Buy Signal Appears – Can DOGE Bounce Back?

On the 4-hour chart, the TD Sequential indicator has just flashed a buy signal, which often precedes short-term reversals. After weeks of decline, DOGE is now trading around $0.218, right above a critical support zone. Analysts suggest that if this signal plays out, DOGE could rebound, stabilize, and set the stage for a stronger recovery.

On the daily chart, DOGE is forming a cup-and-handle pattern, typically signaling bullish continuation. To confirm a breakout, DOGE must clear major resistance levels at $0.244 and $0.277. If successful, the rally could extend toward $0.42.

However, failure to break these barriers could trap bulls and stall momentum. This makes the coming sessions critical for DOGE’s trajectory.

Market Sentiment: Bulls in Control

Data from Binance shows that long positions account for 75% of derivatives trades, compared to just 25% shorts. This reflects strong optimism for a rebound.

Still, such heavy long exposure also raises the risk of cascading liquidations if prices dip. On the flip side, the dominance of longs provides liquidity support that could help DOGE break through resistance levels.

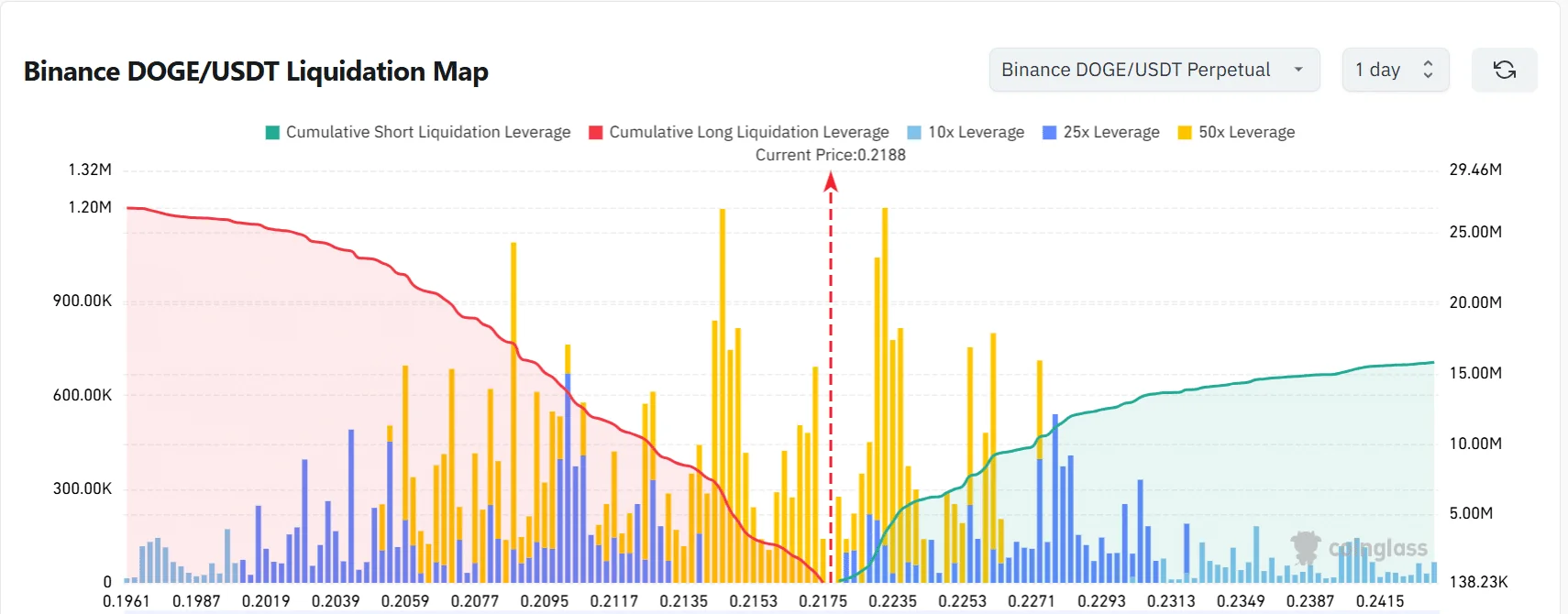

Liquidation Zones – Key to Short-Term Volatility

Heatmap data highlights concentrated liquidation clusters around $0.215 (for longs) and $0.225 (for shorts). These levels are highly sensitive:

A drop below $0.215 could trigger mass long liquidations and drive prices lower.

A surge above $0.225 may spark a short squeeze, accelerating DOGE’s upside.

With the TD Sequential buy signal, a developing cup-and-handle structure, and strong long positioning, Dogecoin is well-positioned for a potential breakout. While short-term volatility between $0.215–$0.225 remains a risk, the mid-term outlook favors bulls. Once DOGE clears $0.244 and $0.277, it could have a clear path toward $0.42, reinforcing its recovery momentum.