Ethereum (ETH) Hits 100 Million Funded Addresses

With Ethereum (ETH) currently trading at $1,565, altcoins are facing tough times amidst a bearish market. The recent achievement of 100 million users on the Ethereum network has raised expectations of new all-time highs for ETH’s price.

Ethereum’s recent milestone in network adoption coincided with challenges from the escalating Middle East crisis. Analyzing on-chain data offers insights into what lies ahead for Ethereum’s price.

Ethereum Achieves 100 Million Non-Zero Balance Addresses

Ethereum’s shift from Proof of Work (PoW) to Proof of Stake (PoS) aimed to reduce energy consumption, lower transaction fees, and promote global adoption. Since “The Merge” on September 15, 2022, Ethereum’s energy consumption has decreased by an impressive 99.988%, and transaction fees are at a 3-year low. Furthermore, global adoption has reached a remarkable milestone.

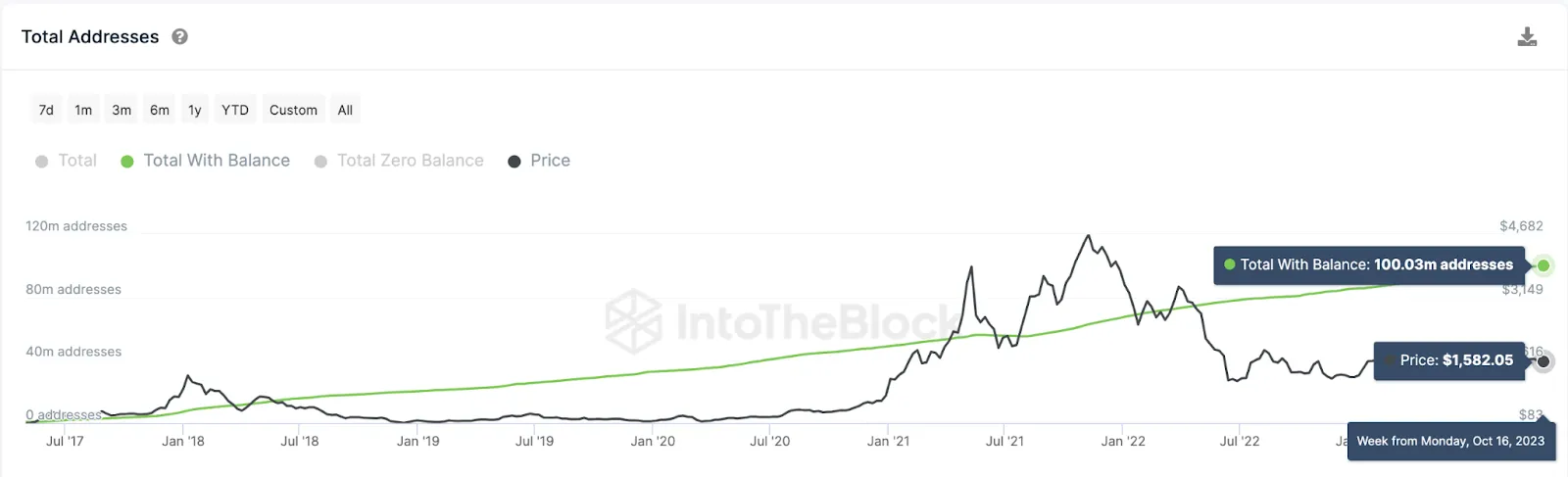

Data from IntoTheBlock reveals that Ethereum achieved 100 million non-zero balance addresses on October 16, 2023. A closer look at the data shows a significant increase in the ratio of non-zero balance addresses since “The Merge.”

On September 15, 2022, only 30% of Ethereum addresses (57.64 million out of 192 million) held a balance of at least 1Gwei. Fast forward to October 19, 2023, and that number has risen to 37%, with 100.07 million out of 270 million total addresses holding an active balance.

Non-Zero Balance Addresses represent crypto wallets or accounts on the blockchain that hold a positive balance of the native currency. This surge in these addresses signals growing adoption and global interest in Ethereum, potentially driving up market demand and, consequently, the price.

It’s noteworthy that this surge in non-zero balance addresses aligns with “The Merge.” This suggests that reduced transaction fees and optimized energy consumption have successfully attracted new active investors by lowering the entry barriers.

Ethereum Attracts High Transaction Activity from New Users

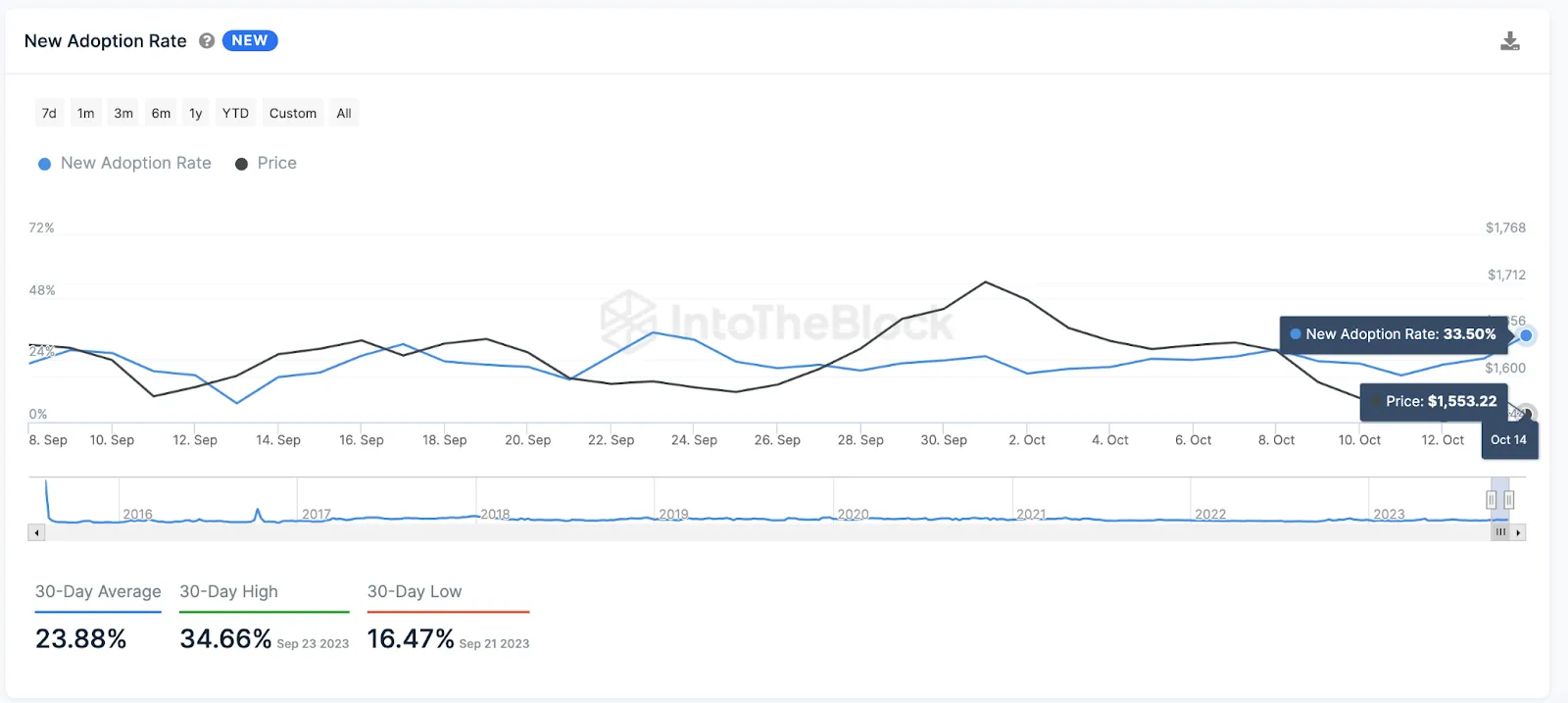

The milestone of 100 million non-zero balance addresses implies that many new users have joined the Ethereum ecosystem. What’s even more striking is the “New Adopters’ Participation Rate,” which confirms that these new investors are actively participating in the Ethereum network’s daily economic activity.

On September 26 and October 14, 2023, the “New Adopters’ Participation Rate” surged to 34%, marking the second consecutive month of such high participation since October and November 2022. This metric provides a clear indication of how newcomers’ transactions are boosting Ethereum’s network demand.

Despite the growing bearish sentiment stemming from the Middle East crisis, Ethereum has managed to hold steady at the $1,500 support level.

Ethereum Price Prediction: $1,600 Is on the Horizon

From an on-chain perspective, the influx of new investors and their transactional activity positions ETH favorably to break into new all-time highs, potentially reaching $5,000 in the next bull rally.

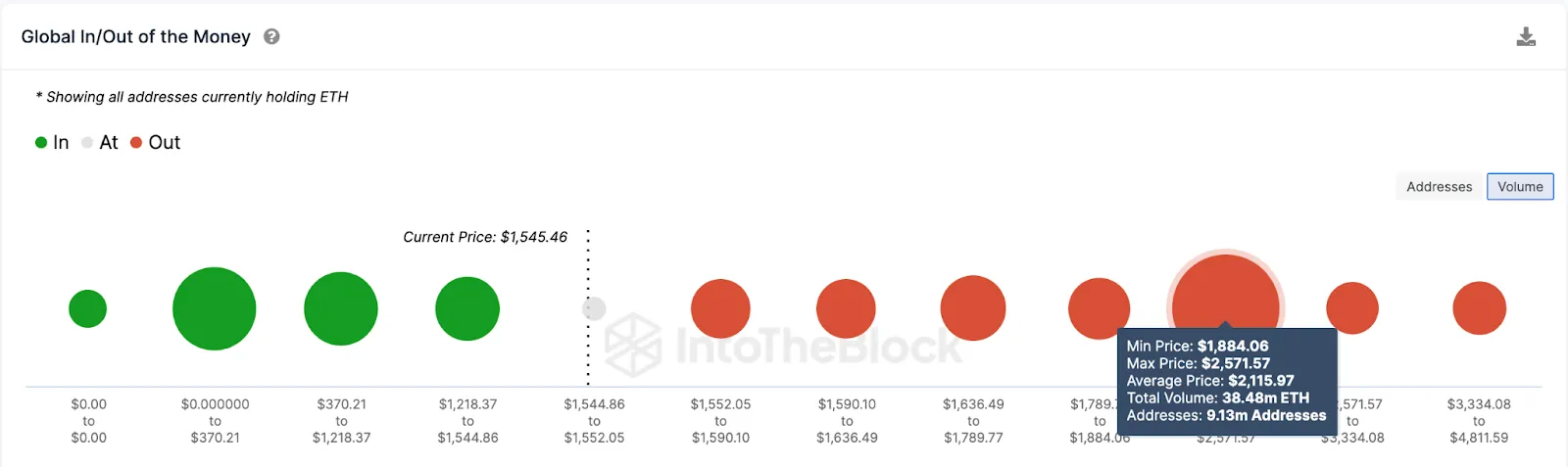

Global In/Out of the Money data, which categorizes Ethereum holders by their entry price distribution, supports this outlook. It identifies a significant sell-wall at $1,900 as the main obstacle between ETH and a new all-time high.

>>> Bitcoin Surges to $29,000, Cathie Wood Forecasts Even Stronger Growth

Approximately 9.13 million addresses acquired 38.48 million ETH at a minimum price of $1,884. If they decide to take early profits, this could trigger a price reversal for ETH.

With Ethereum’s share of non-zero balance addresses now at 37%, the New Adopters’ participation rate could consistently exceed 35%, potentially pushing ETH above the $1,900 resistance in the medium-to-long term.

However, bearish pressure could lead to an ETH price dip below $1,400. Nonetheless, the growing network demand may reinforce the initial buy-wall at $1,500, providing a potential rebound for ETH. But if, against the odds, the bears breach that support level, an ETH price drop towards $1,400 could be in the cards.