Throughout the year, the cryptocurrency market has undergone significant changes, developments, and fluctuations. Amidst these market shifts, Ethereum (ETH) has seen substantial growth in network activity, revenue, and the number of addresses. Similarly, the past year has witnessed a notable increase in the volume of private transaction orders.

Ethereum Users Prefer Private Transactions

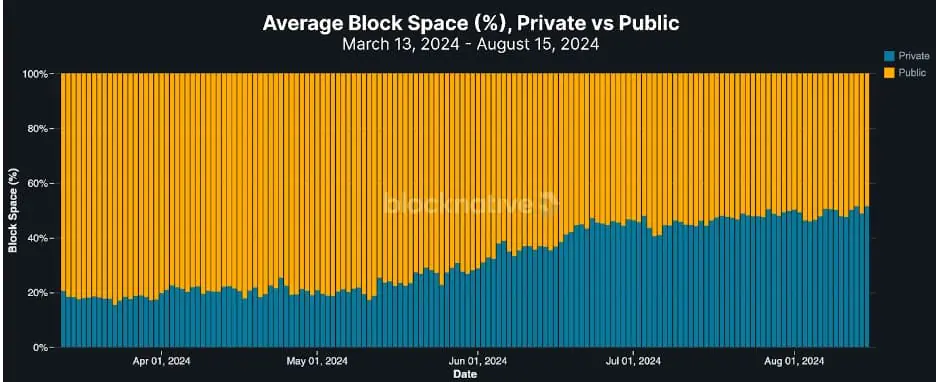

According to a study by Blocknative, the Ethereum network has experienced a sharp rise in private transaction orders.

Data indicates that private transactions account for more than 50% of the total ETH L1 block capacity based on gas usage. However, despite this, private transactions only make up 30% of the total number of transactions within ETH L1 blocks. Users opt for private transaction transmission to safeguard against MEV (Miner Extractable Value), particularly when executing complex transactions.

Such transactions inherently require more gas, leading to higher gas consumption per transaction compared to non-MEV transactions. Essentially, the gas used is directly linked to the economic value of block space. Therefore, each unit of gas represents a portion of the block’s capacity and economic growth.

Increased Volatility in Base Fees

The rise in private transactions and gas usage has significantly impacted Ethereum’s base fees. The 2021 EIP-1559 upgrade introduced dynamic base fees, which fluctuate according to block space demand.

As private transactions have increased, they’ve contributed to greater volatility in base fees. This, in turn, leads to what is known as “vanilla blocks,” which cause fluctuations in base fees.

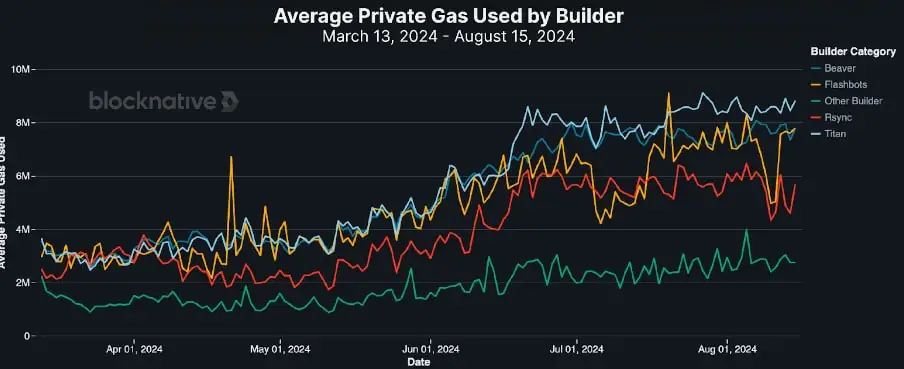

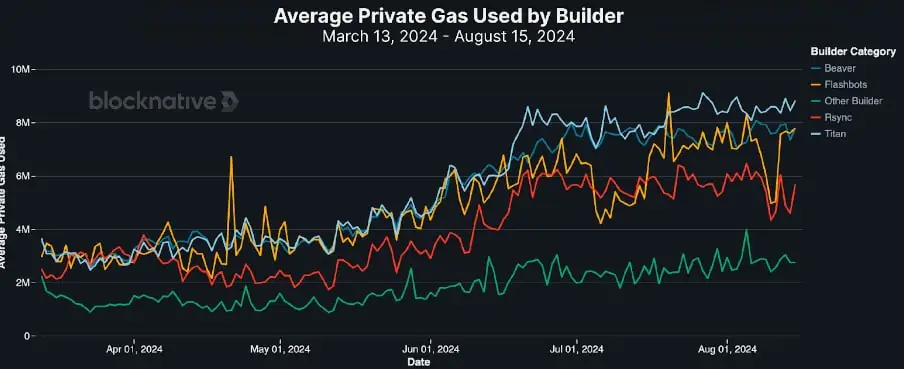

Such volatility poses a challenge for network users, as the rise in private transactions can drive up base fees, particularly when interacting with large entities like Titan, Rsync, Beaver, and Flashbots. For example, leading builders have ramped up their private transactions throughout the year.

As illustrated in the chart above, Titan has increased its gas usage from 3.5 million to 8.5 million through private transactions since March. Other top players, such as Beaver, have boosted their usage from 3 million to 7.5 million, and Rsync from 2.5 million to 6 million.

This surge has significant implications, effectively pushing many users out of the game. This trend is especially noticeable among smaller builders, who are reducing their gas usage, as most struggle to reach the 15 million gas threshold set by the 2021 EIP-1559 upgrade.