Dubai has launched the first licensed tokenized real estate project in the Middle East and North Africa (MENA) region, paving the way for the digitalization of real-world assets and attracting global investors to its property market.

The project is a collaboration between the Dubai Land Department (DLD), the Central Bank of the UAE, and the Dubai Future Foundation. Tokenized real estate assets will be traded on a newly launched platform called “Prypco Mint,” with Zand Digital Bank appointed as the financial partner for the pilot phase.

On May 19, Dubai’s Virtual Assets Regulatory Authority (VARA) updated its regulations to include real-world asset (RWA) tokenization, allowing such tokens to be traded on secondary markets. During the pilot, individual investors will be able to purchase tokenized shares of ready-to-own properties in Dubai with a minimum investment of 2,000 Emirati dirhams (approximately $545). All transactions will be conducted in AED, without the use of cryptocurrencies, and initially limited to UAE ID holders. However, there are plans to expand the program globally.

Earlier in April, DLD and VARA agreed to integrate Dubai’s real estate registry with tokenization infrastructure to enhance market liquidity and attract international investors. The initiative was first announced in March.

The UAE, and Dubai in particular, is accelerating efforts to establish itself as a global digital asset hub. In May, Dubai partnered with Crypto.com to enable crypto payments for government services.

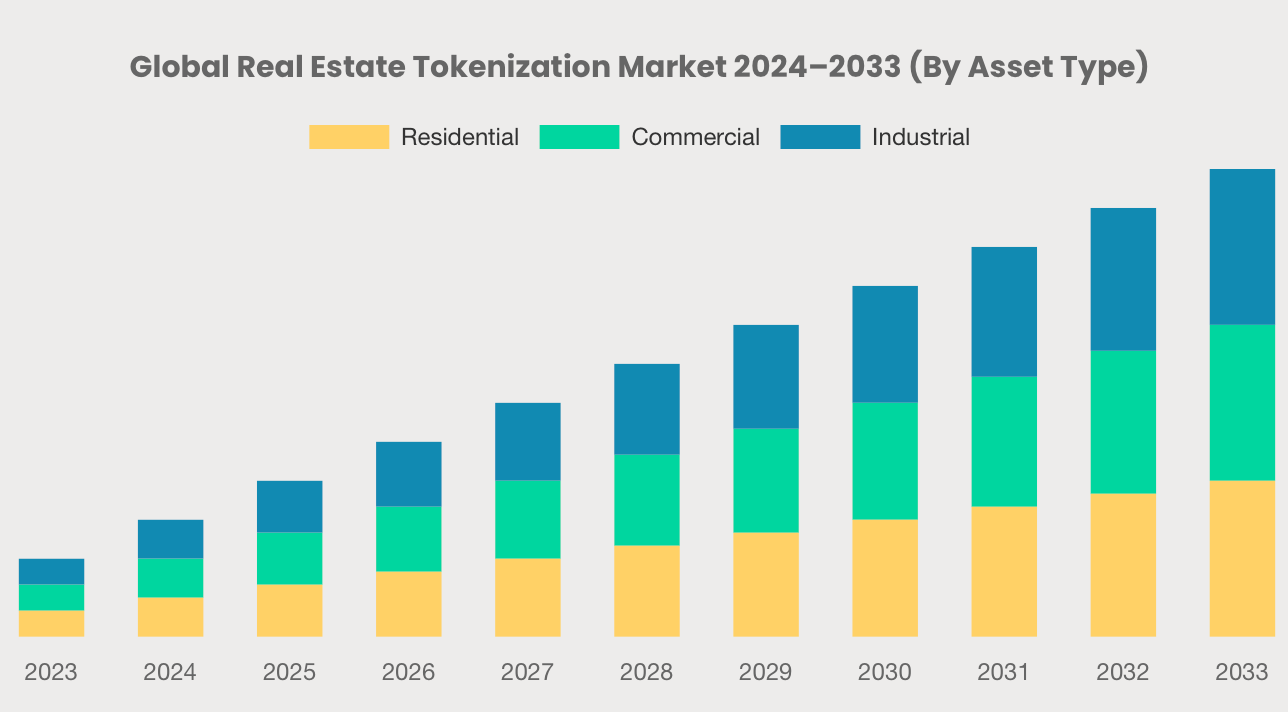

Real estate is among the most promising sectors for RWA tokenization, offering liquidity to traditionally illiquid assets and expanding access for retail investors. According to Custom Market Insights, the global market for tokenized real estate could reach $19.4 billion by 2033, with an annual growth rate of 21%. All segments — residential, commercial, and industrial — are expected to contribute to this growth.

Prominent companies in the field include RealT and Metlabs, though many others have faced challenges due to complex regulatory environments.