The recent buzz surrounding the eagerly awaited Bitcoin ETF has cast a spotlight on the crypto space, overshadowing Ethereum’s presence. The correlation between Bitcoin (BTC) and Ethereum (ETH) has taken a backseat, experiencing a dip below the historical average of 0.71 for the first time since 2021.

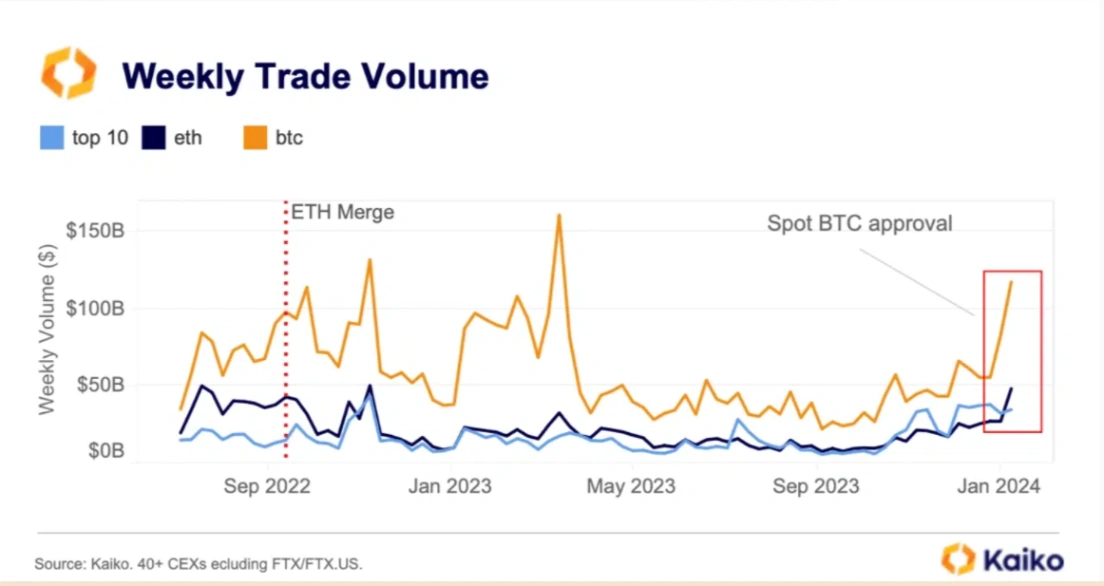

Kaiko’s data reveals a noteworthy departure in the price movements of BTC and ETH. While Bitcoin soared amid ETF-related hype, Ethereum’s rally remained subdued, leading to a significant shift in their correlation dynamics.

BTC’s Pre-Approval Surge and ETH’s Resilience

A closer look at Bitcoin’s performance in the run-up to its ETF approval provides valuable insights into Ethereum’s potential trajectory. Over the past 365 days, BTC has showcased a robust 100% increase in returns, outpacing ETH’s more modest 60% gains.

For the first time since 2021, the BTC:ETH correlation dropped below its all time average of 0.71.

What does this mean for a possible spot #ETH ETF approval? pic.twitter.com/qJSqVVDkbJ

— Kaiko (@KaikoData) January 18, 2024

However, a pivotal moment unfolded on the day of BTC’s approval, witnessing a decline in Bitcoin’s value and a surge in Ethereum’s price. This surge was fueled by the growing anticipation that ETH could be the next cryptocurrency to secure ETF approval.

ETH’s Surge in Volume and Changing Landscape

In the week following BTC’s approval, Ethereum’s spot volume on Centralized Exchanges (CEXs) reached its highest level since the FTX collapse. Notably, the volume gap between ETH and altcoins widened substantially, favoring Ethereum and marking the most significant disparity since March 2023.

This surge in volume indicates heightened market activity and a renewed interest in Ethereum, signaling a potential shift in the cryptocurrency landscape. As Bitcoin’s ETF frenzy subsides, Ethereum appears to be carving its path with evolving dynamics and increased attention from market participants.

Prospects for Ethereum: Beyond ETF Approval

While the anticipation of an Ethereum ETF approval remains a focal point, several other factors are poised to spark interest in ETH over the coming months. Beyond the ETF narrative, the Ethereum network’s recent developments offer a ray of hope for ETH holders.

A noteworthy stride in Ethereum’s development journey is the recent deployment of the Dencun upgrade on the Goerli testnet. This significant move solidifies the progress made by the development teams, highlighting their commitment to advancing the platform.

Quick update from ACD call today:

– Cancun/Deneb upgrade on Sepolia and Holesky testnets remain scheduled for activation on Jan 30 and Feb 7, respectively.

– Client releases for both upgrades will be bundled and shared in a blog post next Tues.

– Full writeup from today’s call…— Christine Kim (@christine_dkim) January 18, 2024

The impact of the Dencun upgrade is not confined to a single testnet. Insights from a recent ACD call indicate that discussions revolve around extending the deployment of the Dencun upgrade to other testnets. This expansion plan underscores the broader vision of Ethereum’s development teams and their dedication to refining the network’s capabilities.

Related: ETFs Have Never Been the Driving Force Behind Bitcoin’s Growth

As Ethereum continues to evolve with these promising developments, the outlook for ETH holders becomes increasingly optimistic. The combination of potential ETF approval and ongoing network enhancements positions Ethereum as a dynamic and forward-looking player in the ever-evolving landscape of blockchain technology.