Exploring the Strategic Moves of Ethereum Whales

A grand orchestration of accumulation by Ethereum whales has set in motion a surge in off-exchange holdings. Noteworthy holders of substantial Ethereum quantities have recently engaged in significant movements, precipitating a marked uptick in accumulation. This heightened accumulation has led to a substantial withdrawal of ETH from exchange platforms.

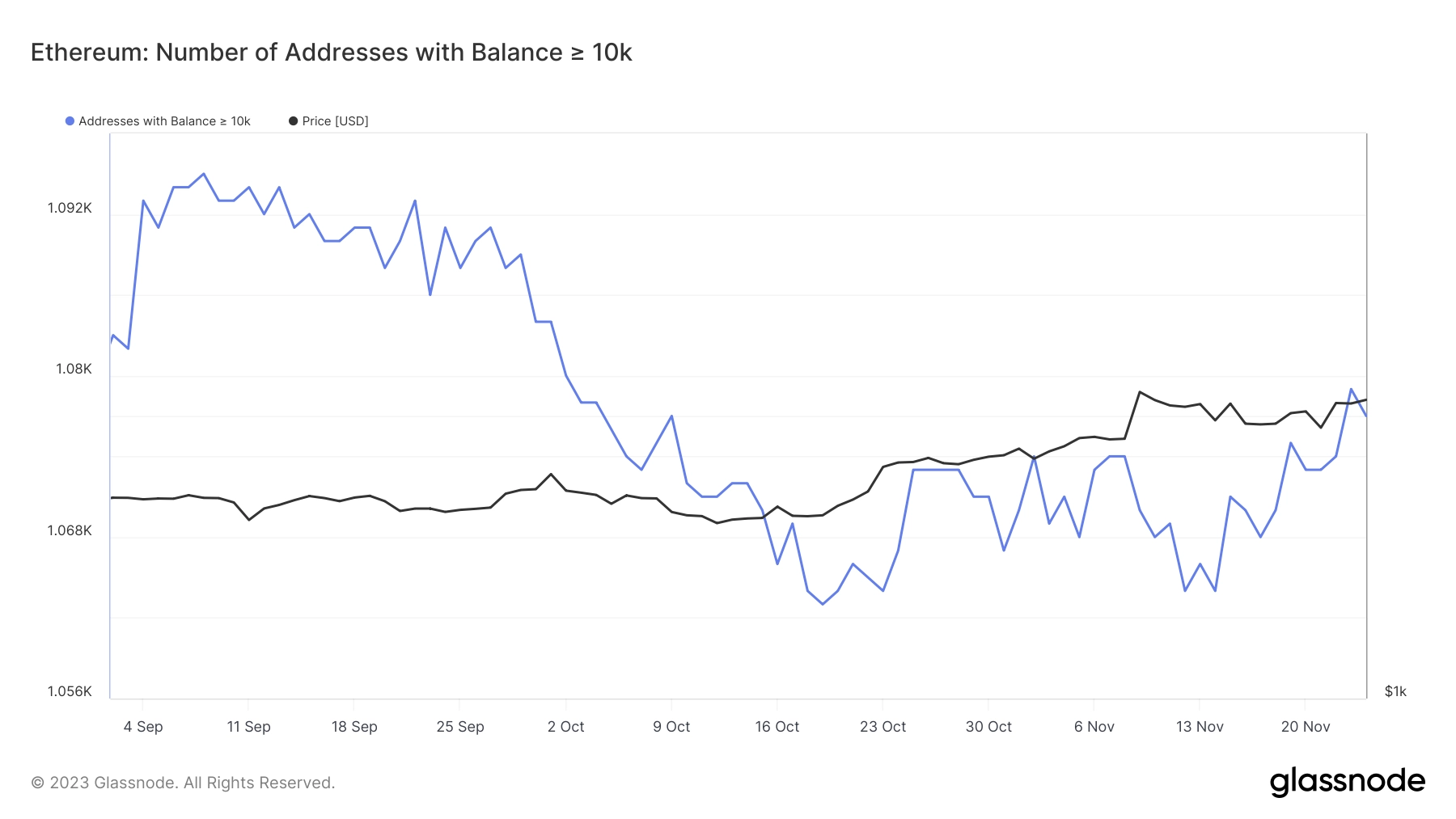

Witnessing the Upward Trajectory of Ethereum Whale Accumulation

Scrutinizing addresses boasting holdings of approximately 10,000 Ethereum or more unveils a recent surge in their numbers.

Data from Glassnode charts indicates a growth in these addresses, particularly towards the latter part of October. This upward trajectory follows a notable decline that temporarily reduced the count from approximately 1,090 to 1,063.

As of the latest update, the tally of such addresses has expanded to around 1,077. This expansion strongly implies an increase in whale accumulation. How has this surge in accumulation influenced the dynamics of Ethereum movement on exchange platforms?

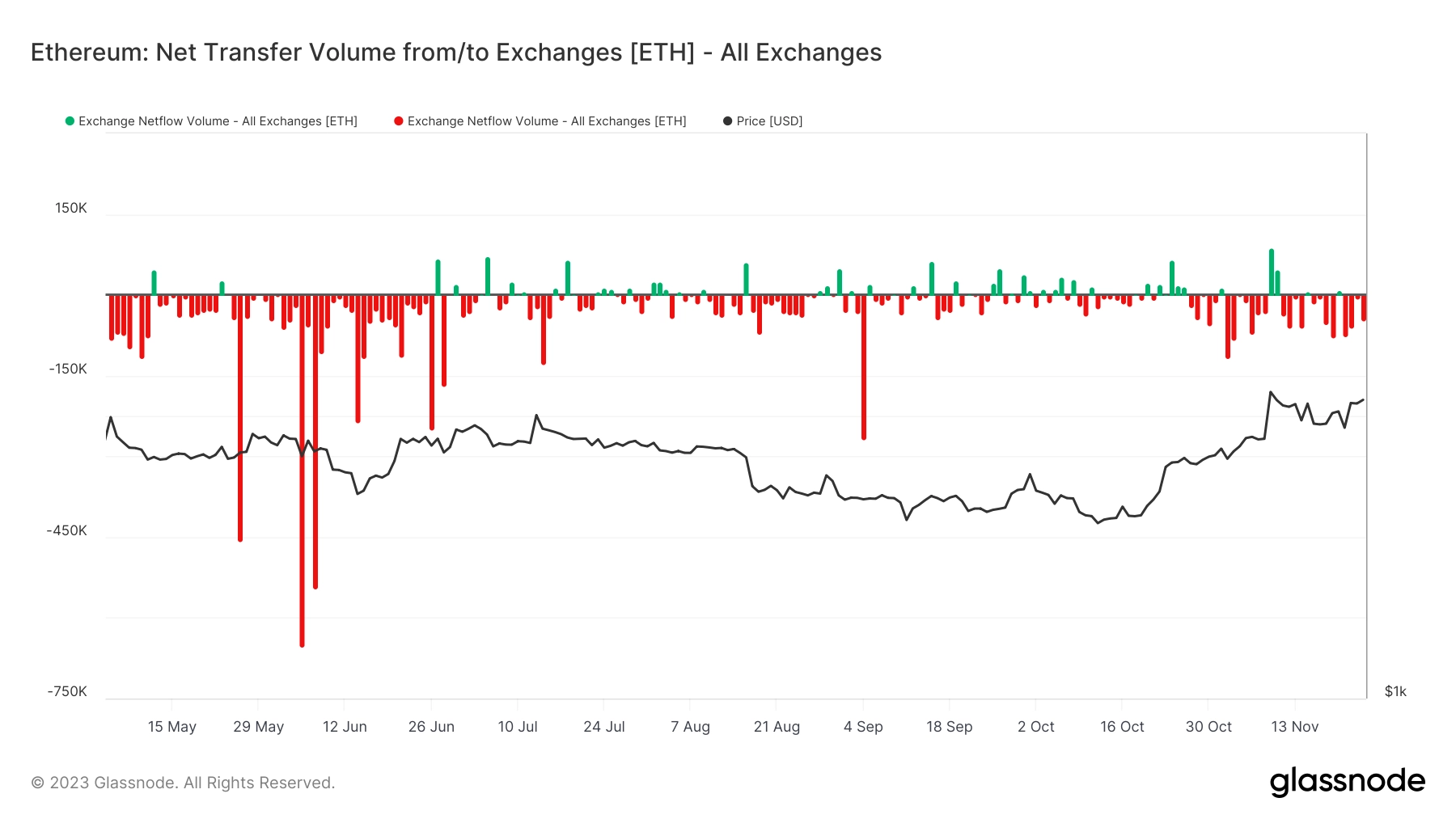

Unraveling the Negative Trend in Exchange Netflow

An in-depth analysis of Ethereum’s exchange activities throughout November exposes a prevailing trend of higher outflows compared to inflows. This suggests a scenario where more ETH is exiting exchanges than entering them.

The statistical data indicates a concurrent reduction in sell pressure and a discernible rise in scarcity. Moreover, this diminished availability tends to augment the overall value of ETH. According to the exchange netflow data provided by Glassnode, an impressive 47,000 ETH has been withdrawn from exchanges.

Consistently portraying negative values over the past few days, the chart further accentuates the unmistakable pattern of Ethereum migrating away from exchange platforms.

Ethereum’s Off-Exchange Supply Surges as On-Exchange Reserves Decline

An examination of a Santiment chart reveals a notable decrease in the Ethereum supply on exchanges, signaling a reduction in the available volume of ETH within these platforms.

Related: Analyst Envisions Ethereum Soaring to $3,100 as Bullish Momentum Takes Hold

The decline in supply commenced around November 14th, with the volume dropping from approximately 10.6 million to about 10.58 million. As of the latest update, the supply on exchanges has dwindled further to around 10.5 million. Intriguingly, as the on-exchange supply contracted, the off-exchange supply witnessed a significant surge, reaching an impressive 118 million.

At the beginning of the current month, the off-exchange volume stood at approximately 117 million. Meanwhile, Ethereum maintains a gradual uptrend.

ETH’s Incremental Price Gains

As of the latest report, Ethereum exhibits a positive price trend on the daily timeframe chart. Over the past two days, a consistent albeit modest price increase has been observed.

Notably, Ethereum continues to trade above the $2,000 price range. The persistence of this positive trend, initiated by the golden cross on the daily timeframe, serves as a robust confirmation of the current trend’s strength.