Following the launch of the Ethereum [ETH] ETF, the market experienced significant fluctuations. BlackRock’s iShares Ethereum Trust (ETHA) quickly established itself as a market leader, becoming the first ETH ETF to surpass $1 billion in inflows. This achievement underscores ETHA’s growing influence in the cryptocurrency space.

ETH ETF Update

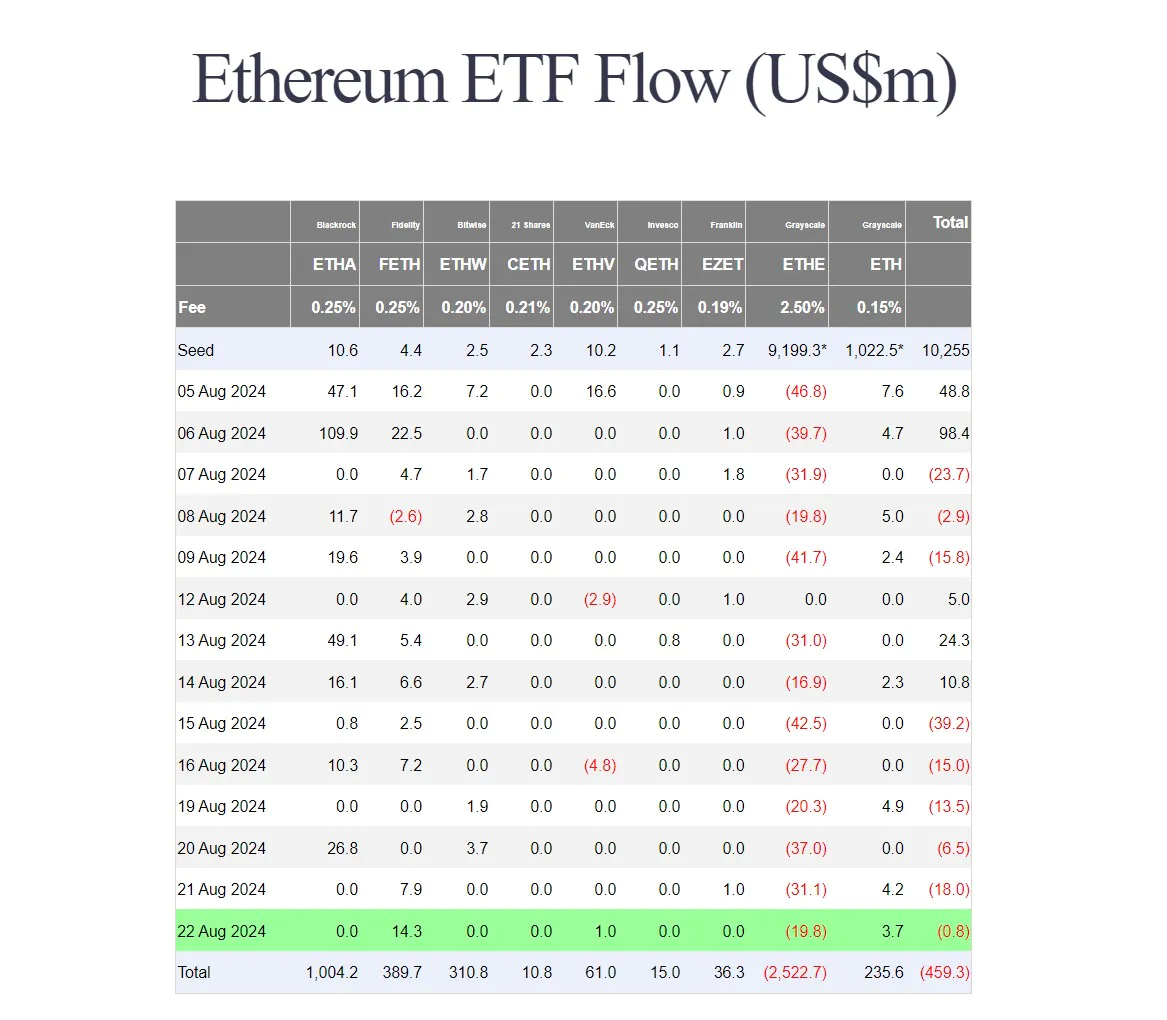

However, not all ETFs have enjoyed the same success. Grayscale’s ETHE is grappling with continuous outflows, and market sentiment remains cautious as the spot Ethereum ETF has seen four consecutive days of withdrawals. Despite ETHA registering zero inflows on August 21, it has accumulated an impressive $1.004 billion to date, according to Farside Investors. This market behavior indicates mixed prospects for ETH ETFs.

Commenting on the divergence between the two ETFs, the cryptocurrency market analysis firm Future Trends remarked, “Is this a sign of trouble or just a temporary dip? Should we be concerned?” This highlights that, despite being relatively new, ETHA has rapidly become the second-largest Ethereum investment vehicle, amassing over $860 million in assets.

The net inflow of $1 billion, surpassing the combined total of the next three largest Ethereum ETFs, reflects its growing dominance and the increasing investor preference for regulated ETH exposure.

Impact on ETH

If the current trend continues, we may soon witness a shift in ETHE toward inflows as well, which could significantly impact ETH’s price. Initially expected to reach $4,000 following the ETF launch, ETH has underperformed. According to the latest update from CoinMarketCap, ETH is currently trading at $2,636. Although the largest altcoin has risen by 2.37% in the last 24 hours, the situation remains precarious.

The Relative Strength Index (RSI) is still below the neutral level, indicating that bears are prevailing over bulls. Additionally, with the Bollinger Bands narrowing, it seems that the bearish momentum might persist.

Executives Offer a Unique Perspective

Contrary to the common belief that the launch of an ETF automatically boosts Ethereum and related assets, cryptocurrency analyst ZERO IKA presents a different view. He argues that, “The notion that ETFs are simply ‘bullish engines’ is entirely misleading,” he cautioned. He pointed out that institutions and hedge funds often exploit ETFs to manipulate the market through strategic buying and selling, challenging the belief that ETFs inherently drive prices up. Despite the remarkable success of BlackRock’s ETHA, Ethereum ETFs overall are still lagging behind Bitcoin ETFs, with total net outflows exceeding $440 million.

Bitcoin ETFs Outshine the Hype

This is in stark contrast to the early performance of spot Bitcoin [BTC] ETFs, which saw rapid asset accumulation, amassing over $11 billion within just a month. Notably, BlackRock’s iShares Bitcoin ETF (IBIT) set a record with an astounding $20.5 billion in assets, far outpacing the total inflows of all other Bitcoin ETFs combined, according to Farside Investors.

This underscores the continued investor preference for Bitcoin and highlights the ongoing challenges that Ethereum-focused investment products face in gaining similar traction.