Ethereum (ETH) prices are showing strong bullish signals following Nasdaq-listed SharpLink Gaming’s announcement to establish a $425 million Ethereum treasury.

SharpLink revealed plans to raise capital through a private investment in public equity (PIPE), purchasing approximately 69.1 million shares at $6.15 each. This move makes SharpLink the first Nasdaq-listed company to build a strategic Ethereum reserve, similar to MicroStrategy’s successful Bitcoin treasury strategy that generated over $8.2 billion in gains in 2025.

Former Ethereum developer Eric Conner highlighted that SharpLink’s move could create a “public ETH proxy” allowing funds that can’t hold tokens directly to gain exposure. The acquisition of around 120,000 ETH—likely to be staked—could lead to “supply compression,” reducing circulating supply and potentially driving up ETH prices. This strategy also positions ETH as a “digital reserve collateral” on corporate balance sheets via the $SBET equity wrapper.

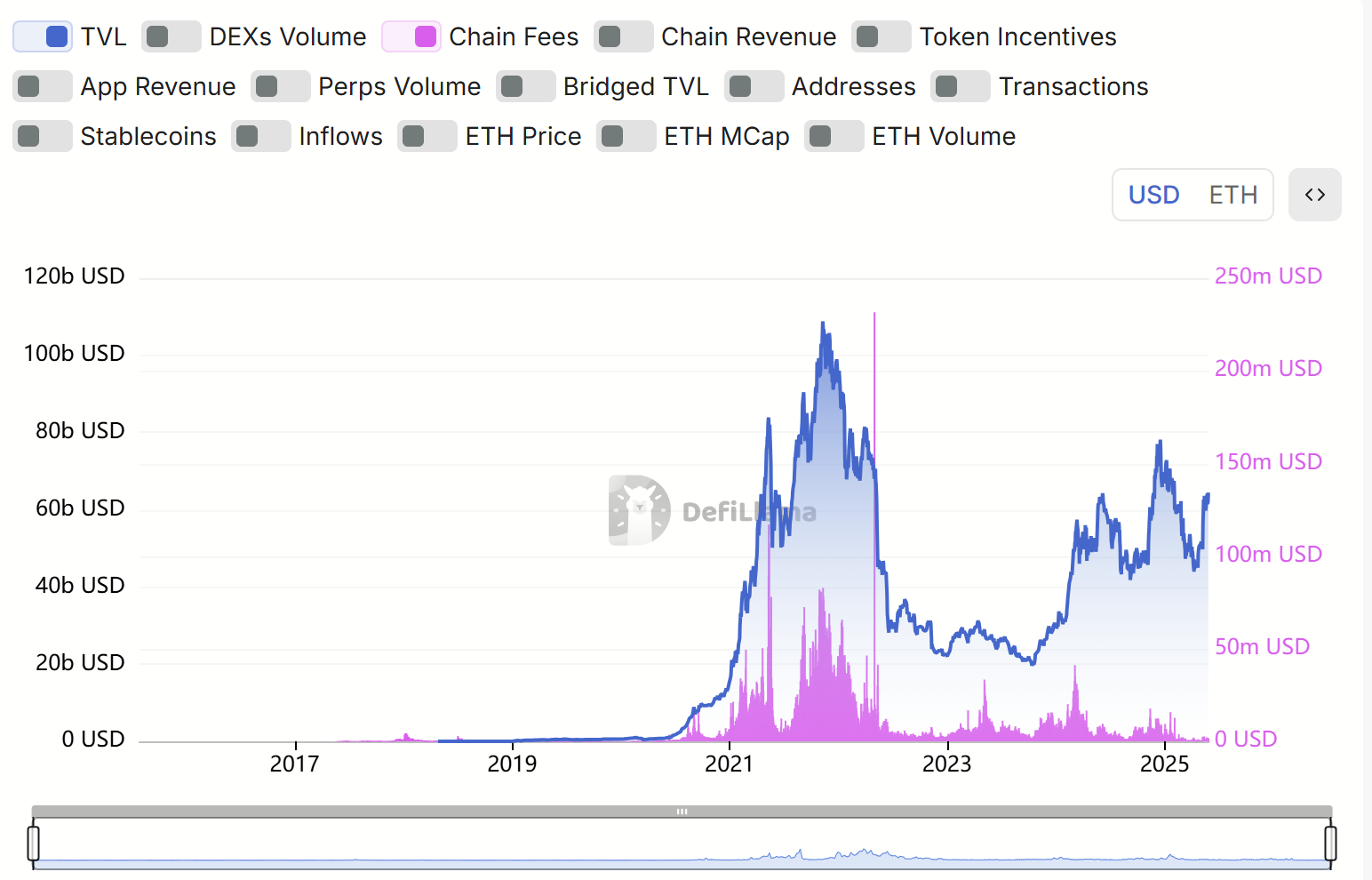

However, some analysts like VICTOR warn of risks given ETH’s 19% decline so far in 2025 despite recent gains. Ethereum network fees also saw a sharp drop in Q1 2025, falling from $2.5 million to $605,000 within two weeks in March, reflecting lower decentralized app (DApp) activity.

Following SharpLink’s announcement, Ethereum futures markets surged. Open interest (OI) hit a new all-time high of $36.1 billion, increasing $3.5 billion in 24 hours. Over the past month, ETH prices rose 48%, although many rallies were leverage-driven and ended with corrections.

Technically, ETH’s daily chart shows a bullish ascending triangle pattern. A breakout above resistance at $2,677 could target $3,100 to $3,200, aligning with previous resistance levels. The Relative Strength Index (RSI) at 68.5 supports the bullish momentum.

Crypto analyst mo_xbt also noted a “sandwich setup” pattern for Ethereum on the daily chart, predicting an imminent retest of the $3,000 level.