Ethereum Supply Dries Up as Whales Accumulate – Is a Major Breakout on the Horizon?

-

Over 820,000 ETH have left Binance since August, driving exchange reserves to their lowest level since May.

-

Shrinking supply combined with renewed institutional accumulation signals a potential upcoming rally.

-

ETH hovers near the $4,000 mark, but a clear breakout is needed to confirm a bullish reversal.

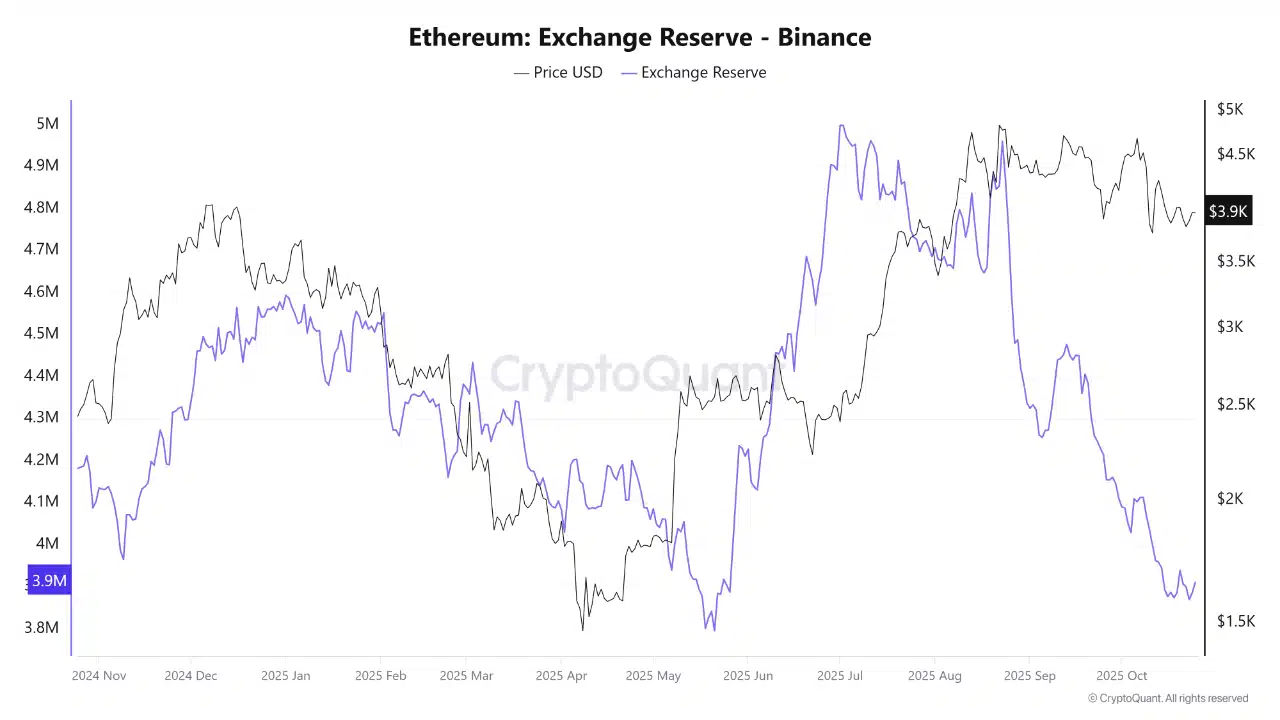

Binance ETH Reserves Hit a 5-Month Low

Latest data shows that Ethereum holdings on Binance have dropped sharply—from 4.69 million ETH to just 3.87 million ETH in under two months, marking a net outflow of over 820,000 ETH.

This is the lowest level since May, when ETH prices surged from $3,800 to $4,800 within weeks. The steady outflow suggests that investors are moving assets off exchanges, a sign of growing long-term confidence.

With fewer tokens available for trading, the market could soon face a supply squeeze, where even a modest rise in demand may trigger a sharp price surge.

Institutional Money Returns?

Another bullish factor is the stabilization of corporate Ethereum holdings after months of steady decline.

According to analyst TedPillows, institutional ETH holdings had been falling consistently since August 2025, which contributed to the token’s lackluster performance. However, recent data indicates that this downtrend may be bottoming out.

If institutional buying resumes, ETH could mirror previous phases of explosive growth, when renewed confidence from major investors acted as a key price catalyst.

ETH Attempts to Reclaim the $4,000 Level

At press time, ETH traded around $3,986, posting a modest 0.82% daily gain.

-

RSI stood at 46.9, showing a balanced market.

-

OBV hovered near 11.92 million, indicating steady but limited buying pressure.

-

Trading volume remained moderate, with no major spikes observed.

Recent price action suggests a slow but steady recovery after previous sell-offs. Still, a sustained move above the $4,000 resistance is essential to confirm a stronger bullish reversal.

In summary: With Ethereum supply on exchanges drying up and institutional investors showing renewed interest, the market could be on the verge of a significant breakout—if bulls can maintain momentum and push ETH decisively past the $4,000 threshold.