Ethereum Bulls

With Ethereum bulls successfully surpassing the $1,700 resistance level, they are now setting their sights on higher price targets. The immediate significant resistance level lies at $1,850, as evidenced by Tuesday’s rejection of the bulls at that point. Clearing the $1,850 hurdle is the first step in establishing a more robust bull trend.

Moving forward, the $1,920 level is expected to present a major challenge for the ETH price. This level represents one of the last lines of defense for the bears, as they attempt to prevent a full-fledged bull rally. Ethereum bulls can anticipate encountering substantial resistance at this juncture.

>>> Famous Analyst Predicts Bitcoin Will Reach All-Time High in 2023

Lastly, the elusive $2,000 mark stands out as the most pivotal price level for Ethereum at present. Conquering this level would signify a potential end to the prolonged price decline. Therefore, ETH bulls must regain control of this level from the bears and transform it into a strong support zone.