This milestone follows a notable shift by the U.S. Securities and Exchange Commission (SEC) regarding the approval of spot Ethereum exchange-traded fund (ETF) applications.

According to a report, Bloomberg analysts dramatically increased the approval probability to 75%, up from a previous estimate of 25%. This reassessment stems from rumors about the SEC’s rapid change in stance. Just days ago, consensus held that VanEck’s ETF application would be rejected by the SEC due to insufficient participation.

Bloomberg’s senior ETF analyst, Eric Balchunas, noted that the SEC has requested exchanges to promptly update their 19b-4 filings. The SEC might approve an Ethereum ETF as early as this Wednesday. Alex Thorn, head of research at Galaxy Digital, indicated that the SEC is likely to recognize the underlying asset as non-security while considering staked Ether as a security. He added, “This approach aligns with their various court cases and ongoing investigations, potentially allowing the SEC to approve Ethereum ETFs while maintaining their previously stated positions.”

According to CoinGecko data, the price of the largest altcoin surged by up to 16.2% in the past 24 hours. Bitcoin also saw a 6% increase, peaking at $71,650 earlier today. Despite this, ETH remains 25.4% below its all-time high of $4,878, reached two years ago.

Related: ETH Surges as Spot ETF Approval Nears

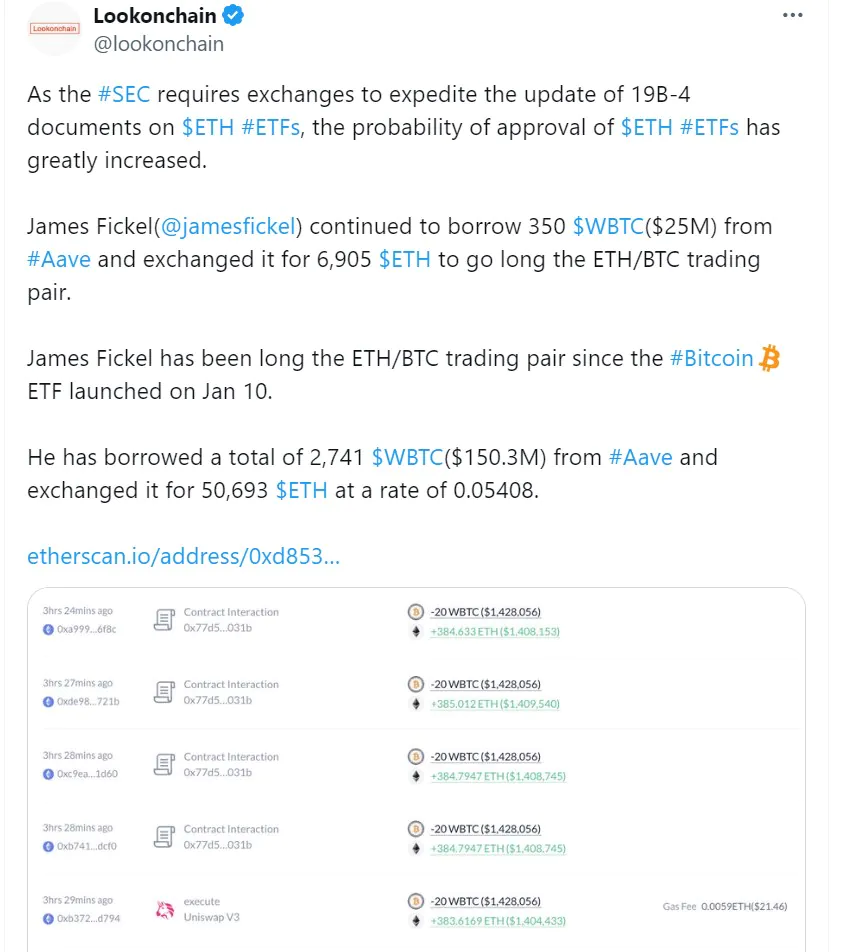

Ethereum whales have been active again, accumulating 110,000 ETH worth an astounding $341 million within the last 24 hours. As the approval rate for a spot Ethereum ETF rises, investor James Fickel (@jamesfickel) borrowed 350 WBTC (worth $25 million) from Aave, converting it into 6,905 ETH to trade the ETH/BTC pair. Fickel has maintained a long position on ETH/BTC since the launch of the Bitcoin ETF on January 10.

To date, Fickel has borrowed a total of 2,741 WBTC (valued at $150.3 million) from Aave, exchanging it for 50,693 ETH at a rate of 0.05408.

This app is good

More grace

Form grace to grace

$341 million within the last 24 hours.

Wow 😦