Institutional Sell-off On September 10, blockchain analytics firm Lookonchain reported on X (formerly Twitter) that Metalpha, a prominent Hong Kong-based asset management firm, had sold 10,000 ETH, worth $23.45 million, to Binance (BNB). Over the past four days, the firm has offloaded a total of 33,589 ETH, valued at $77.55 million, on Binance.

Despite this substantial sell-off, Metalpha still holds 51,300 ETH, equivalent to $120 million, as of the latest reports.

Are whales abandoning ETH?

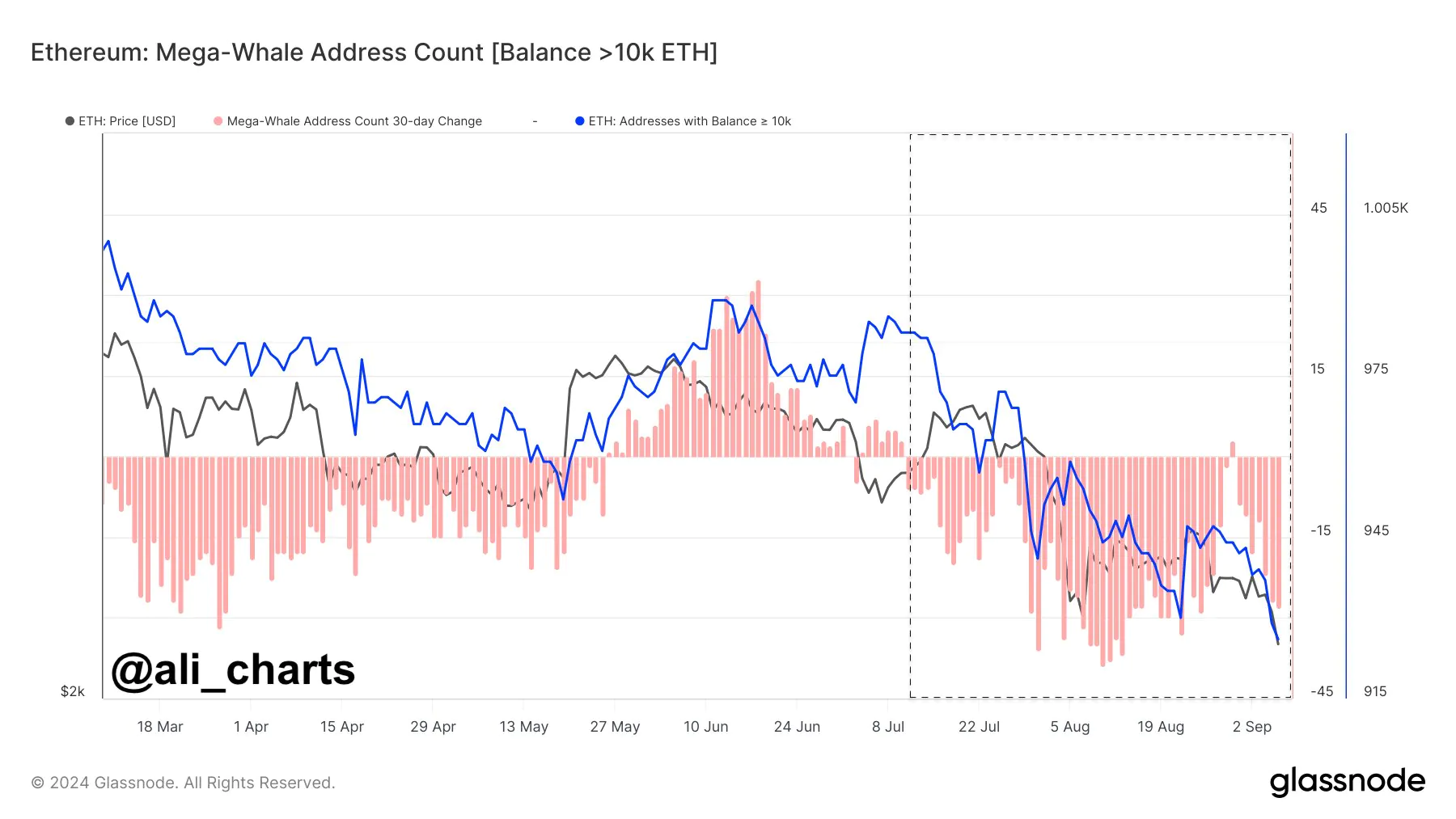

A well-known crypto expert recently posted on X, pointing out that Ethereum whales have stopped accumulating ETH since early July. Instead, they have been either selling or redistributing their holdings.

This trend indicates a waning interest from both whales and investors in recent weeks. If this pattern continues and institutional investors proceed with large-scale sell-offs, a major price decline could be imminent in the days to come.

Key levels to watch

Despite the current situation, Ethereum’s technical analysis shows some encouraging signs. Notably, the leading altcoin may experience a price surge due to a bullish divergence on the Relative Strength Index (RSI). Additionally, it has found support at the critical $2,150 level.

Based on historical price trends, whenever ETH reaches this key support level, it has consistently rallied by over 23%. This time, a similar surge is expected, with ETH potentially climbing to $2,700. However, this bullish outlook hinges on ETH maintaining its critical support at $2,150.

Bullish On-Chain

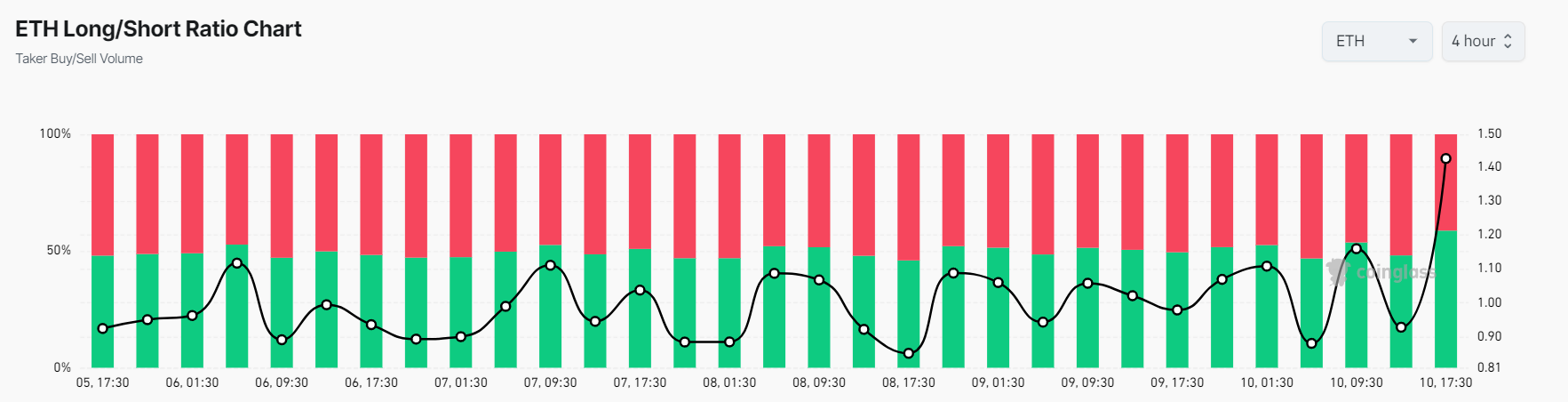

Data On-chain data also supports this optimistic forecast. According to Coinglass, the ETH Long/Short ratio stood at +1.424 at the time of reporting, the highest level in the past week, indicating a strong bullish sentiment among traders.

Moreover, ETH futures open interest increased by 2.5%, suggesting that traders are increasingly betting on long positions. A positive Long/Short ratio, along with rising open interest, signals a potential buying opportunity. At the time of writing, 58.75% of top ETH traders held long positions, while 41.25% were short, highlighting the dominance of bulls who might force a short squeeze.

As of the latest reports, ETH was trading near $2,350, marking a 2.35% price increase over the past 24 hours. Trading volume also saw a modest 14% uptick during the same period, reflecting greater trader engagement amid the market’s recovery.