However, this rally is not necessarily a sign of a sustainable uptrend. DYDX prices may face pressure as investors start to take profits, which will directly affect the market.

DYDX Day, an event organized by the DYDX Foundation in Dubai. The event will provide a unique opportunity to learn from industry leaders, explore the latest innovations in decentralized trading, and meet like-minded individuals who are passionate about shaping the future of finance. This has sparked a wave of excitement among DYDX holders, contributing to the current price surge.

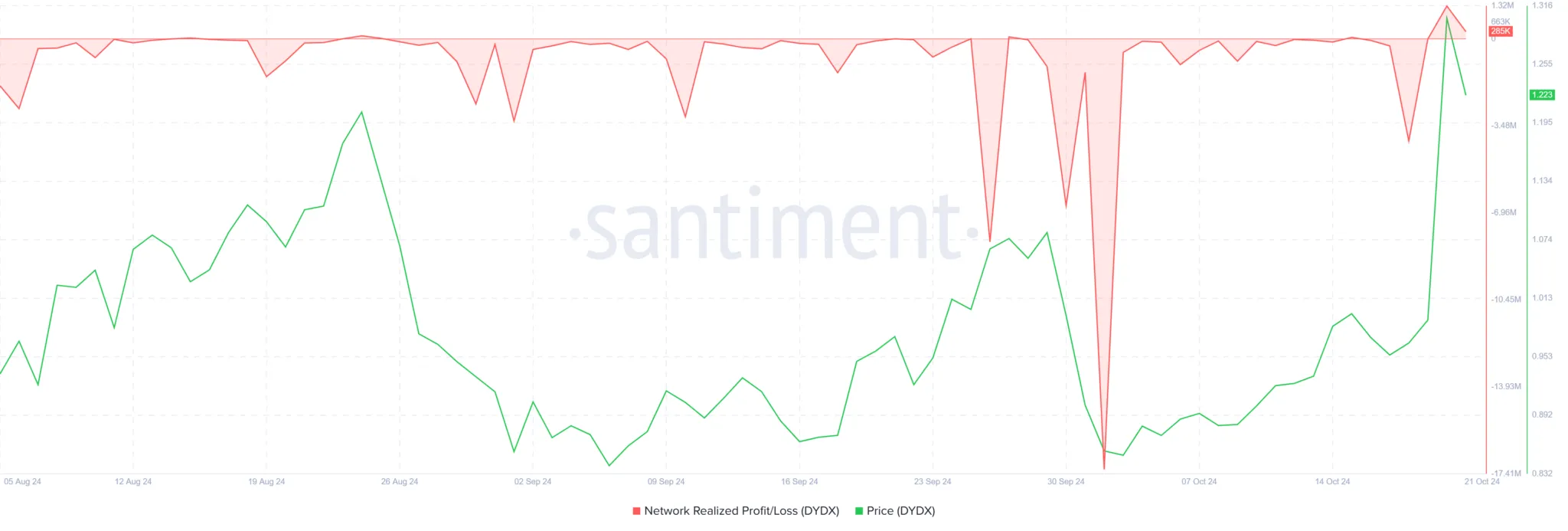

DYDX investors start to take profits

After the weekend’s rally, many investors quickly took profits. The realized yield index recorded its first significant increase since March, reaching a seven-month high.

This wave of profit-taking could drag DYDX prices lower as many seek to preserve profits. Market history shows that this phenomenon often leads to temporary declines due to increased selling pressure.

As more investors continue to withdraw their funds, market sentiment gradually turns pessimistic. This sell-off could have a negative impact on the price of DYDX, especially if many decide to reduce their holdings. This trend could derail the current bullish momentum, leading to a possible further correction in the market.

Technically, the bullish momentum of DYDX is showing signs of weakness. The Relative Strength Index (RSI), a key indicator of overbought and oversold conditions, is currently in the overbought zone.

This is a rare phenomenon among altcoins and usually signals that the asset is likely to undergo a price correction. In the past, when the RSI touched this zone, the price of DYDX tended to decline immediately after.

With the RSI rising, a similar scenario could occur this time. If the overbought condition continues without any strong factors continuing to push the price up, DYDX may face more selling pressure, leading to a price decline.

DYDX Price Prediction: Focus on Avoiding Losses

After a 32% surge on Sunday, DYDX price stalled just below the key resistance level at $1.33. However, today alone, the price has dropped 6%, largely due to profit-taking as mentioned earlier. This pullback suggests that the recent rally may have peaked and a further correction is likely.

Given the current factors, DYDX is likely to continue to face bearish pressure. The coin is at risk of losing the key support level at $1.16. If this level is broken, the next support lies at $0.91, which could lead to a deeper decline, erasing the recently accumulated gains.

However, if DYDX can rebound from the $1.16 support level, it could hold on to some of its recent gains. A successful recovery would open the doors for DYDX to retest the $1.33 resistance, which could change the current bearish outlook.