On February 25th, Ethereum (ETH) surpassed the significant psychological resistance of $3000. Despite closing the daily trading session at $3014 on the 20th, ETH experienced a slight dip to the $2900 range in the subsequent days.

Notably, NFT sales on the Ethereum network recently reached a ten-month high, totaling an impressive $400 million in volume. On-chain analysis further revealed substantial ETH outflows from exchanges, amounting to $2.4 billion in 2024, indicating a trend of asset accumulation.

The range breakout has not yet stalled

The ongoing breakout from a highlighted purple range, observed in the latter part of January and extending from $2100 to $2600, remains in progress. Two demand zones at $2500 and $2650 were identified on lower timeframe charts, with the price yet to retest either region.

Examining the 3-day chart, the market structure and momentum exhibit a robust bullish stance. The rising On-Balance Volume (OBV) indicates significant buying volume, collectively suggesting a favorable outlook for continued Ethereum price rallies.

Surpassing the psychological resistance at $3000 marks a substantial milestone, potentially intensifying the prevailing bullish sentiment in the market.

The subsequent higher timeframe resistance level rests at $3580, and there’s a likelihood that ETH could make a swift move towards this level before a notable retracement occurs.

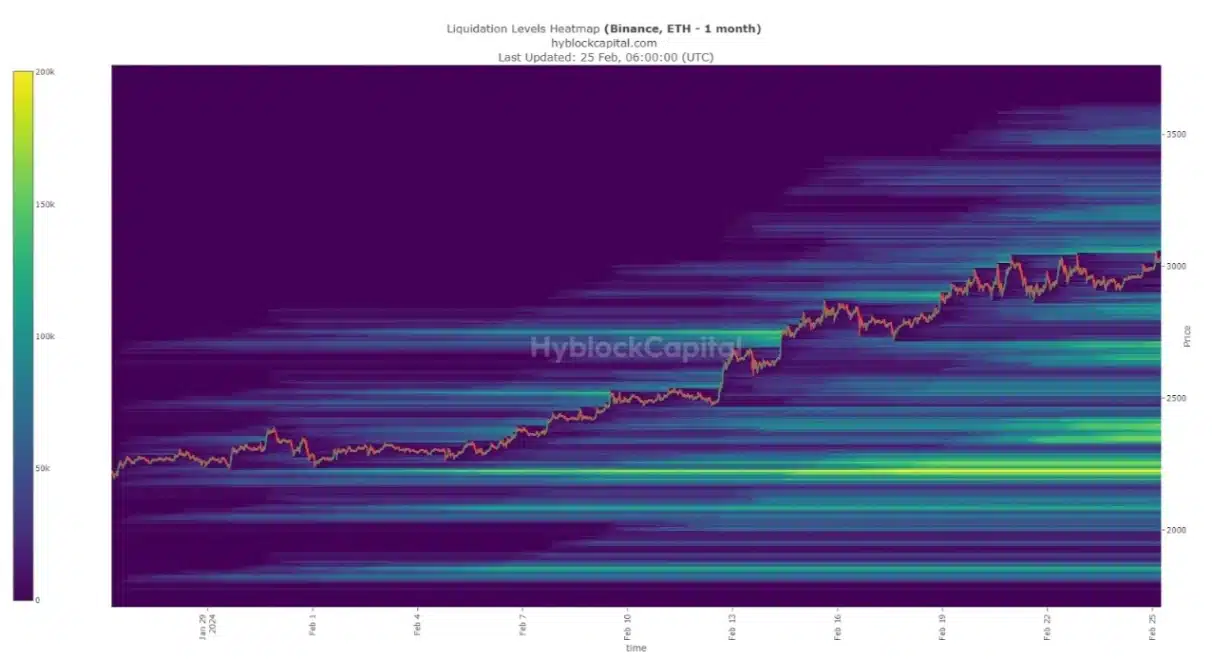

The liquidation heatmap showed three key areas of interest

Examining the liquidation heatmap over a 3-month period reveals three noteworthy areas. The $3050-$3110 range is highlighted with multiple levels, indicating liquidations within the $2 billion to $4 billion range. While the $3050 level has already undergone testing, additional liquidity is anticipated up to $3100.

Related: Altcoin Price Boom With Ethereum ‘Dencun’ Upgrade

Moving upward, the $3190-$3225 region exhibits multiple liquidation levels ranging from $1.4 billion to $2.3 billion. Similarly, the $3460-$3520 range includes liquidation levels in the $2 billion territory. These regions are pivotal resistances that could attract price action before a potential bearish reversal.

On the support side, the $2800-$2880 area represents a substantial liquidity pocket. A retest of this zone is likely to trigger a price rebound.