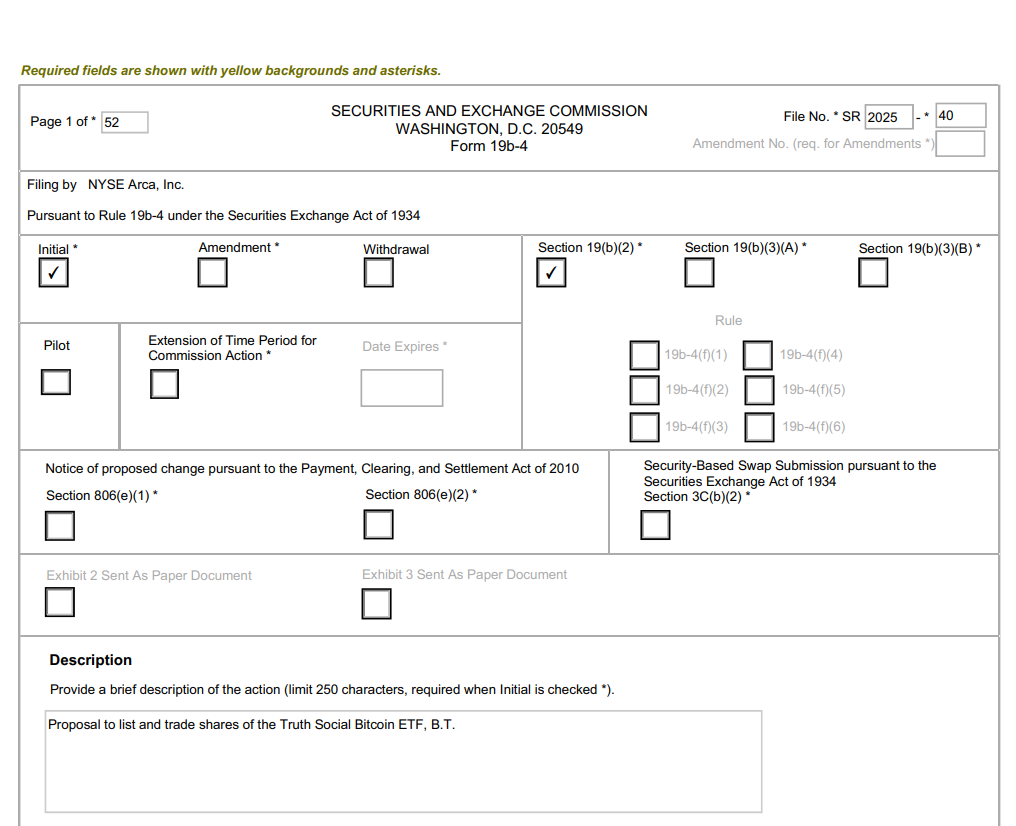

Truth Social, the social media platform owned by former U.S. President Donald Trump, has officially filed with the U.S. Securities and Exchange Commission (SEC) to launch a spot Bitcoin ETF on the NYSE Arca exchange.

According to the filing submitted on June 4, the ETF aims to track the price performance of Bitcoin, representing a new step in Trump Media and Technology Group’s (TMTG) expansion into digital assets. Although Trump’s name does not appear in the documents, Truth Social is a product of TMTG, a company he holds a majority stake in, currently traded on Nasdaq under the ticker DJT.

The ETF is being developed through a partnership between Truth Social and Yorkville America Digital, an investment firm known for its “America-first” approach. Custody of the underlying Bitcoin assets will be handled by Foris DAX Trust, affiliated with Crypto.com.

The SEC filing states that the fund seeks to closely mirror the market price of Bitcoin before expenses. Specific details such as the trading ticker and fee structure have yet to be disclosed.

Submitting a Form 19b-4 is a necessary step for listing any ETF on a U.S. exchange. This allows the SEC to begin its review process, which includes gathering public feedback and could take up to 240 days for a final decision.

Yorkville America Digital will serve as the fund’s sponsor, overseeing its management and ensuring regulatory compliance. In April 2025, TMTG signed a partnership agreement with Crypto.com to support its crypto financial products, including custodial services via Foris DAX.

This move is part of TMTG’s broader strategy to grow its presence in the cryptocurrency space. Beyond Truth Social, the company is developing the Trump Coin wallet and Truth.Fi—a digital finance platform launched in early 2025—authorized to invest over $250 million in Bitcoin, ETFs, and other digital assets.

Truth Social’s entry into the spot Bitcoin ETF market places it among a growing number of firms tapping into the demand for regulated crypto investment products. However, this particular filing stands out due to its connection with Donald Trump and his political influence.

The timing also appears favorable, as the SEC—under new Chairman Paul Atkins—has taken a more open stance toward digital assets. Several investigations into crypto firms have recently been dropped, and efforts to foster industry dialogue have increased.