Ethereum (ETH) continues to lose ground, down 9% over the past 24 hours, extending its losing streak.

According to information from CoinMarketCap, the second largest cryptocurrency is still in the red since the activation of the Dencun Upgrade, with weekly losses of up to 18% as the press reports.

Whales are withdrawing

The emergence of market sell-offs has become more widespread, causing fears of a reversal of ETH’s bullish trend. According to data from Spot On Chain, three “whales” are said to have liquidated a total of 26,946 ETH in the past 4 days, raking in nearly $40 million in profits.

One notable development is that an investor transferred 8,870 ETH to Binance on March 16 at a price of $3,733 per coin. This sale brought that person more than 25 million USD in profits.

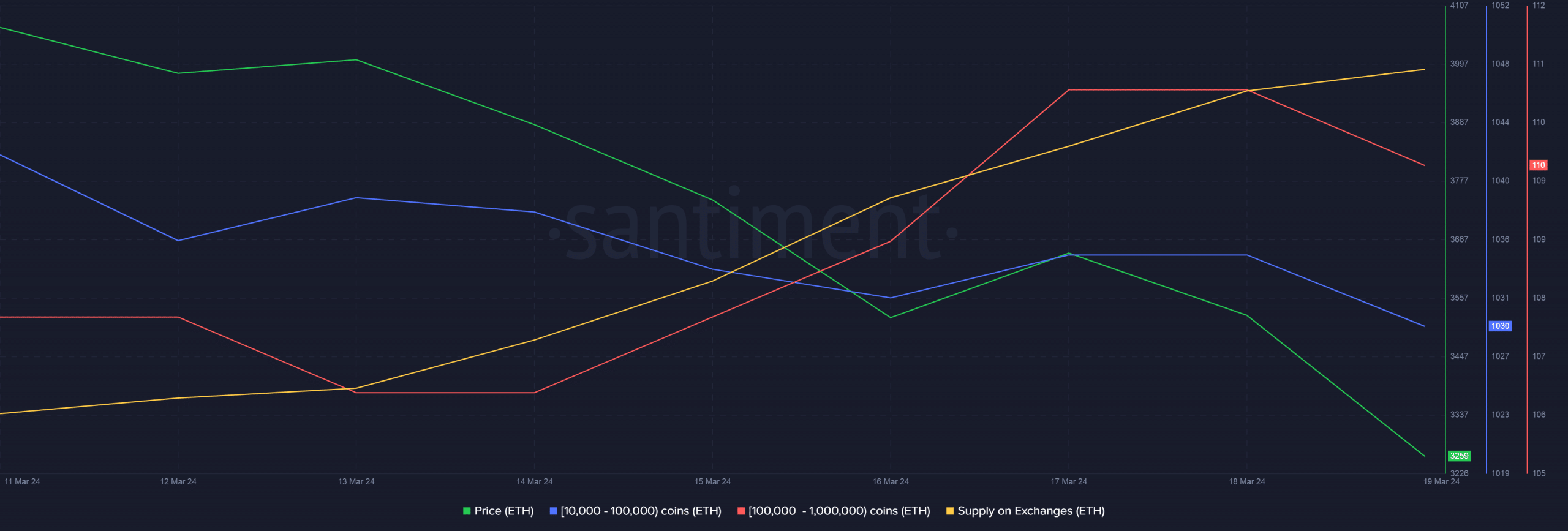

Source: Santiment

Other data studies, using Santiment to gauge market reaction, show that ETH supply on exchanges has increased by 5% since the Dencun Upgrade was implemented. At the same time, the amount of ETH in important “whale” wallets, from 10,000 to 1 million, has decreased significantly.

The analysis of these two indicators shows that “whales” are withdrawing money from the market. This could be due to experienced investors taking profits when they no longer see positive potential in the asset.

Related: Ethereum Dips Below $4000 But Signals Remain Positive

This could be the reason

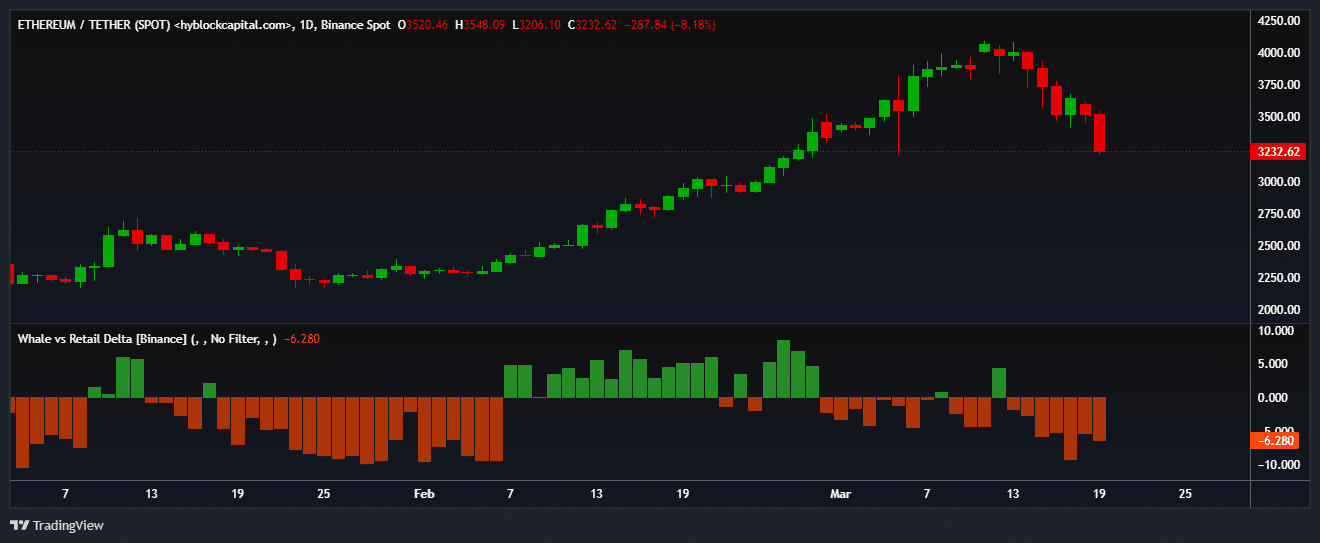

Source: Hyblock Capital

Cryptocurrency investment services company Matrixport recently proposed a strategy for shorting ETH versus buying Bitcoin (BTC). This proposal is based on two main factors.

First, the implementation of the Dencun Upgrade took away one of the most important factors driving ETH growth. Second, spot ETF approval rates are decreasing over time. This could increase concerns and prompt large investors to sell ETH.

The decline in “whales” is also further illustrated by Hyblock Capital’s Retail Whale vs Delta index, which shows a reduction in their long exposure over the past week.

Wonderful 😊