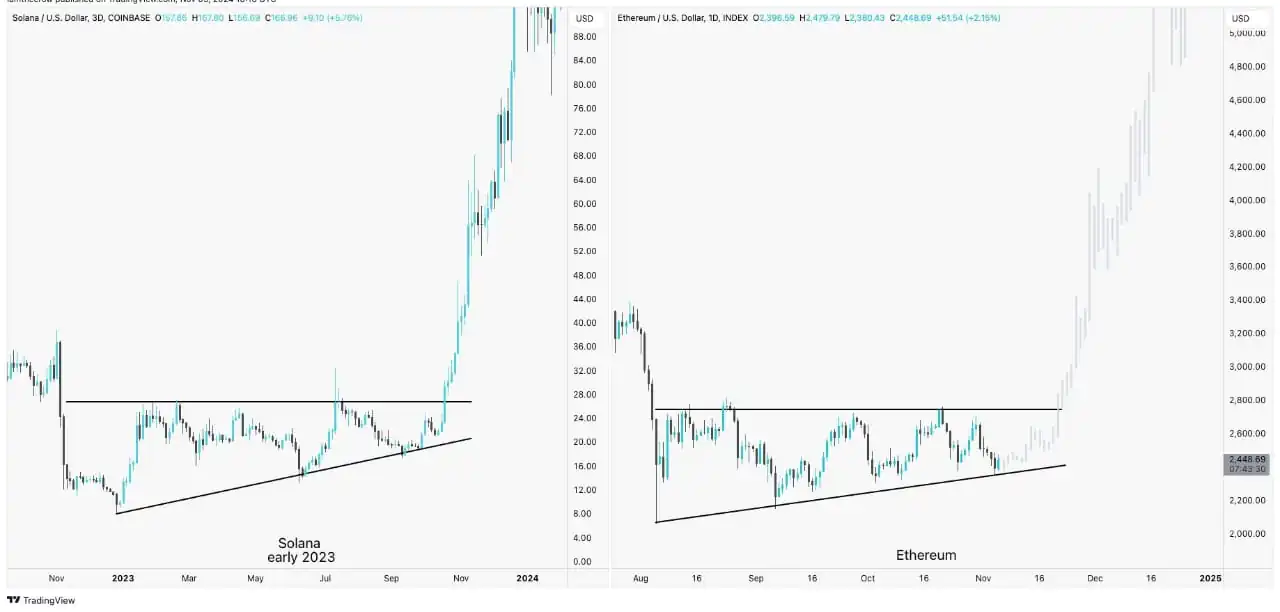

At the start of 2023, Solana’s price formed an ascending triangle pattern, consolidating below resistance before breaking out, sending the price up by over 222%. Ethereum is currently displaying a similar structure—forming an ascending triangle pattern below resistance, signaling a similar accumulation and consolidation.

With this pattern, Ethereum has the potential to peak at a major breakout if it follows Solana’s trend. The ascending triangle is often viewed as a bullish continuation pattern, indicating a potential breakout that could push ETH significantly higher. For ETH to achieve similar gains, momentum indicators and investor activity need to be in agreement.

If Ethereum breaks above the current resistance, there is a high probability of a strong rally, with a similar upside target as Solana, pushing ETH into a significant uptrend.

Ethereum’s RSI and MACD indicators also show potential strength in the market, supporting this prediction. The RSI is currently hovering near neutral territory but is trending slightly bullish, signaling that price momentum could soon turn positive.

On the MACD histogram, the red bars are decreasing, suggesting that selling pressure is waning. Additionally, the MACD line is trending closer to a crossover above the signal line—a key bullish signal. Overall, these indicators suggest that ETH could start to attract buying momentum, especially if fundamentals such as liquidity and on-chain activity continue to increase in tandem with the price pattern.

The Impact of Liquidity on ETH Price Trend

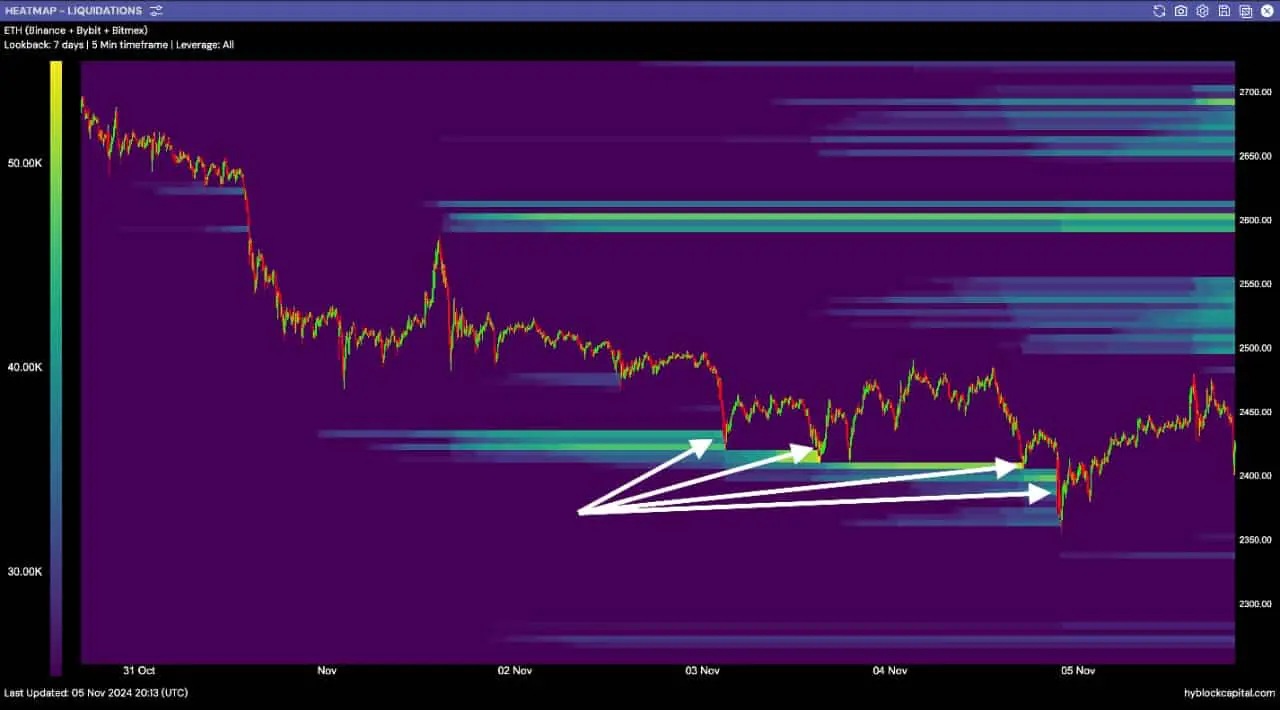

Analyzing the ETH liquidity heatmap, a familiar pattern emerges: another day of strategic liquidity holding.

The ETH price continues to fluctuate to absorb liquidity, creating continuous candle wicks, a sign that market makers and large institutions are squeezing out small players. This opens up the possibility of a strong ETH recovery after the liquidity accumulation phase, especially when there is a significant amount of liquidity remaining in the current price range.

Read more: Bitcoin Rises 1900% During Donald Trump’s First Term

These higher liquidity zones act as magnets, potentially drawing ETH towards the next upside target in those areas, with the potential to generate a similar increase as SOL did, around 222%.

Traders can expect that after this liquidity holding, ETH will use the recovery momentum to head towards nearby liquidity clusters, supporting a short-term bullish trend.