Ethereum Whales Accumulate 200,000 ETH Analyst Ali Martinez highlighted in a recent post on X that Ethereum whales have been on a buying spree. These “whales” are investors holding between 10,000 and 100,000 ETH in their wallets. At the current exchange rates, this range equates to holdings valued between $26.4 million and $264 million, placing them among the largest market players.

In the cryptocurrency ecosystem, an address’s influence generally grows with the number of coins it holds, making these whales key figures. Their behavior is significant, as it can offer insights into the sentiment among these major traders, even if it doesn’t always have an immediate impact on the asset’s price.

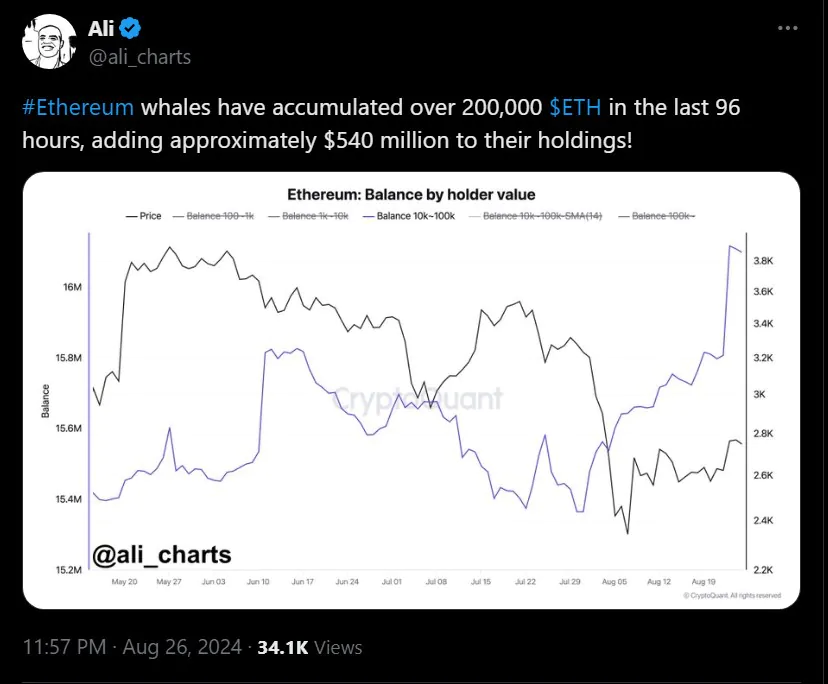

The chart shared by the analyst illustrates the trend in the combined balance of Ethereum investors who qualify as whales. As shown, the total balance of these investors has been rising since the market crash in early August.

This behavior suggests that these large-scale investors have viewed the recent price levels as favorable entry points into the cryptocurrency market. Notably, a particularly intense buying spree has occurred within the last few days, as indicated by a sharp spike in the chart.

In this latest accumulation, the whales have added more than 200,000 ETH—worth nearly $530 million—to their combined holdings, which is a substantial amount.

The timing of this surge in the indicator coincides with ETH’s recent recovery, suggesting that these investors may view the price rebound as a signal of further bullish momentum. As a result, they appear to be doubling down on their investment.

However, whether this strategic bet by the Ethereum whales will pay off, leading to a significant price increase, remains to be seen.

Regardless, the metric should be closely watched in the near future, as any shifts could indicate changes in these investors’ confidence levels. A decline in the metric would likely suggest that the whales are losing faith in the asset.

ETH Price Ethereum recently climbed above the $2,800 mark, but the coin has since experienced a pullback and is currently hovering around $2,477.