DigiAsia Corp, an Indonesian fintech firm, saw its stock price nearly double in a single day after announcing plans to raise $100 million to invest in Bitcoin. In a May 19 statement, the Nasdaq-listed Jakarta-based company said its board of directors had approved the creation of a Bitcoin treasury reserve and committed to allocating up to 50% of its net profits toward acquiring BTC.

DigiAsia also revealed it is in talks with regulated partners to develop strategies for generating yield from its Bitcoin holdings through methods like lending and staking. The firm is considering issuing convertible notes or crypto-linked financial instruments tied to its planned Bitcoin portfolio.

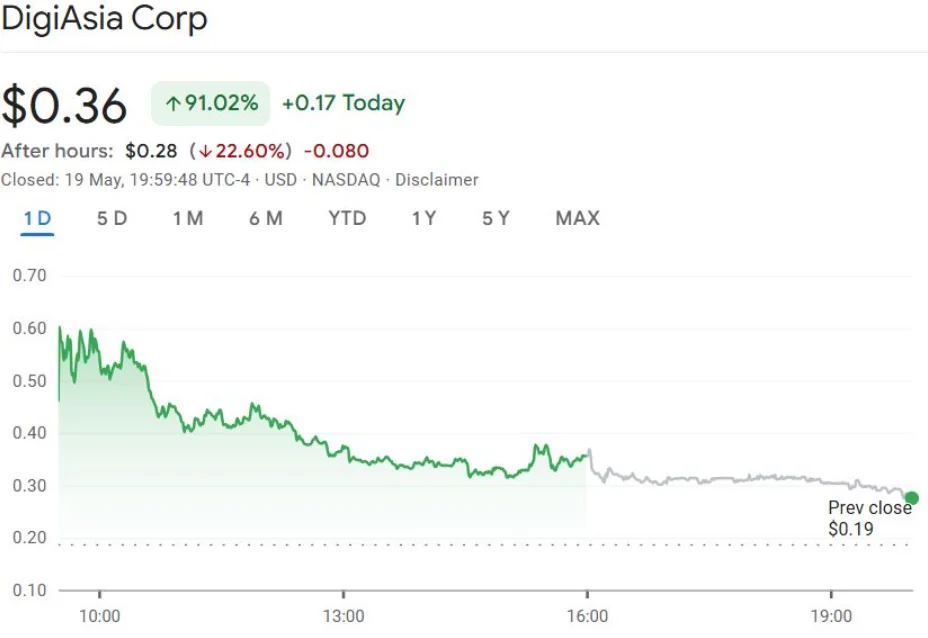

Following the announcement, DigiAsia shares (ticker: FAAS) surged 91% to $0.36 at the close of trading on May 19, according to Google Finance. However, after-hours trading saw the stock fall 22% to $0.28. Despite the rally, DigiAsia’s stock is still down about 53% year-to-date, having peaked at nearly $12 in March 2024.

In a financial update released on April 1, DigiAsia reported a 36% year-over-year increase in revenue, reaching $101 million in 2024. The company projects 2025 revenue of $125 million—a 24% rise—with earnings before interest and taxes (EBIT) estimated at $12 million.

DigiAsia is not alone in turning to Bitcoin as part of its corporate strategy. An increasing number of companies are adopting Bitcoin as a reserve asset, following the lead of MicroStrategy, which holds over 576,000 BTC worth nearly $61 billion—more than any other public company. On May 7, Strive Asset Management announced it would transition into a Bitcoin treasury firm, and in April, video game retailer GameStop raised $1.5 billion via a convertible bond offering, some of which is earmarked for Bitcoin purchases.

According to data from Bitbo, publicly listed companies now hold over 3 million BTC collectively, valued at more than $340 billion. Adam Back, CEO of Blockstream, predicts that Bitcoin-focused corporate treasuries could significantly boost global adoption, potentially pushing Bitcoin’s market cap to $200 trillion within the next decade.

Currently, Bitcoin’s market capitalization stands at approximately $2 trillion, with BTC trading around $105,642—up 2% in the past 24 hours, according to CoinGecko.