The analysis below will show some blockchain data that shows ETH’s rise may face many hurdles.

Ethereum Still Faces Many Challenges Over the past 30 days, Ethereum’s price has increased by 6%. In the last 24 hours alone, the coin’s trading volume has surged by 90%, indicating strong interest from investors.

However, data from IntoTheBlock shows that Ethereum’s Holding Period has decreased by 56% over the past 7 days. This metric measures the length of time investors have held onto the cryptocurrency without selling. Typically, longer holding periods are associated with bullish trends, while shorter holding periods usually signal bearishness. For Ethereum, the recent decline in holding periods suggests that despite the price increase, many holders are still selling ETH.

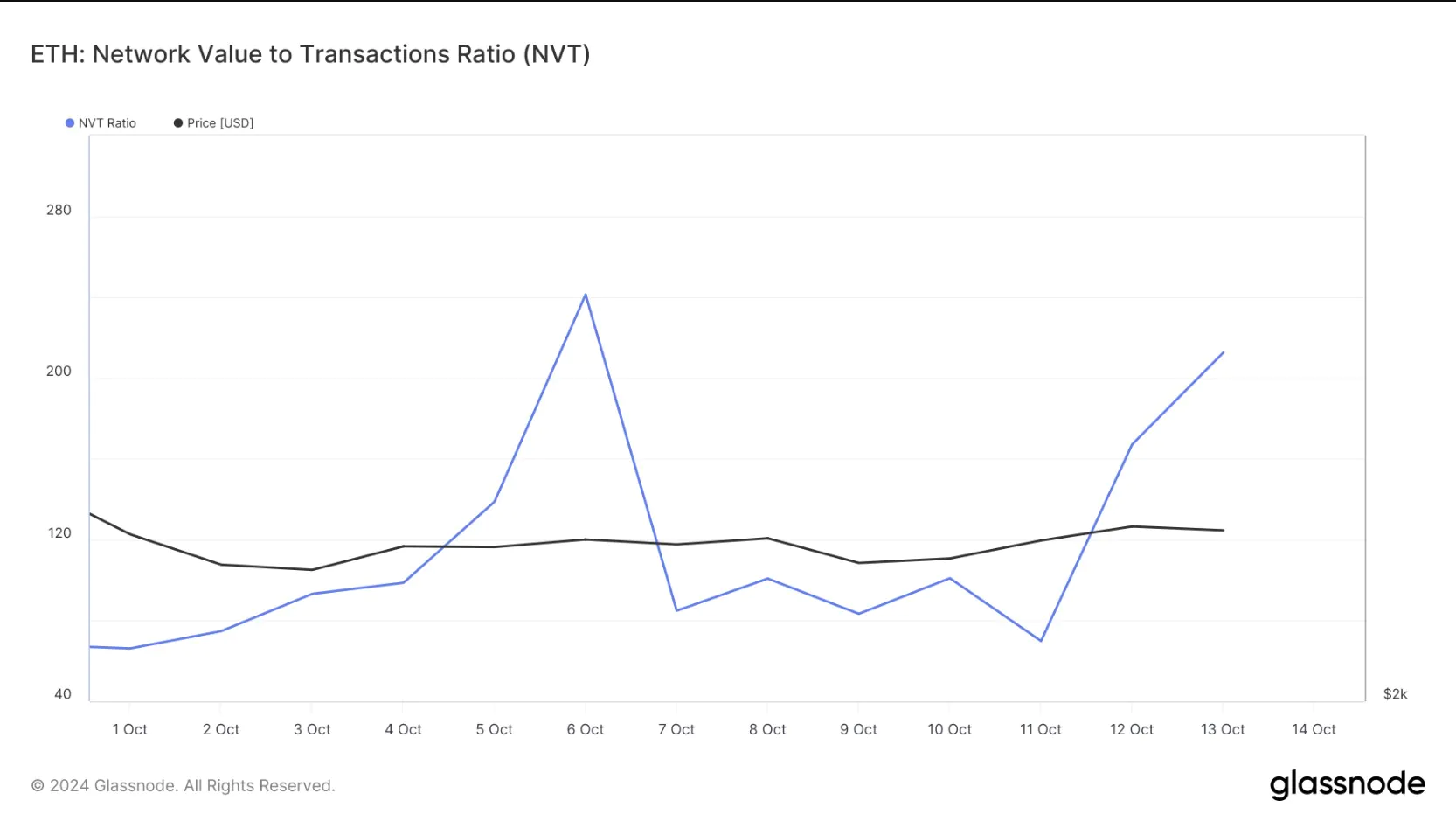

If this trend continues, Ethereum’s value could decline in the short term. Additionally, the Network Value to Transactions (NVT) metric shows a similar signal. A high NVT ratio reflects a market capitalization that far exceeds the actual value of transactions on the network.

Conversely, a low NVT ratio indicates that transaction volume is far exceeding the growth rate of market capitalization. While a high NVT ratio is usually a sign of bearish potential, a low ratio indicates bullish potential.

Data from Glassnode shows that Ethereum’s NVT ratio has increased over the past few days, which could be a sign that ETH is overvalued given the current market conditions.

ETH Price Forecast: Likely to Drop Below $2,400

A daily chart analysis of the ETH/USD pair shows that the Average True Range (ATR) indicator remains flat. A low ATR reflects low volatility and suggests that the price may continue to consolidate or is at risk of a reversal.

Conversely, a high ATR indicates increased volatility, opening up the potential for further upside. Currently, with the indicator remaining flat, there is a possibility that ETH could drop to $2,345, especially if buying pressure eases and sellers gain the upper hand in driving the altcoin’s trend.

However, Ethereum could continue to rise if buyers succeed in maintaining control over sellers. In this case, ETH could surge past $2,600, possibly even reaching $2,983.