Ethereum (ETH) is poised for a significant uptrend, supported by a notable decrease in its exchange supply as holders opt for long-term storage. Following a retest of the $2,100 threshold, the second-largest cryptocurrency globally is positioning itself for an upward trajectory. At present, Ethereum (ETH) is valued at $2,200, boasting a market capitalization of $264 billion.

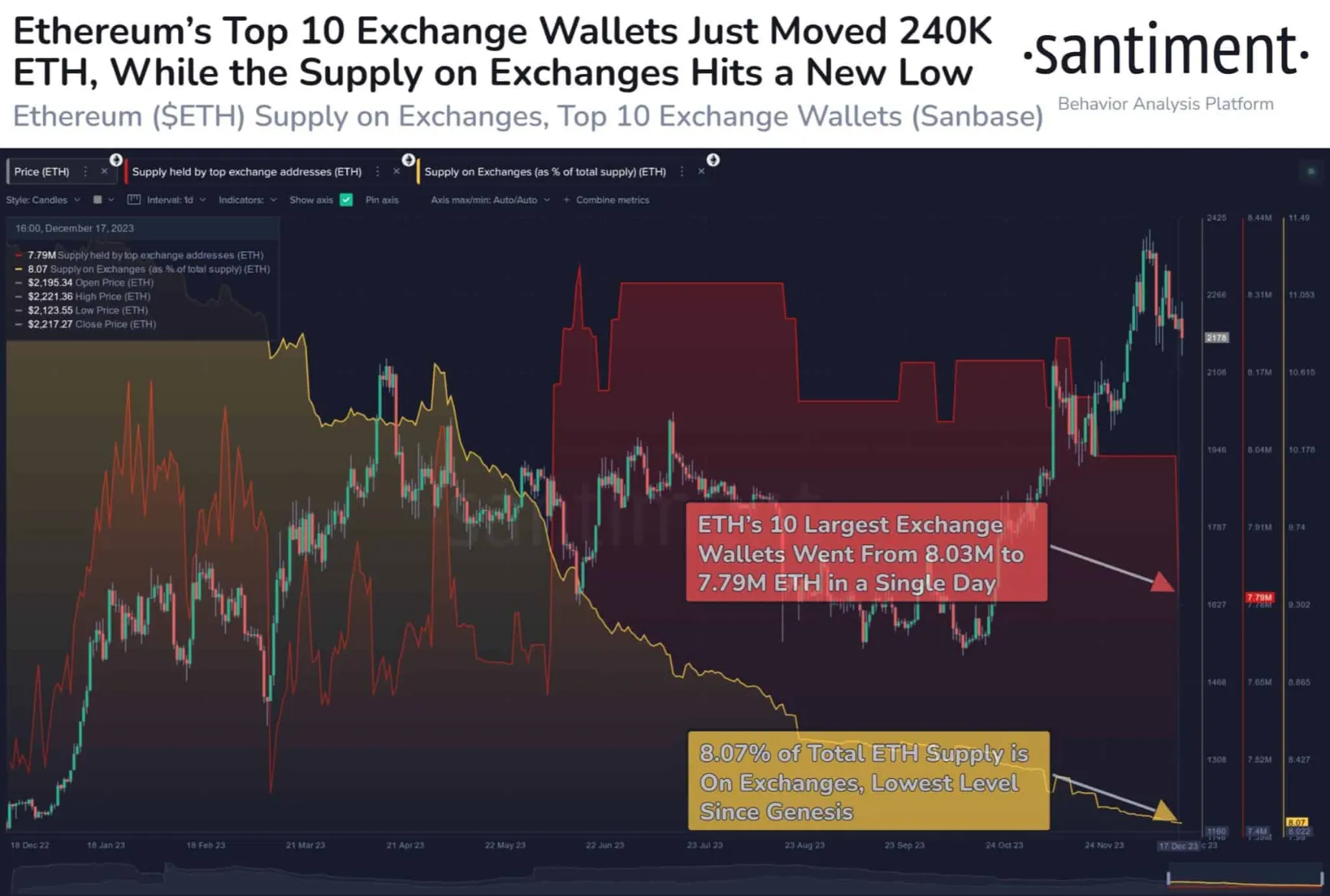

The outflow of Ethereum from exchanges is a key trend, indicating a diminishing supply on trading platforms. Despite the prevailing price volatility, the reduced Ethereum holdings on exchanges suggest a growing inclination among investors to retain their ETH for an extended duration. On-chain data from Santiment reveals that, with Ethereum’s market value slightly surpassing $2,170, major exchange wallets are actively engaged in transferring coins to smaller wallets or withdrawing them entirely. In the last 24 hours, a substantial 240,000 ETH has shifted from these prominent wallets, reflecting a 2.99% decrease in the overall holdings.

Crypto analyst Michael van de Poppe offers insights into the current dynamics. While altcoins demonstrate resilience, he cautions against definitively labeling it as a trend. Noting a current lack of momentum in Ethereum (ETH), van de Poppe envisions a forthcoming shift in the weeks ahead. Anticipating a capital flow from Bitcoin to Ethereum, he foresees a robust performance by altcoins in the first quarter of 2024. This potential surge coincides with a projected peak in Bitcoin dominance, according to van de Poppe’s analysis.

ETH Price Analysis

During Tuesday’s trading session, Ethereum initiated an early rally amid the ongoing market volatility. The $2,100 level stands out as a crucial support, having played a significant role in the past. This level, previously a resistance point in the broader market, faced repeated challenges from an ascending triangle. Anticipated short-term pullbacks are expected to find support around this level. Even in the event of a breakdown below $2,100, close attention is warranted as the 50-Day EMA is anticipated to offer substantial support.

#Altcoins show strength, but it might not be anything yet. $ETH isn’t showing any momentum, which I think is going to change in the next weeks.

Money flow from Bitcoin to Ethereum, through which altcoins are going to have a great Q1 and Bitcoin dominance peaks. pic.twitter.com/Xwftgv0dfg

— Michaël van de Poppe (@CryptoMichNL) December 19, 2023

On the optimistic side, traders have set their sights on the $2,500 level as a potential target, anticipating a considerable push from market participants aiming to propel Ethereum in that direction. Beyond that, the $2,700 level becomes the next focal point. The current trend suggests a scenario where traders consistently seek value during every dip, indicating an active pursuit of value by the majority of crypto traders.

Related: SEC Postpones Decision on Multiple Ethereum ETFs to May

However, a breakdown below the 50-Day EMA could have adverse implications for Ethereum. Additionally, the market shows sensitivity to changes in interest rates, particularly in the United States and other bond markets. Any resurgence in rates is likely to exert pressure on the market, potentially leading to a broader decline in the crypto markets, extending beyond the impact on Ethereum.