On April 7, Ethereum recorded its highest profit of the month, which also reflects the positive upward trend recently recorded in buying volumes from several large investors.

As overall network volumes remain stable, Layer 2 (L2) solutions are handling the majority of transactions, which is also playing an active role in maintaining Ethereum’s stability.

Ethereum increased sharply in price

Source: Trading View

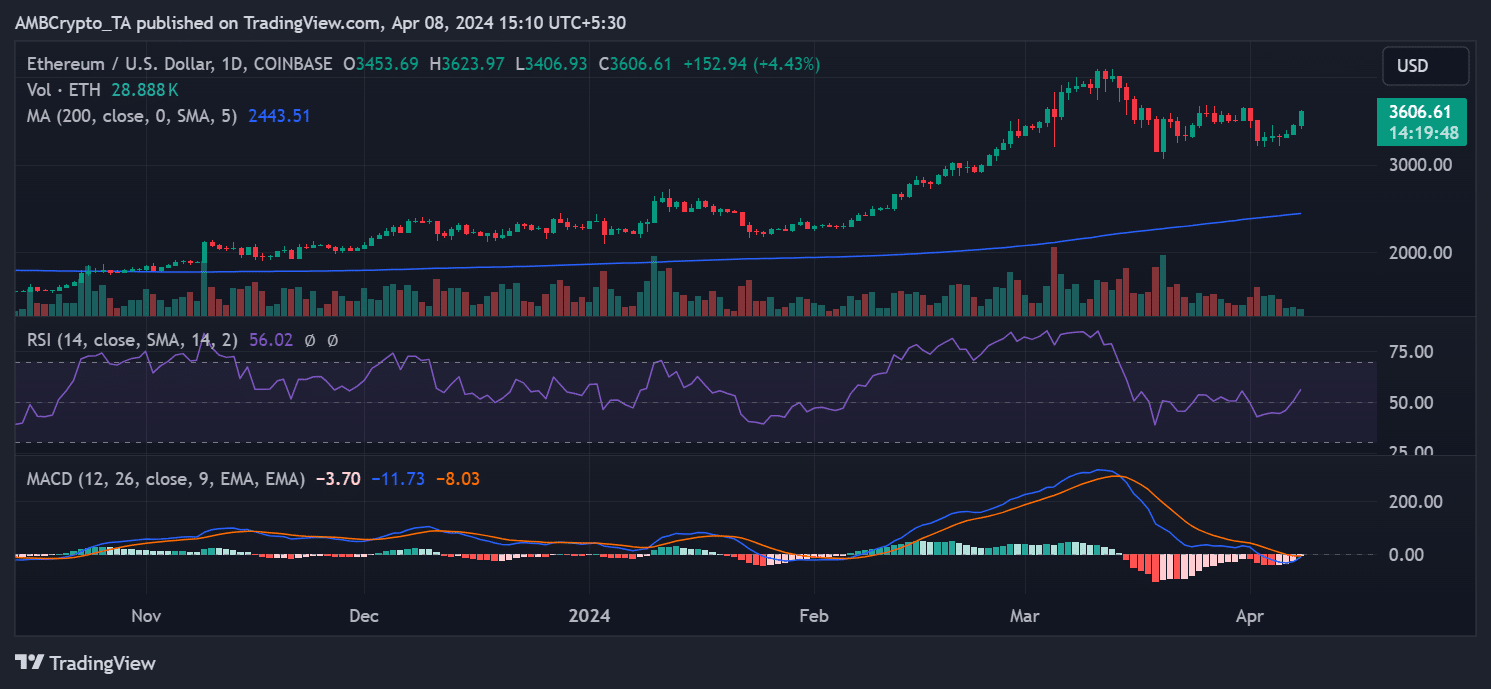

Analysis of Ethereum’s daily chart shows that on April 7, the price increased by more than 3%, with the closing price surpassing the $3,400 threshold. This increase is especially notable because Ethereum has undergone a significant decline before, making this the largest increase recorded in recent times.

What’s more notable is that at the time of writing, Ethereum is experiencing a stronger rally, with a price increase of over 4%. The chart shows ETH is trading above $3,600 with a recent spike.

Chart analysis also shows that the highest price this year has been reached at around $4,000, and with current trends, surpassing this record is likely to happen in the following weeks.

Another positive is that chart research has revealed that the price rally has effectively helped Ethereum return to an uptrend, with data from the Relative Strength Index (RSI) showing that ETH is currently in above the neutral zone, signaling a continued uptrend.

Ethereum whale activity increases

While Ethereum’s price continues to rise, the latest data shows increased buying activity from some major investors. According to Spot on Chain, within the past 24 hours, two major investors together spent more than $35 million to buy ETH, with an average price of about $3,400 for 10,322 ETH.

Whales are buying $ETH on chain!

In the past 14 hours, two whales have spent a total of $35.11M in stablecoins to buy 10,322 $ETH, allegedly pumping the price above $3,400, including:

1. 8 wallets (likely one entity) spent 20.86M $USDT to buy 6,145 $ETH at ~$3,395 in the past 9… pic.twitter.com/jatHgGkKhA

— Spot On Chain (@spotonchain) April 8, 2024

Additionally, as the price continued to rise to around $3,455, two other large investors withdrew 11,657 ETH, worth more than $40 million, from an exchange. This action of large investors shows that accumulation is increasing, and it can be predicted that the price will continue to increase.

Related: The DeFi Boom Could Propel Ethereum Prices to $3500

It is worth noting that Ethereum Open Interest data on Coinglass also shows a recent decline over the past few days. However, there has been a slight increase at the time of writing, with over $13.3 billion in open interest, which suggests that more capital is flowing into Ethereum, which may be contributing to the price increase. Combined with the current behavior of large investors and the increase in Open Interest, these data suggest that it is likely that new prices may be set in the near term.

We are waiting