Donald Trump Jr., the eldest son of former U.S. President Donald Trump, has made headlines with a major investment in Thumzup Media Corporation — a social media marketing firm that has recently adopted a Bitcoin treasury strategy.

Thumzup Media Corporation provides a platform that allows influencers to monetize their content by promoting products on social media. However, the company is now expanding its financial strategy by accumulating Bitcoin as part of its corporate treasury.

According to Bloomberg, Trump Jr. currently owns 350,000 shares of Thumzup, valued at approximately $3.3 million, with shares trading around $9.50 each. This investment comes as the company increasingly embraces Bitcoin’s potential as a reserve asset.

In November 2024, the company’s board of directors approved a plan to purchase up to $1 million worth of Bitcoin for its treasury. CEO Robert Steele commented:

“With newly approved Bitcoin ETFs and growing interest from institutional investors, Bitcoin is a solid addition to our treasury approach. Its limited supply and anti-inflationary properties make it a reliable store of value.”

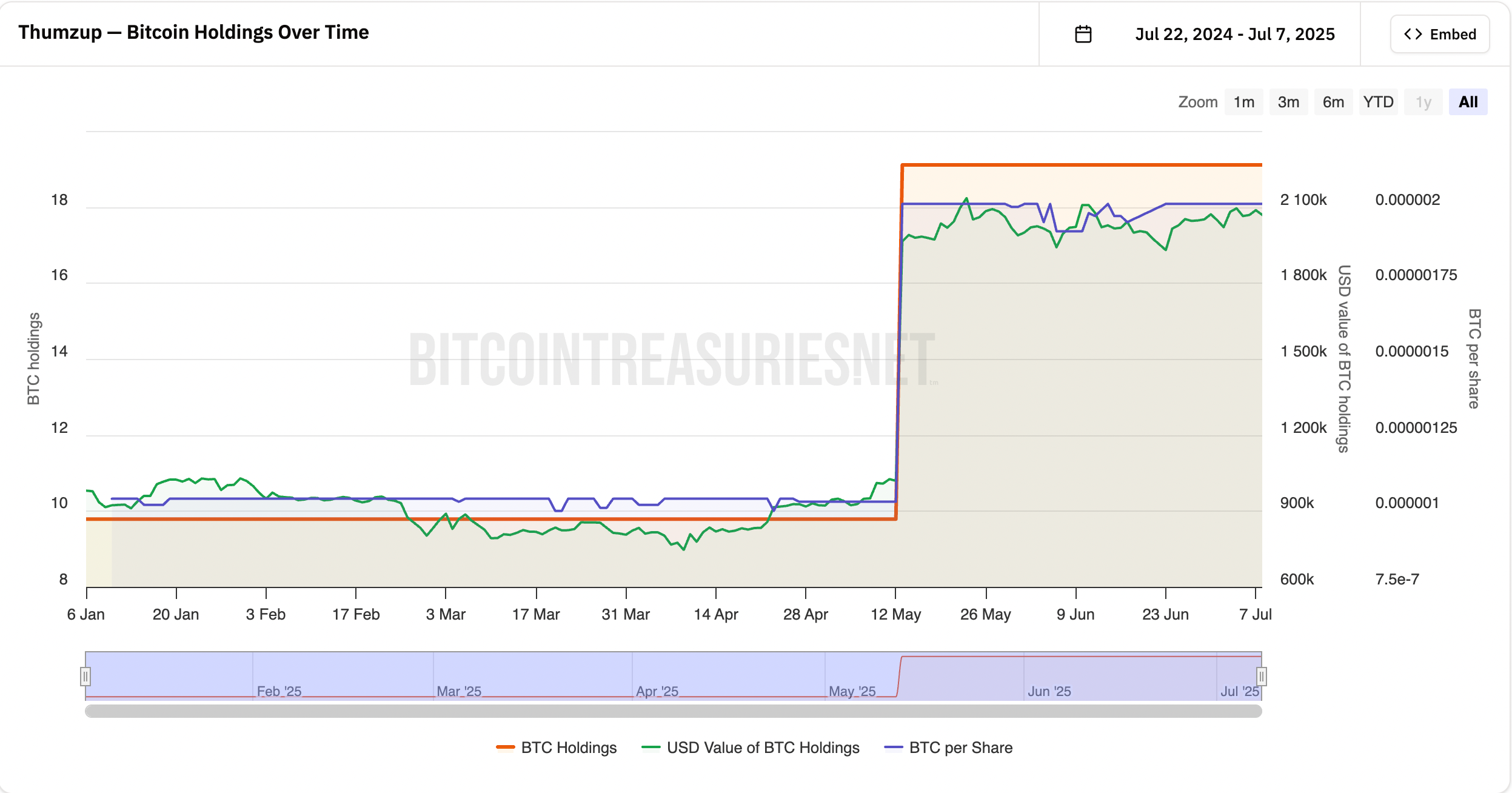

Furthering its commitment, Thumzup filed a public listing application with the U.S. Securities and Exchange Commission (SEC) in May to raise $200 million through debt and equity to fund future Bitcoin acquisitions. As of now, the company holds 19.11 BTC — worth over $2.1 million — according to BitcoinTreasuries, having started its accumulation in January.

The rise of Bitcoin treasury companies since early 2024 has sparked debate within financial circles. While some see it as an innovative and promising strategy, others raise concerns about its sustainability, particularly in the event of a prolonged market downturn.

The concept was popularized by MicroStrategy co-founder Michael Saylor, who pivoted his software company into one of the first major firms to accumulate Bitcoin in 2020. Since then, 258 organizations have followed suit, including public and private companies, asset managers, crypto custodians, and even some government entities.

However, critics argue that not all companies can withstand the intense volatility of the crypto market. A recent report by venture firm Breed warned that most Bitcoin treasury firms are unlikely to survive a significant BTC price drop and could spiral into bankruptcy.

Bitcoin maximalist Max Keiser echoed this sentiment:

“Michael Saylor and MicroStrategy have endured multiple market cycles and continued accumulating through downturns — something newer treasury firms have yet to face.”

As crypto markets remain unpredictable, companies like Thumzup embracing Bitcoin as a treasury asset continue to draw global attention and stir debate over the future of corporate finance in the digital age.