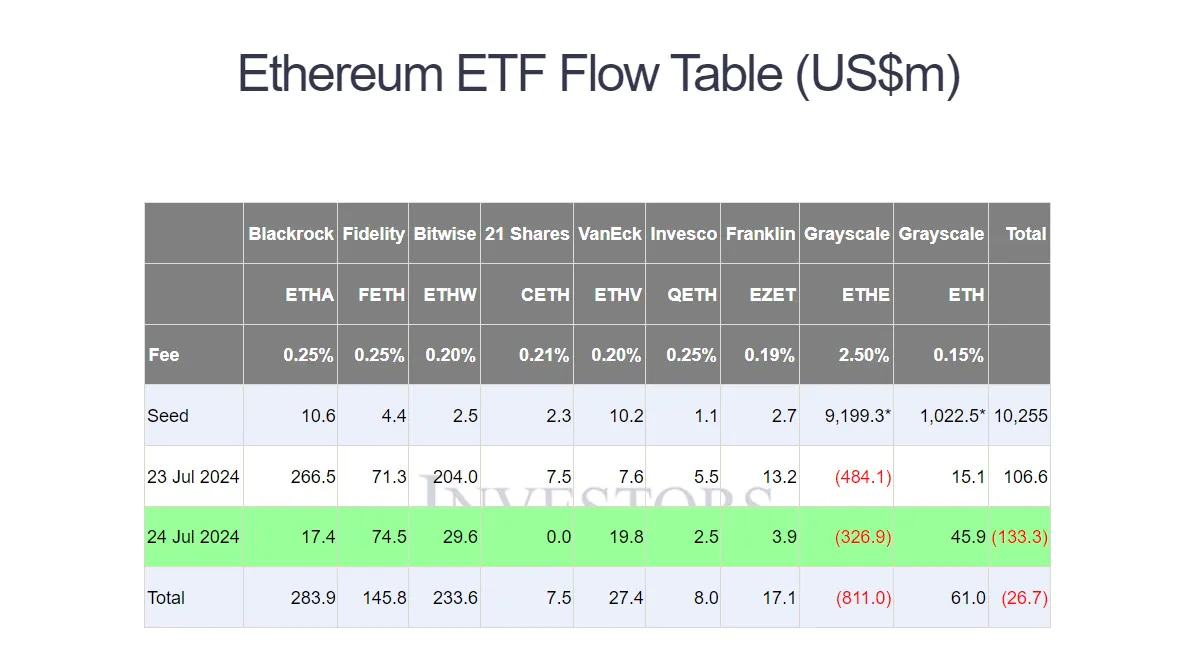

In the United States, the newly launched spot-traded Ethereum ETFs experienced a net outflow of $113.3 million on Monday. This was largely driven by substantial withdrawals from Grayscale’s recently converted Ethereum Trust (ETHE). Although seven out of the eight new ETFs saw net inflows, the significant outflows from Grayscale’s fund resulted in an overall notable net outflow. So, what does this complex situation imply for investors?

Grayscale’s ETHE fund, established in 2017, allowed institutional investors to purchase ETH with a six-month lock-up period. However, the fund’s conversion to a spot-traded Ethereum ETF on July 22 enabled investors to sell their assets more freely. This newfound flexibility led to the sale of over 9% of the fund’s assets, culminating in a total outflow of $811 million within two days of the conversion.

Fidelity’s Ethereum Fund (FETH) and Bitwise’s Ethereum ETF (BITW) attracted positive inflows of $74.5 million and $29.6 million, respectively. BlackRock’s iShares Ethereum Trust (ETHA) also showed a positive trend on its first day, although it only garnered $17.4 million on the second day. This mixed performance underscores the market’s sensitivity and volatility in response to new financial instruments and significant institutional actions.

ETH Price Volatility

ETH is currently trading at $3,172, having dropped over 6.8% in the past 24 hours and 7.4% over the past week. This decline coincides with a broader market sell-off, as evidenced by the S&P 500’s 2.3% drop on the same day.

The steeper drop in ETH compared to Bitcoin, which only fell by 2.6%, highlights ETH’s heightened sensitivity to inflows and outflows following the launch of the new ETFs.

In the United States, the newly launched spot-traded Ethereum ETFs witnessed a net outflow of $113.3 million on Monday. This substantial outflow was primarily due to significant withdrawals from Grayscale’s recently converted Ethereum Trust (ETHE). Although seven of the eight new ETFs recorded net inflows, the outflows from Grayscale’s fund significantly impacted the overall net outflow. What does this complex scenario imply for investors?

Grayscale’s ETHE fund, established in 2017, allowed institutional investors to purchase ETH with a six-month lock-up period. However, the fund’s conversion to a spot-traded Ethereum ETF on July 22 enabled investors to sell their assets more freely. This newfound flexibility led to the sale of over 9% of the fund’s assets, resulting in a total outflow of $811 million within two days of the conversion.

Fidelity’s Ethereum Fund (FETH) and Bitwise’s Ethereum ETF (BITW) attracted positive inflows of $74.5 million and $29.6 million, respectively. BlackRock’s iShares Ethereum Trust (ETHA) also showed a positive trend on its first day, although it only garnered $17.4 million on the second day. This mixed performance underscores the market’s sensitivity and volatility in response to new financial instruments and significant institutional actions.

I this really working