This transformation is notably linked to a surge in network activity, drawing in a fresh wave of investors, institutional players, and crypto whales, fueled by the optimistic expectation of the approval of a spot Bitcoin ETF.

As of November 28, 2023, Glassnode, an on-chain analytics firm, reports a substantial deflationary trend in the supply of Ethereum (ETH), the foremost smart contract platform. This trend is primarily attributed to an upswing in transaction demand.

Emerging leaders: Token transfers and stablecoins

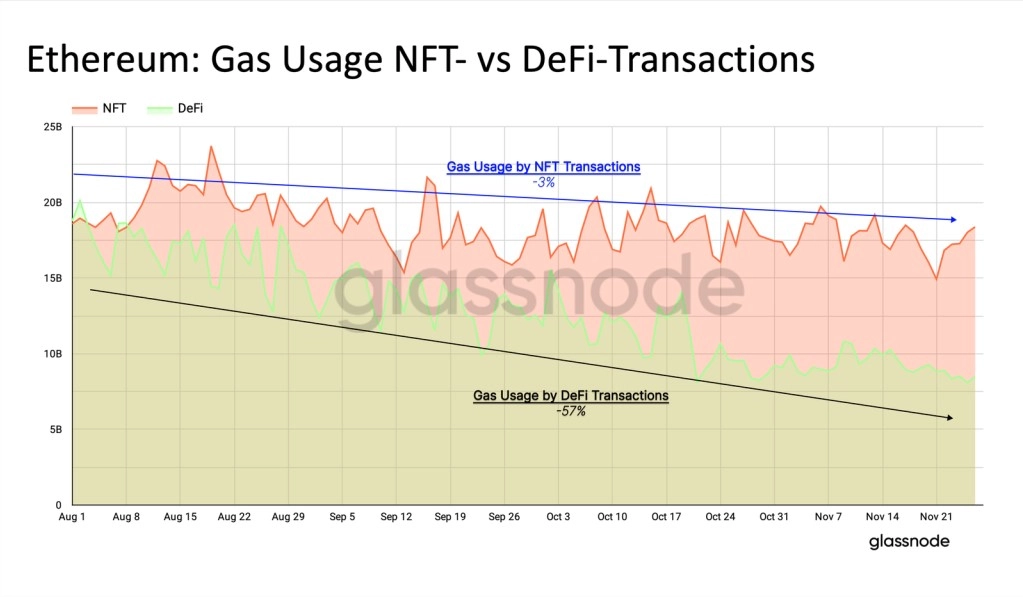

Over the last four months, Non-Fungible Token (NFT) transactions have witnessed a 3% reduction, and Decentralized Finance (DeFi) transactions have experienced a notable decline of 57%. In stark contrast, token transfers and stablecoin transactions have seen a marked increase of 8.2% and 19%, respectively. These statistics underscore that the recent surge in network activities is predominantly driven by heightened token transfers and stablecoin transactions.

Despite historically driving Ethereum network adoption, NFT and DeFi transactions have shown relatively muted contributions over the past four months. This decline in adoption signals a shift in market dynamics, with token transfers and stablecoins emerging as leaders, reflecting a growing confidence in market strength.

Related: Why Ethereum is Attracting Increasing Institutional Capital?

As of now, ETH is trading around $2,065, exhibiting a 2.3% positive price momentum in the last 24 hours, as per coinmarketcap. Over the past 7 days, despite facing various challenges in the cryptocurrency realm, it has demonstrated a more than 5% upward movement.

Impact of the London hard fork: Ethereum’s move towards deflation

Since the introduction of the London hard fork, Ethereum has undergone a significant transformation from a net inflationary state to one characterized by stability and outright deflation. The network briefly experienced net inflation between August and October, attributed to reduced network activity. However, in recent weeks, a combination of diminishing issuance rates and an uptick in supply burn has once again shifted the overall ETH supply towards a net deflationary position.